Barring a market meltdown in the last days of December, it looks like 2024 will be a very successful year for my ISA/SIPP portfolio.

As things stand, I’m poised to record a return of 45.6% for this calendar year. This would easily make it one of my best years ever!

Which stocks helped drive this return? Let’s take a look.

Clarification

Before I go on, I should clarify that I’m talking about three portfolios here. I have a Self-Invested Personal Pension (SIPP), a Stocks and Shares ISA, and a Lifetime ISA.

Every month, I invest in my Stocks and Shares ISA, so this is where most of the action takes place. I also occasionally contribute to my Lifetime ISA because the government adds a 25% bonus to anything I put in.

In contrast, I rarely trade in my SIPP, which is made up of a handful of large, high-conviction holdings that I’ve mostly held for years. Essentially my best ideas, this portfolio had a barnstorming year.

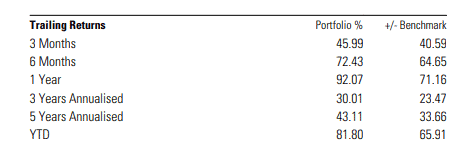

My SIPP is up 81.8% year to date (23 December). Over five years, it’s delivered an annualised return of 43.1%. Needless to say, I’m more than happy with this outperformance!

Unsurprisingly, my two ISA portfolios didn’t come anywhere close to matching this. Taking all three together, the collective return is 45.6%.

What went right

The star of the show was undoubtedly my overweight position in Axon Enterprise. The Taser maker’s shares are up 144% year to date.

I like to buy high-quality companies when an opportunity presents itself. At the start of 2024, I added Taiwan Semiconductor Manufacturing (NYSE: TSM) to my SIPP.

TSMC is the world’s leading contract chip manufacturer, supplying nearly every artificial intelligence (AI) innovator, including Nvidia.

In January, investors could have scooped up shares of TSMC for just 15 times forecast earnings for 2024. The valuation is now 28 times after the stock’s 90% year-to-date surge.

Wall Street’s expecting 25% revenue growth in 2025. However, if AI spending slows down, that would hurt TSMC’s growth trajectory.

Nevertheless, I was happy to see this new portfolio addition contributing to performance. With its pivotal role in the digital revolution, I reckon TSMC is set up for more strong gains.

Other stocks from my portfolio worth highlighting include The Trade Desk (up 74% this year), Intuitive Surgical (+55%), and Shopify (+40%).

UK shares

A few UK stocks also did the business. The best of the bunch was Rolls-Royce, whose shares rocketed 93%.

Some of the investment trusts I hold also made gains, including Scottish Mortgage (+17%) and Schiehallion Fund (+51%).

Elsewhere, British American Tobacco and HSBC contributed nicely, with total returns (i.e., including dividends) of 36% and 30%, respectively. And Games Workshop‘s total return was 36%!

Not all milk and honey

I’d love to say all my holdings performed strongly. But that wasn’t the case and likely never will be. This is why diversification is crucial.

My once-large holding in Moderna bombed 65%, along with penny stock Creo Medical (down 60%), and spirits giant Diageo (-11%). BlackRock World Mining Trust also slumped 17%.

Stepping back though, I’m over the moon with 2024’s return. It’ll be hard to top, but I’ll continue seeking opportunities in high-quality stocks in 2025.

Here’s to a Foolish New Year!