I’m searching for the greatest exchange-traded funds (ETFs) to add to my portfolio in the New Year. Here are two I think could explode in value over the next 12 months.

iShares Physical Gold ETF

2024 has proven a spectacular year for the gold price. It’s up 29% since 1 January, at $2,666 per ounce, and has struck repeated record highs in that time.

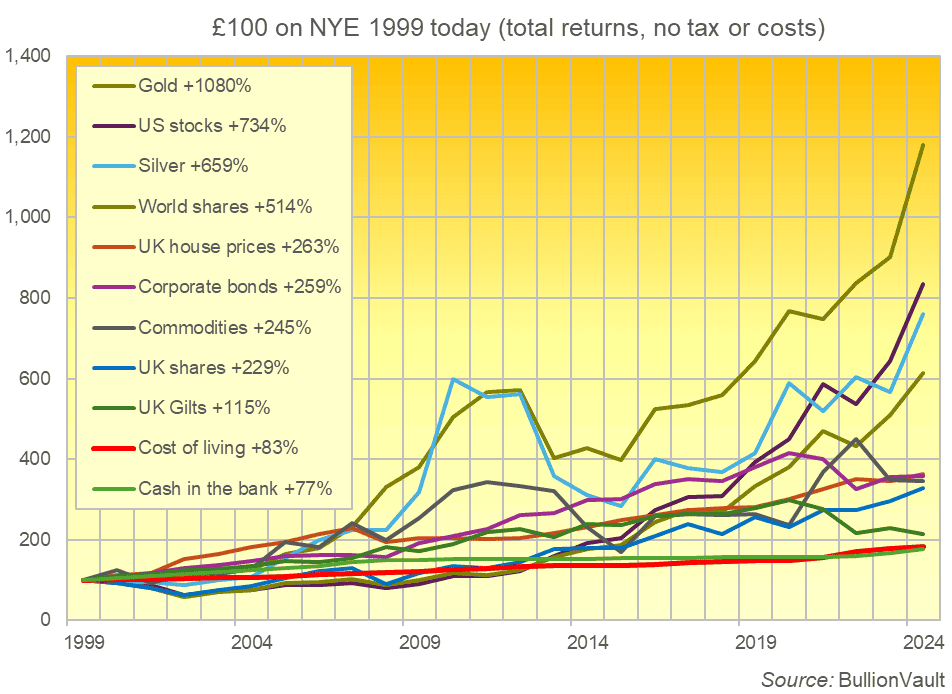

Gold’s strong performance is no rare phenomenon. In fact, data from precious metals retailer BullionVault shows that gold has delivered a total return of 1,080% since the end of the 20th century.

Should you invest £1,000 in Gsk right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Gsk made the list?

As the graphic shows, that’s better than every other major asset class, including UK and US shares.

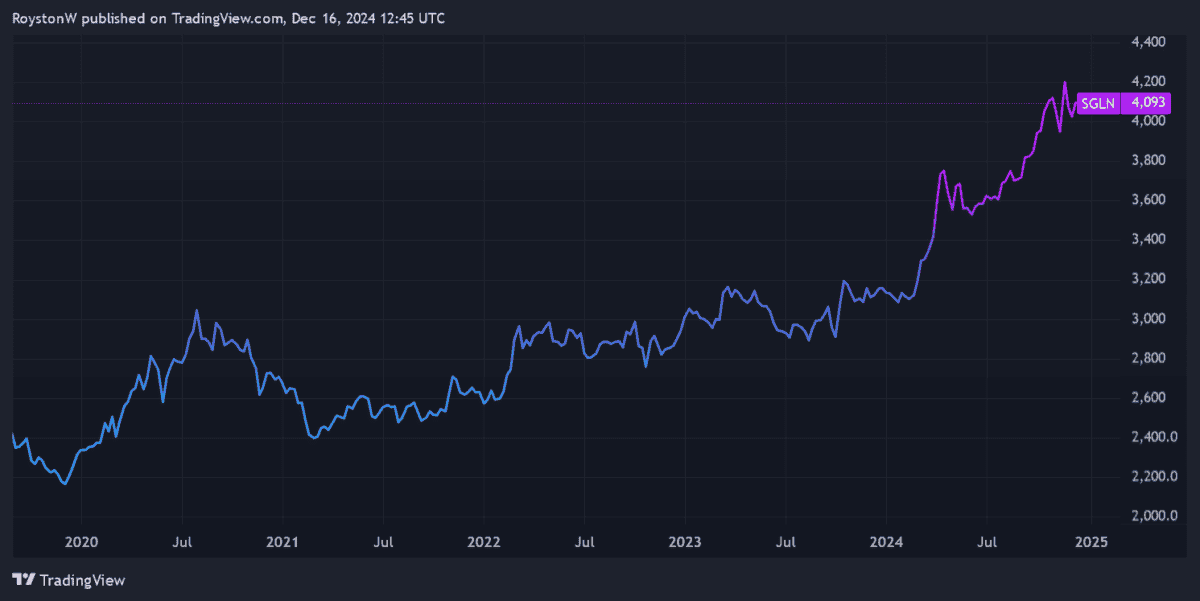

Gold’s stunning returns mean a metal-backed ETF is worth serious consideration from long-term investors. One that’s attracted my attention recently is the iShares Physical Gold ETF (LSE:SLGN).

