A Stocks and Shares ISA is perfect for UK investors wanting to build a nest egg for retirement. The generous £20,000 yearly contribution allowance is easily enough for this purpose, especially when gains are sheltered from tax.

In fact, with the right investments, an individual can construct a decent-sized pension investing £700 a month. Here’s how a 40-year-old could do that, even when starting from scratch.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Should you invest £1,000 in The Schiehallion Fd Ltd Ord Shares right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if The Schiehallion Fd Ltd Ord Shares made the list?

Considering portfolio risk

The first thing to note here is that stock markets can be volatile and unpredictable. And while the market goes up over time, it certainly doesn’t do so in a straight line!

That said, some shares are far less volatile than others. With thoughtful planning, it’s possible to build a portfolio that spans multiple sectors and includes a mix of growth stocks, dividend shares, funds, and trusts. These could comprise both UK and US shares.

This diversification helps smooth out market fluctuations, reducing the risk of being overly exposed to a single geography or sector, like technology or energy.

I reckon 15-20 different investments is a good target to aim for when starting out.

Looking at the rate of return

The S&P 500 has long outperformed the UK’s FTSE 100, delivering a 12% average return a year versus the latter’s 7-8%.

However, there’s no guarantee that will happen every year. UK stocks might have a purple patch, while investors sour on those listed in the US (on the grounds of overvaluation, say).

By investing in both markets though, I think it’s entirely possible to aim for a 10% average return over the long run. This is the ballpark figure for global stocks.

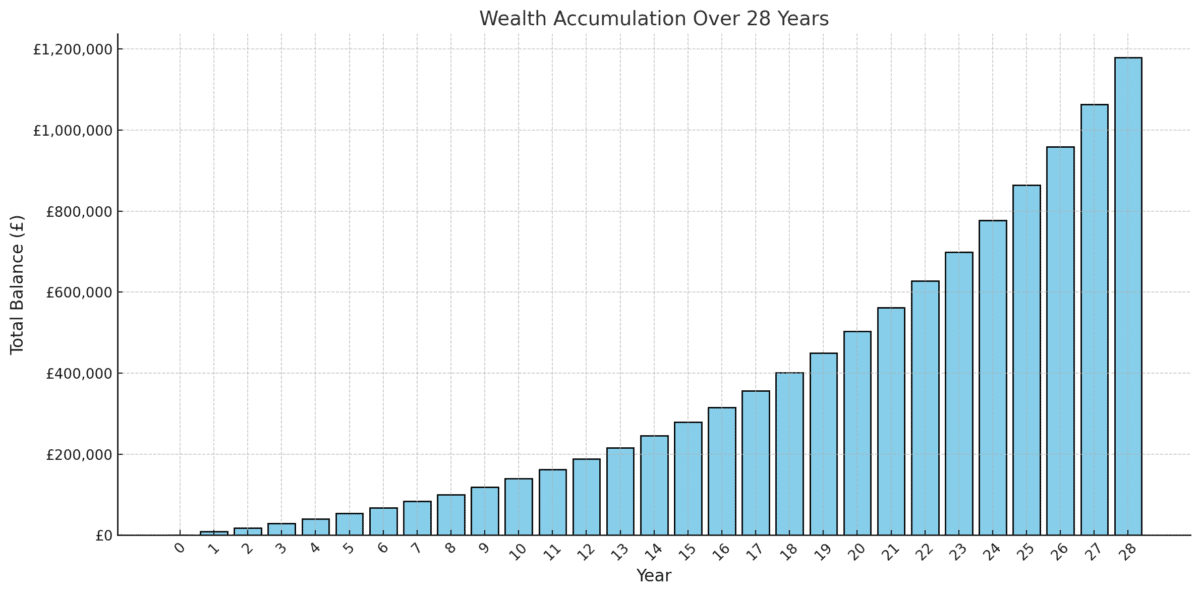

For a 40-year-old starting out, it means investing £700 a month at this rate of return would result in an ISA worth £1.18m after 28 years. This assumes reinvested dividends and a State Pension age of 68.

According to Vanguard, a single retiree who qualifies for the full State Pension would need £488,688 in pension savings to afford a ‘moderate’ retirement, as defined by the Pensions and Lifetime Savings Association. So £1.18m would be a fantastic outcome.

A fund aiming for mountainous returns

There are many shares an investor can buy to achieve these returns. Those starting out might want to consider Schiehallion Fund (LSE: MNTN).

This is an investment trust that backs fast-growing private companies. But rather uniquely, it then keeps holding the shares once they’ve gone public, aiming for outsized returns.

Today, there are around 44 stocks in the portfolio. They offer exposure to exciting areas that are tipped for massive long-term growth.

Top 10 holdings (as of 30 November)

| Stock | Description | Weighting | |

|---|---|---|---|

| 1 | Affirm | Provides buy now, pay later services for Amazon and Shopify. | 7.0% |

| 2 | ByteDance | Chinese owner of TikTok. | 7.0% |

| 3 | SpaceX | Makes rockets, satellites and spacecraft. | 6.7% |

| 4 | Wise | International money transfer. | 5.2% |

| 5 | Bending Spoons | Mobile app developer. | 5.0% |

| 6 | Tempus AI | AI-driven personalised healthcare. | 3.9% |

| 7 | Brex | Fintech. | 3.4% |

| 8 | Databricks | Data analytics and AI platform. | 2.7% |

| 9 | Stripe | Internet payments giant. | 2.7% |

| 10 | Wayve | Developing autonomous-driving technology. | 2.6% |

One thing to consider here is that the managers aren’t guaranteed to get it right every time. As an example, the fund lost money in 2024 on an investment in Northvolt, a Swedish EV battery maker that went bust. It can’t afford more such high-profile failures or its performance/strategy will come under fire.

However, the shares remain 63% off their 2021 peak, while trading at a 16% discount to the fund’s net asset value. I think Schiehallion could deliver market-beating returns from here, especially once the IPO market starts heating up, potentially as soon as 2025.