I’ve toyed with the idea of adding Fundsmith Equity to my Stocks or Shares ISA or Self-Invested Personal Pension (SIPP) for a few years now. But I’ve never invested in the fund.

Should I put that right in 2025? Let’s take a look.

Keeping it simple

At just over £23bn, Fundsmith’s the biggest of its kind in the UK. It aims to deliver long-term growth by investing in large, high-quality companies from around the world.

Should you invest £1,000 in Vodafone right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Vodafone made the list?

Key traits it looks for include predictable earnings, enduring competitive advantages, high returns on capital, and low debt.

I’ve always admired manager Terry Smith’s simple investment philosophy, based on three principles:

- Buy good companies

- Don’t overpay

- Do nothing

Here are the top 10 holdings, as of 29 November.

| Top 10 Holdings |

|---|

| Meta Platforms |

| Microsoft |

| Novo Nordisk |

| Stryker |

| Philip Morris |

| Automatic Data Processing |

| Visa |

| L’Oréal |

| Waters |

| Marriott |

A handful of quality companies

The portfolio’s concentrated with just 26 stocks. Personally, I like Smith’s high-conviction strategy, as he stands out in a crowd of fund managers hedging their bets with hundreds of stocks.

But it does add risk, particularly if the top holdings don’t perform. Or the manager fails to invest in the stocks or sectors that drive market returns. Unfortunately, this has happened in recent years.

Underperformance

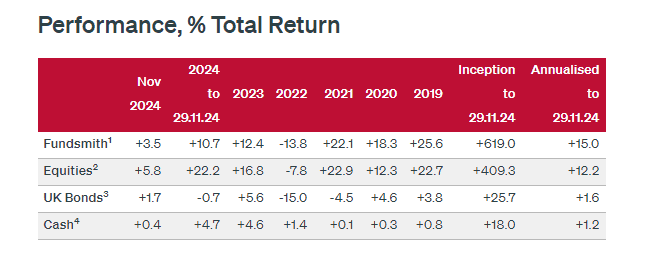

Fundsmith hasn’t beaten the market since 2020, when it returned 18.3% versus 12.3% for the MSCI World index. From the start of this year to November, the return was 10.7%, well below the index’s 22.2%.

As we can see, the long-term outperformance is still intact. But the recent poor run’s very disappointing, especially when the fund has ongoing charges of 0.94% on the big investment platforms.

The main issue has been an underweight allocation to some of the big names leading the artificial intelligence (AI) rally. It hasn’t owned AI darling Nvidia, whose shares are up 2,297% in five years, or Tesla (up 75% in 2024).

Mistimed Amazon trade

In 2023, the fund also sold Amazon (NASDAQ: AMZN), just 19 months after investing. That was a mistake, with Amazon shares nearly doubling since.

Smith saw Amazon’s investments in the grocery space as a potential misallocation of capital. He said it had already “stubbed its toe in this sector with the Whole Foods acquisition” a few years previously.

To be fair, he has a point. Amazon does take risks investing in different areas, including self-driving cars and AI projects. None of these are guaranteed to pay off and could weigh on future earnings.

This is why I was surprised when Smith invested in Amazon (it has unpredictable earnings from one year to the next). And while I’ve never owned Amazon stock, it seems like one where you “do nothing” after investing, letting trends like e-commerce, digital advertising, and cloud computing play out long term. So I was a bit confused by the whole thing.

My decision

Has Smith lost the Midas touch? My hunch is this is just a rough patch, though admittedly an extended four-year one. I’d prefer to have more confidence before I invest.

The fund now has just 12.6% in the Information Technology sector. If the AI boom continues, that could prove costly. Or perhaps one of Smith’s finest calls.

I’ll be interested to know which, but not as a Fundsmith investor, as things stand.