Every year, UK residents can put up to £20,000 in a Stocks and Shares ISA. However, investors don’t need to max out their ISA contributions to build wealth.

Instead, many people get started by investing just a few pounds a day. Over time, and when combined with a sensible investment strategy, this can compound into considerable wealth.

The warm-up

Opening the ISA’s like the investing equivalent to warming up before the gym. The Stocks and Shares ISA provides UK residents with a place to shelter their investments from capital gains tax and tax on dividends.

After opening a Stocks and Shares ISA with a reputable investment brokerage, an investor can focus on consistent contributions to their portfolio, even if the amounts are modest. Regular contributions, combined with the power of compounding, can significantly grow wealth over time.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Mix it up a little

Just like going to the gym, when we invest, we need to mix it up a little. And by that, I mean diversification. Investors should look to spread their money across different asset classes, including stocks, bonds and funds, while exploring a variety of geographies.

Many novice investors in the UK will likely want to invest in companies and brands they know best, many of which will be UK-listed stocks. However, the US market offers investors opportunity to diversify further, arguably with better access to emerging and advanced technologies.

How it could look

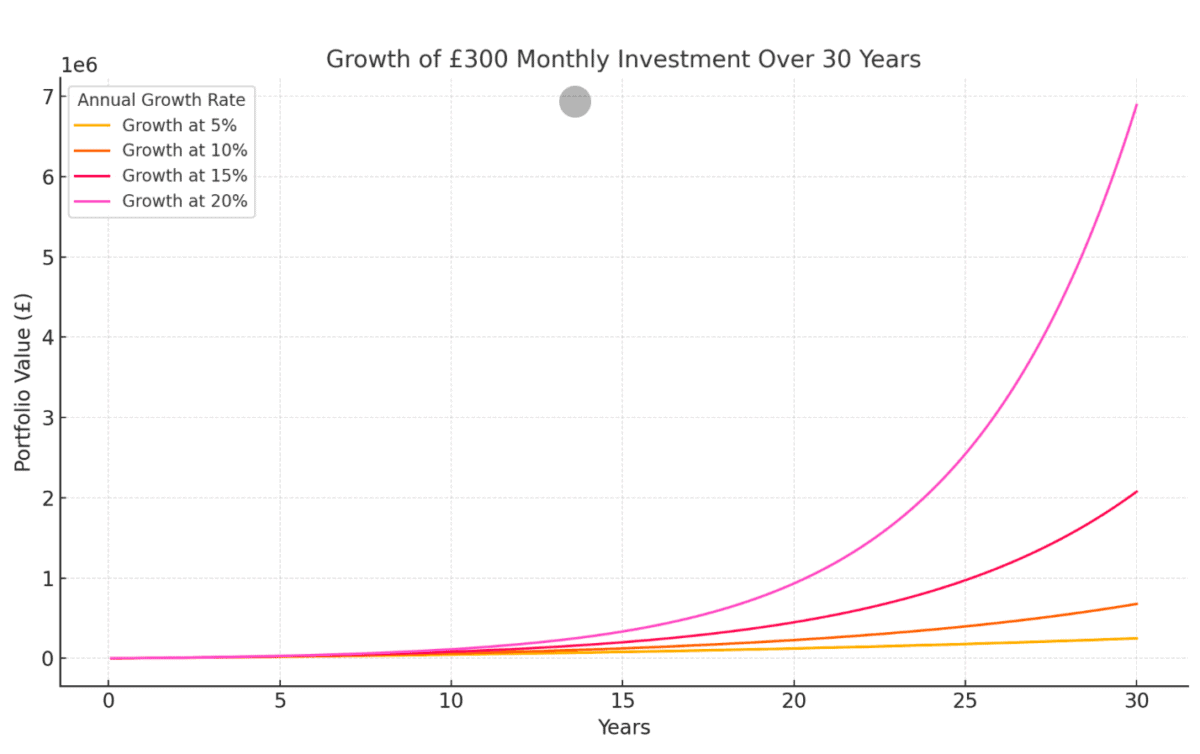

An investor contributing some like £300 monthly can achieve significant portfolio growth depending on the annual return rate, which is enhanced by the power of compound returns. While poor investment decisions can result in losses, here’s how investment could grow over 30 years.

While 20% annualised growth is only regularly achieved by some of the best investors, note how £300 a month could transform into nearly £7m over 30 years. However, for context, many seasoned investors can beat even 20%. J Mintmyzer, for example, has averaged over 40% annually over the past decade.

One stock for consideration

Investors looking to achieve some degree of diversification immediately may consider investing in Scottish Mortgage Investment Trust (LSE:SMT). The UK-based investment trust is a FTSE 100 constituent but invest in primarily in companies operating in advanced and disruptive technologies, mostly in the US.

After some recent re-jigging, the portfolio’s largest three holdings are now Amazon, Mercado Libre and Elon Musk’s privately-traded SpaceX. The first two stocks, accounting for around 12% of the portfolio collectively, point to ongoing confidence in online retail. However, Scottish Mortgage has a very diverse portfolio, which also includes some luxury stocks including Ferrari.

Any concerns? Well, with around a quarter of the portfolio consisting of stocks that aren’t publicly traded, investors may question the valuations of these privately held assets. For example, SpaceX is reportedly valued at $350bn. That could be a hard figure to digest, especially when we know so little about the company’s operations.

Nonetheless, despite some considerable volatility during the pandemic, this stock’s delivered very impressive returns for shareholders. In fact, it’s doubled in value over seven years.