The S&P 500 jumped 23.3% last year, the second consecutive annual rise above 20%. And it’s already around 2% higher in 2025.

But is the surging index heading towards a correction (that is, a 10% fall)? Here are my thoughts.

Arguments for

Incredibly, the S&P 500 has delivered a return above 20% in four out of the past six years. On a total return basis (including dividends), it has been above 25% for four of those years, with a Covid-struck 2020 producing ‘just’ 18.4%.

| Year | Price return | Total return |

|---|---|---|

| 2019 | 28.88% | 31.49% |

| 2020 | 16.26% | 18.40% |

| 2021 | 26.89% | 28.71% |

| 2022 | −19.44% | −18.11% |

| 2023 | 24.23% | 26.29% |

| 2024 | 23.31% | 25.02% |

Historically though, these returns are far higher than usual for the index. Indeed, the last period there were such monster returns clumped together was in the late 1990s. And we know what followed that boom…

| Year | Price return | Total return |

|---|---|---|

| 1995 | 34.11% | 37.58% |

| 1996 | 20.26% | 22.96% |

| 1997 | 31.01% | 33.36% |

| 1998 | 26.67% | 28.58% |

| 1999 | 19.53% | 21.04% |

| 2000 | −10.14% | −9.10% |

| 2001 | −13.04% | −11.89% |

| 2002 | −23.37% | −22.10% |

Of course, this doesn’t guarantee that something similar will happen this time around. But both then and now, there was the dawn of a revolutionary new technology that was getting investors excited (the internet and artificial intelligence (AI), respectively). Might history be rhyming here? It’s possible.

Moreover, Donald Trump has promised/threatened widespread tariffs, which many economists predict will be inflationary. If so, this would be a hindrance to interest rate cuts.

Finally, the index is extremely richly valued, with a forward price-to-earnings (P/E) ratio of 21.6. This high starting point makes it more difficult for corporate earnings to grow at a rate that justifies the valuation.

The index performed very strongly the last time Trump was in charge of the US economy. However, the multiple is currently around 27% higher than it was when he took office in early 2017. Therefore, a correction could be on the cards.

Arguments against

Yesterday (20 January), the new President was sworn in. In his speech, he promised to boost consumer spending power by lowering energy bills, taxes, and inflation, thereby making the economy stronger in the process. He even mentioned putting the American flag on Mars.

Given this optimism, it could be argued 2025 will be yet another positive year for the S&P 5OO. Talk about a US recession has faded, animal spirits are strong, and interest rates still look set to move lower.

How I’m responding

The mood in the US right now is incredibly bullish. My hunch then is that the index will chug higher this year, but that it won’t deliver a third straight double-digit return. Naturally, I could be totally wrong.

What I’m more certain about though is that specific S&P 500 stocks appear grossly overvalued. One is Palantir Technologies (NASDAQ: PLTR), whose share price has exploded 1,017% since the start of 2023.

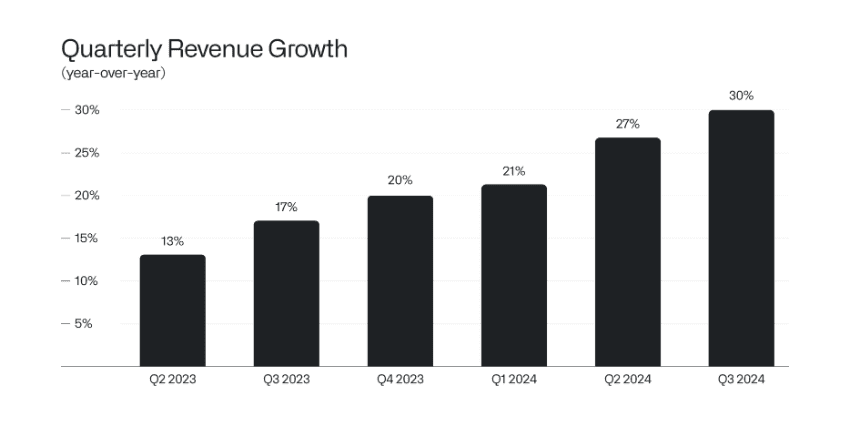

Palantir provides AI solutions to both government organisations and companies. It has been growing like wildfire, with third-quarter revenue up 30% year on year to $725m.

Revenue has actually accelerated for six straight quarters!

Palantir also generated a record $144m in net profit. And CEO Alex Karp struck an incredibly bullish tone: “A juggernaut is emerging. This is the software century, and we intend to take the entire market.”

Clearly then, there’s a lot to like about this AI company. However, the stock is trading at an eye-watering price-to-sales (P/S) multiple of 66. The forward P/E ratio is above 150. If growth normalises, these valuations are likely unsustainable.

Palantir is the type of overvalued S&P 500 stock that I’m avoiding right now.