The London stock market is home to a diverse mix of dividend shares. Thanks to years of underperformance, investors can grab a high dividend yield on a large number of them.

Broker forecasts aren’t always a reliable guide to future returns. But if City estimates are accurate, a £10,000 lump sum invested in THIS real estate investment trust (REIT) will provide £1,589 worth of dividends over the next two years (with next year’s dividends reinvested).

I think it’s worth serious consideration leading into the New Year. Here’s why.

Should you invest £1,000 in HSBC right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if HSBC made the list?

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

First, the bad news

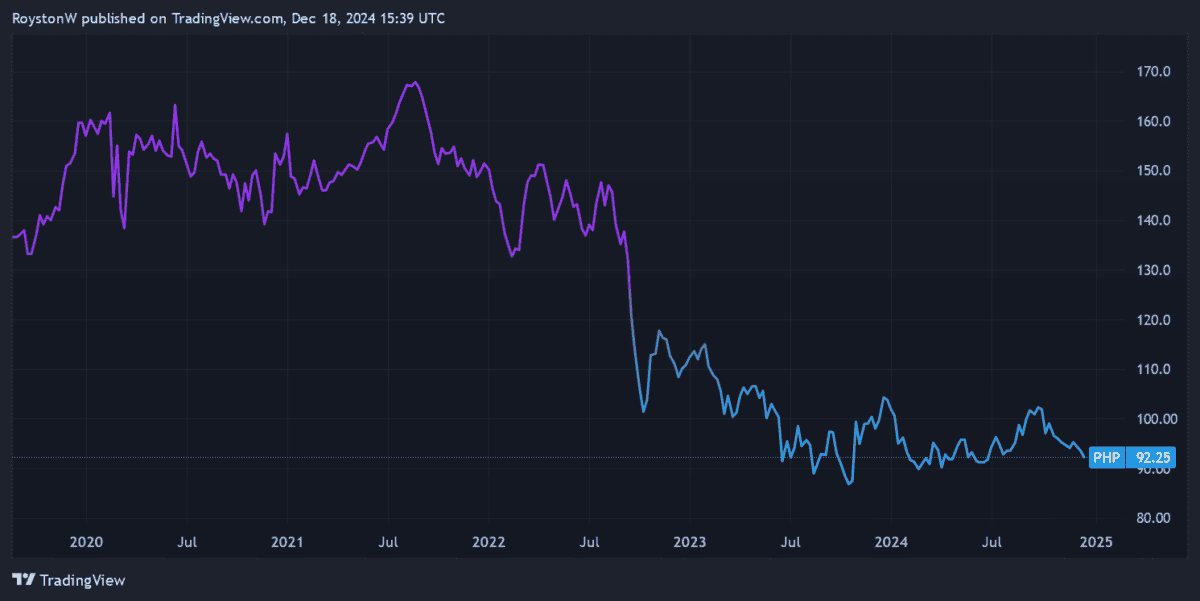

Many property stocks like Primary Health Properties (LSE:PHP) have dropped in value in the second half of 2024. This reflects growing fears over the possibility of interest rates remaining higher than hoped.

In fact, this asset class has fallen sharply since the Bank of England started raising interest rates in late 2021.

Higher rates lower property valuations and push up borrowing costs. This has made REITs such as this a less appealing investment more recently.

Unfortunately, investor demand may remain weak, too, if the direction of recent inflationary data becomes a trend. News that November’s Ponsumer Price Inflation (CPI) reading was an eight-month high has tapered expectations of substantial Bank of England rate cutting in 2025.

Yet, despite the threat of further share price weakness, I’m still tempted to buy more Primary Health shares for my portfolio. This is thanks to its excellent dividend prospects.

Look at those dividends!

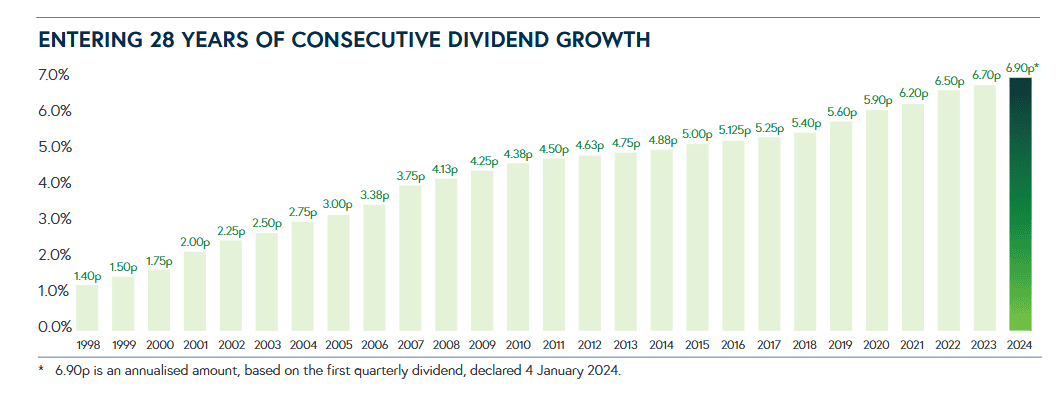

As the chart above shows, the FTSE 250 business has an impressive record of raising dividends dating back to the late 1990s.

This is down to multiple factors, including:

- Its focus on the non-cyclical healthcare sector, providing stable earnings from year to year.

- Inflation-linked rental contracts allow it to absorb rising costs, protecting profits growth.

- The rents it receives are effectively guaranteed by government bodies like the NHS.

- Occupancy is high and tenants are locked into long-term contracts.

- Almost all (97%) of its debt is fixed or hedged, reducing the impact of rising interest rates.

The long record of profits growth this has provided has, in turn, meant Primary Health Properties has been able to consistently raised dividends.

Under REIT rules, the firm must pay at least 90% of annual rental earnings out to shareholders.

Bright future

City analysts expect earnings and dividends to keep rising throughout their three-year forecasts. And so the dividend yield on Primary Health shares stands at 7.6% and 7.7% for 2025 and 2026, respectively.

To put that in context, the average dividend yield on FTSE 100 shares sits way back at 3.6%.

I opened a position in Primary Health in 2022 to boost my passive income. And I plan to hold it for the long term. I believe it will deliver exceptional returns in the years ahead as Britain’s growing elderly population drives healthcare demand services through the roof.

In fact, I’m considering adding to my holdings in the New Year.