With just a few days of the year left, the S&P 500 looks set to post another strong result. But there has been a wide divergence of results across different sectors.

At the sector level, I found the results slightly surprising – I had expected technology to be the top performer and real estate to be last. But I was wrong on both counts…

Winners and losers

Surprisingly, technology has – so far – underperformed the S&P 500 average this year. While there have been some outstanding results, there are plenty of stocks – such as Intel – that have fallen sharply.

Equally, real estate has had mixed results. While the sector has a whole has underperformed, companies that are involved in data centres – such as Iron Mountain – have produced excellent results.

The top-performing S&P 500 sector from 2024 has been communication services, where Netflix has had a strong year. Importantly, there have only been a few stocks that are actually down since January.

At the other end, it’s a close-run thing. But as I write this, the healthcare sector has lagged all the others, with Moderna having lost almost two-thirds of its market value this year.

Healthcare and real estate

In general, I like looking for opportunities in sectors that are out of fashion. And that’s certainly true of healthcare, with the US set to appoint a health secretary with controversial views about vaccines.

The trouble is that forecasting the outlook for drug companies often takes a lot of specialist knowledge. So there’s a high risk of finding a value trap – something that looks cheap but actually isn’t.

Nonetheless, the underperformance of pharmaceutical companies like Moderna gives me a different idea. There’s a stock that isn’t in the healthcare sector, but is adjacent to it.

A 25% fall in the price of Alexandria Real Estate Equities (NYSE:ARE) this year has caught my attention. The company is a real estate investment trust (REIT) that leases life science laboratories.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

Alexandria Real Estate

The stock comes with a dividend yield approaching 5.5%. And while UK investors should be mindful of withholding taxes, I think this could be an interesting passive income opportunity.

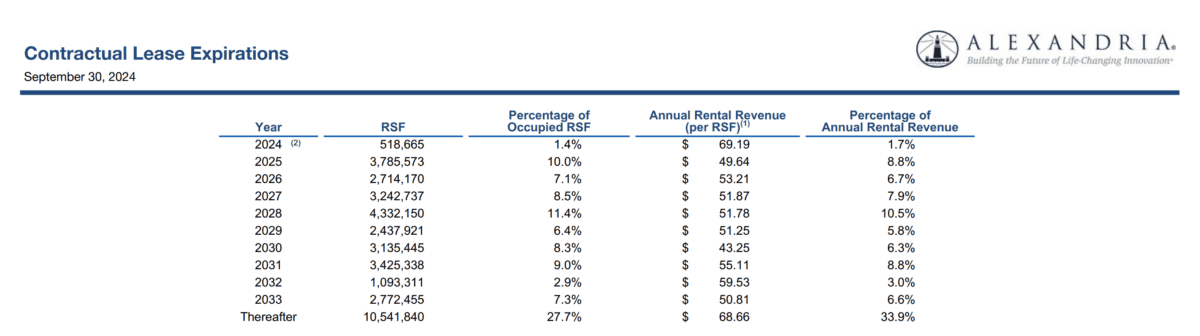

While the average lease still has almost eight years to run, the firm does have some expirations coming up in the next couple of years. And the risk of vacant periods has led analysts to downgrade the stock.

Source: Company Q3 Earnings Release & Supplemental Information

Alexandria’s facilities are fairly generic, though, and this should help the company find new tenants if it comes to it. Importantly, they are also in good locations that are important for the industry.

Occupancy levels and rent collection metrics have also been strong for some time. So while the risk can’t be ignored, I think it’s also important not to overestimate it.

REIT investing

To some extent, Alexandria Real Estate’s shareholders are protected from a downturn in the healthcare sector. Even if its tenants make less money, this isn’t a problem as long as they keep paying rent.

The other side of the coin is that it doesn’t stand to benefit directly from breakthrough treatments. But from a passive income perspective, I think the discounted share price makes the stock one to consider.