Not everyone on the FTSE 100 was popping champagne when it hit a new all-time high of 8679 points last Friday (31 January 2025).

Major fashion retailer JD Sports (LSE: JD.) had little to celebrate. Its share price is down 50% over the past five years. Despite several attempts to relive previous highs, the stock continues to struggle.

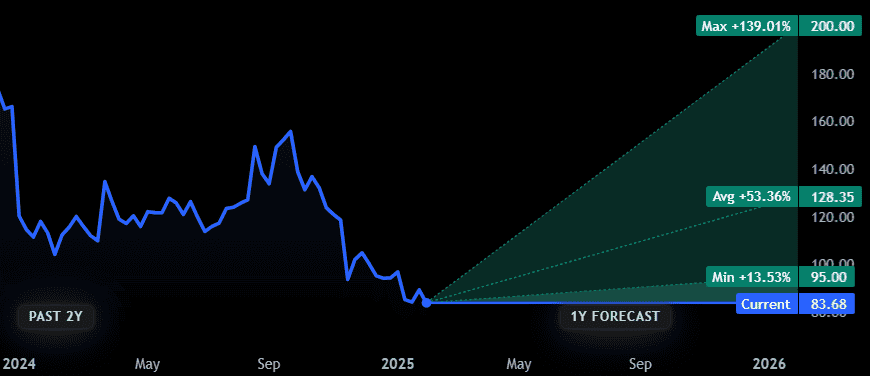

Now at only 83p per share, it’s a far cry from the dizzying all-time high of 233p achieved in November 2021.

The most recent collapse mirrors that of 2022. By late October that year, shareholders were staring in disbelief at a stock down 60%. Three months later, those who bought the dip were celebrating 98% gains.

So why does the stock experience such mind-bending volatility? And is there an opportunity in it for investors?

Slow and steady wins the race

If JD Sports were a marathon runner, it would be an abject failure. It seems to have no ability to maintain a slow and steady pace, stopping and starting more frequently than my first car. The reasons for this are three-fold: a slew of executive changes, constant supply chain disruptions, and a large dollop of stubborn inflation.

When a £4.7m regulatory fine led to the departure of long-time CEO Peter Cowgill in 2022, the issues had already begun. A moderate recovery hit a wall in 2023 when high inflation – compounded by supply chain issues – sent the shares tumbling again.

The ongoing fallout from this triple threat has built up over the years, punctuated by two profit warnings issued since November 2024.

Back on track

Through it all, JD Sports has continued to perform well, with earnings beating expectations four years in a row. It also completed the recent acquisition of Hibbett in the US, boosting its international credentials.

Consequently, the disparity between price and performance has given the stock an attractive valuation. Sales are more than double the stock’s value and the price is only 8.6 times forward earnings. That’s well above average on both counts.

The majority of analysts are bullish about the stock, with an average 12-month target 53% higher than today’s price. Even the most bearish analysts expect a 13% rise, while the highest forecast expects a huge 139% gain. While it’s true that broker forecasts are overwhelmingly positive, seldom are they that good.

So what makes them so confident?

Good stock, bad situation

Inflation, while still stubborn, has been tipped to drop this year if the Bank of England cuts interest rates. And with tensions in the Middle East subsiding, the Red Sea supply chain issues are improving and may continue to do so.

These developments are likely the core reasons for the hopeful sentiment.

Of course, it would be unrealistic to suggest the risks are entirely overcome. Trump’s trade war has become a key issue that could send markets into turmoil this year. And supply chain issues remain an ever-present threat that could re-emerge.

In its simplest form, JD’s situation amounts to a company that’s performing well but has been beaten down by external issues. Remove the problems and what’s left is a quality stock at a low price. That’s why I think it’s a heavily undervalued stock that’s worth considering in 2025.