A Self-Invested Personal Pension (SIPP) can be started at any stage of life — even for a baby. For the 2024/25 tax year, the Junior SIPP allowance is £3,600, which includes government tax relief. As such, contributions of up to £2,880 annually can be made, with the government adding £720 in pension tax relief. This makes it an attractive option for long-term savings.

Why start so young?

Starting a pension early harnesses the power of compounding, where investments grow exponentially over time as returns generate further returns. The earlier contributions begin, the more time there is for this effect to amplify savings. This means even modest early investments become highly valuable later. Additionally, the minimum age to access a pension will rise to 57 in 2028. Younger savers will have an extraordinarily long period of time to build wealth. By starting early, individuals can build a more substantial pot, ensuring a comfortable retirement and taking full advantage of the extended investment period before accessing their pension.

Let’s do the maths

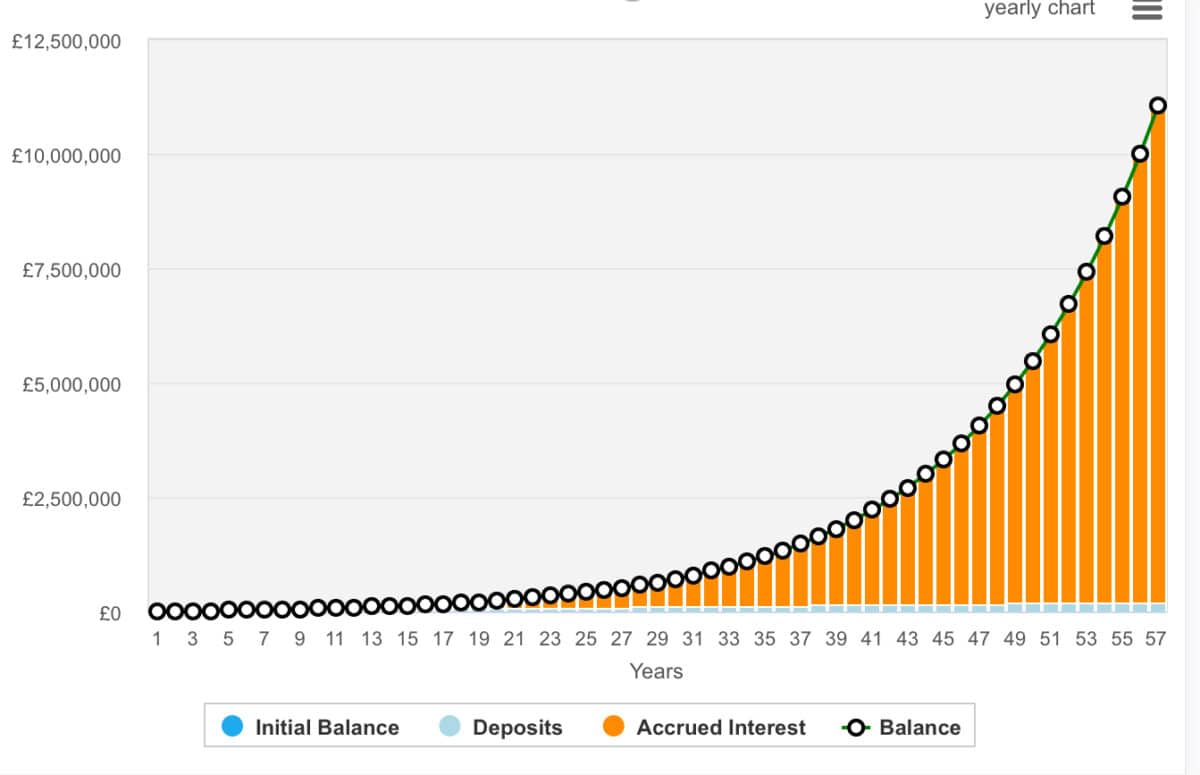

With a possible 57 years of growth — or maybe longer given the direction of retirement ages — a SIPP could become a massive pot of money. In fact, £3,600 a year would compound to £1.2m with 5% annualised growth, £11m at 10%, and £127.3m at 15%. It goes without saying but there’s a huge disparity in end figures based on the annualised growth rate. That’s simply the way compounding works and it’s a reminder as to how investing, even in simple index-trackers, can help build wealth faster than with savings accounts.

Should you invest £1,000 in BP right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if BP made the list?

Moreover, we need to recognise that the portfolio growth appears to accelerate in the later years. This can be seen in the below graph where we see the growth of £3,600 at 10% annualised.

Fuel for thought

My daughter’s SIPP hasn’t grown as fast as her ISA — which has seen about 60% growth over 12 months. One reason for that is that Hargreaves Lansdown offers fee-free trading on Junior ISAs, but not on SIPPs. In turn, given the relatively small figures involved in the SIPP, I have typically preferred investing in trusts and funds rather than individual stocks to gain diversification.

One of those stocks is growth-focused trust Edinburgh Worldwide Investment Trust (LSE:EWI), operated by Baillie Gifford — which also runs the better known Scottish Mortgage Investment Trust.

While this fund offers diversification, its investment strategy is inherently rather risky. That’s because it aims to invest in entrepreneurial companies before they’re anywhere near maturity. In fact, the trust’s policy was to make the first investment in companies only with a market cap below $5bn. That was actually raised last month to $25bn.

Interestingly, SpaceX represents a whopping 12.3% of the portfolio, which may actually present some concentration risk. That’s followed by another unlisted company, PsiQuantum, at 7.5%. With almost 20% of invested assets wrapped up in these two unlisted pre-profit companies, I appreciate why some investors will be hesitant.

However, Baillie Gifford has a great reputation for picking the next big winners and I’m personally very bullish on SpaceX and quantum stocks in the long run. I believe it will be a bumpy ride, but that’s fine when you’ve got 57 years for maturation.