I’m partial to the odd small-cap share, if it floats my boat. Unfortunately, these two penny stocks don’t, leaving me keen to avoid them.

Beleaguered luxury brand

The first stock’s Mulberry Group (LSE: MUL). Shares of the luxury accessories maker have fallen 76% in just under four years!

This has seen the company’s market-cap slump to just £63m. Part of me thinks that’s too low for a company that posted £153m in FY24 sales (which ended in March). On the other hand, Mulberry’s being hammered by the global slowdown in demand for luxury goods.

Should you invest £1,000 in The City Of London Investment Trust Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if The City Of London Investment Trust Plc made the list?

In November, the company reported that revenue dropped 19% to £69.7m in the six months to the end of September. Sales fell in every region, with particular weakness in Asia. Gross margin contracted to 66.5% from 70.4% and the loss widened by 23% to £15.7m. Grim stuff.

The company doesn’t see things picking up anytime soon, saying the “wider macro-economic environment, including ongoing inflationary pressures, continues to present uncertainty and challenges“.

Now, Mulberry’s the UK’s largest designer and manufacturer of luxury leather goods. I don’t like to see the British brand suffering like this. So I hope new CEO Andrea Baldo is successful in cutting costs, renewing the brand, and restoring profits.

Perhaps he’ll succeed, or maybe the firm will be acquired at a higher price (though it rejected two bids from Frasers Group last year). Truth is, I haven’t the foggiest what’s going to happen. With the firm posting losses, there’s just far too much uncertainty for me to invest here.

Not ready for lift-off

The next penny stock I’m not touching with a bargepole in February is Virgin Galactic (NYSE: SPCE). This is the space tourism business founded by Sir Richard Branson.

The share price has suffered a supernova collapse, plummeting 99.5% in four years!

The company’s listed in the US, where there’s a slightly different definition of a penny stock. It’s typically defined as one that trades for less than $5 and has a low market-cap. That certainly describes Virgin Galactic, with its share price at $4.50 and a meagre $130m market cap.

What’s gone wrong? Well, the company conducted its final spaceflight last summer before announcing a two-year pause in commercial operations to focus on building its next-generation spacecraft. So there’s almost zero revenue coming in until at least 2026.

In Q3, it burnt through $118m of cash, leaving $744m in cash and equivalents. While that sounds a lot, cash burn’s expected to have risen to between $115m and $125m in Q4. At that rate, it probably won’t have enough to fund itself through to mid-2026.

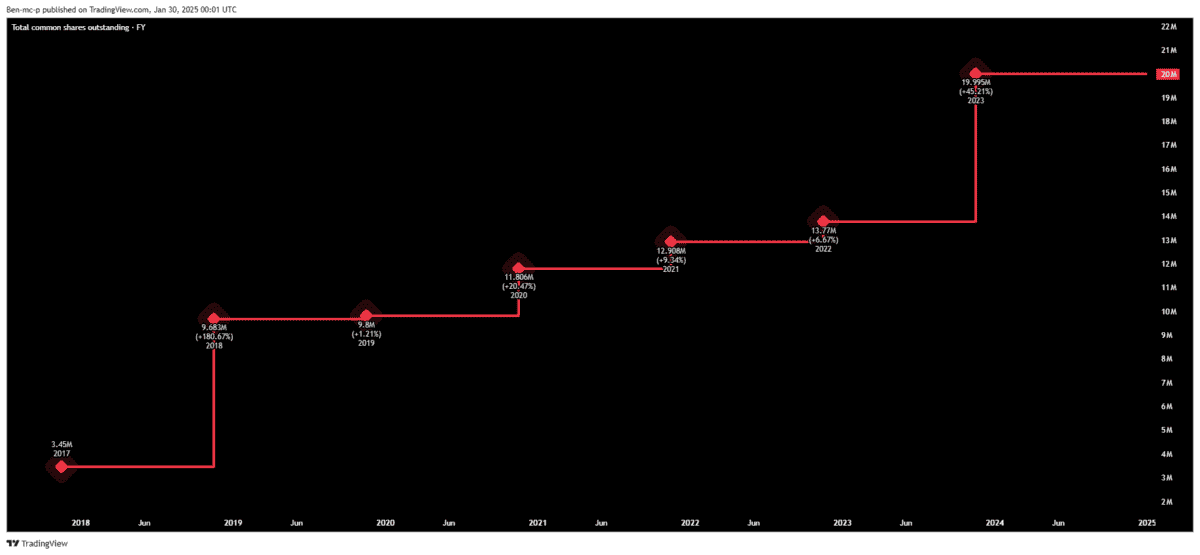

The solution? Keep selling more stock, massively diluting shareholders in the process. This isn’t new, as the share count history shows.

Now, I do support Virgin Galactic’s mission to fly thousands of private astronauts to space. Seeing our planet from above famously changes perspectives in a profound way (known as the ‘Overview Effect’). If space travel can bring humanity together, then I’m all for that (its retired spacecraft was called ‘VSS Unity’ for this reason).

However, I doubt such idealism will do much for my portfolio down here on Earth. So I’m sitting this one out.