This fund is designed to solely follow gold price movements. It therefore differs from many other ETFs that track the performance of gold mining stocks, and which can therefore deliver poor returns if a major holding suffers operational issues.

During the past 10 years, this fund has delivered an average annual return of 8.2%.

Past performance is not a guarantee of future profits. And returns here could underwhelm if the US dollar appreciates, making it less cost-effective to purchase buck-denominated assets like gold.

But there are also plenty of reasons to predict another price surge. Central bank gold buying should remain strong as institutions diversify their reserves. An flurry of (expected) interest rate cuts should also support bullion values.

On top of this, concerns over the political landscape in the US and Europe, growing geopolitical tensions, and emerging strains on the global economy — worsened by potential new trade tariffs — might drive safe-haven gold to new highs.

In this climate, I believe funds like iShares’ Physical Gold ETF could prove shrewd investments.

abrdn Physical Silver Shares ETF

Silver is another precious metal that’s looking good for the New Year. In fact, I think its dual role as both investment and industrial metal could see it outperform gold during 2025.

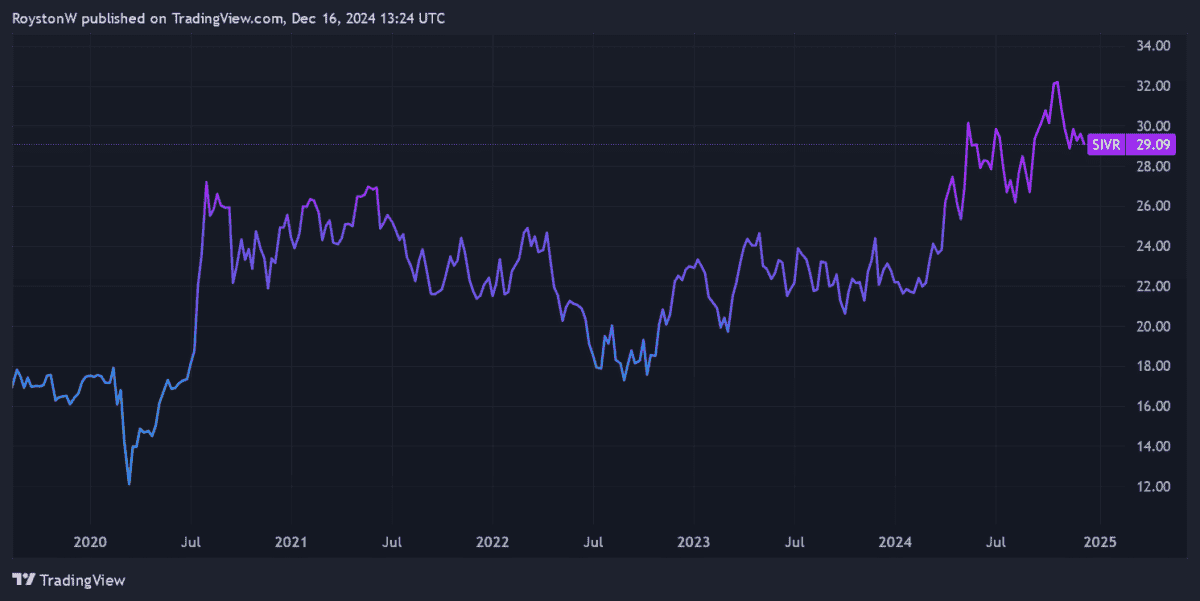

The abrdn Physical Silver Shares ETF (NYSE:SIVR) is an fund individuals can buy to capitalise on any upswing.

Like gold, silver has risen 29% in value since 1 January. It was last changing hands at $30.74 per ounce. Yet if economic conditions improve as interest rates fall, it might outperform the yellow metal given its greater role in industry.

Around 50% of silver demand is for industrial applications like electronics and photography. That compares to around 10% for gold.

Like the gold ETF I’ve described above, this fund also only tracks metal prices. And since 2014, it’s delivered a healthy average yearly return of 6.7%, which is roughly in line with the FTSE 100.

Given the uncertain outlook, it could be a great way for investors to hedge their bets. Having said that, remember that returns could disappoint if economic conditions toughen.