Whether it’s growth or passive income, it’s better to buy shares when they trade at lower prices. And one that seems to stand out at the moment is Supermarket Income REIT (LSE:SUPR).

The company has been a steady source of dividend income, but the stock’s down 19% since the start of the year. So is this an opportunity for investors to consider?

Reliable income

Supermarket Income REIT’s a real estate investment trust (REIT) that owns and leases a portfolio of supermarkets. And I think this is an interesting industry to consider investing in.

Should you invest £1,000 in Supermarket Income Reit Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Supermarket Income Reit Plc made the list?

In the real estate sector, warehouses have been getting a lot of attention recently with the rise of e-commerce. But groceries have proved to be a lucrative space to be in for this FTSE 250 firm.

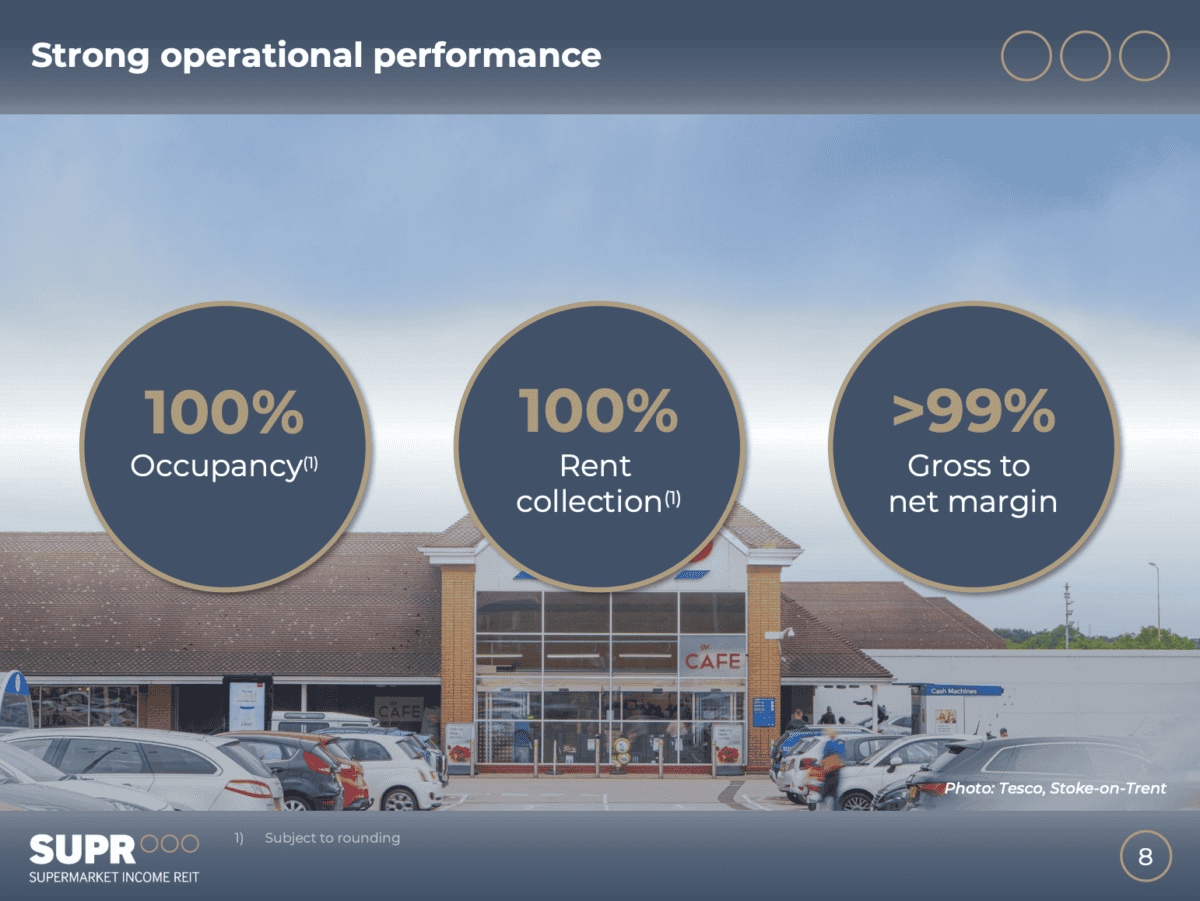

There are two things real estate companies really want to avoid – unoccupied properties and rent defaults. And Supermarket Income REIT has neither.

Source: Supermarket Income REIT Investor Presentation

A 100% occupancy rate and 100% rent collection means things are going well. And with the average lease having 12 years to expiry and inflation-linked increases, the outlook’s positive.

Around 75% of the firm’s rent comes from two companies – Tesco and Sainsbury’s. This brings concentration risk, but it’s not something that I’m hugely concerned by.

The UK’s leading supermarkets have been highly reliable tenants. And I wouldn’t want to see Supermarket Income REIT diversify into tenants where the risk of default’s higher.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

What’s not to like?

There’s clearly a lot to like about this business from an investment perspective. So the obvious question to consider is why the stock’s going down – and one big reason stands out to me.

With REITs in general – and Supermarket REIT in particular – the scope for growth’s very limited. In real terms, contracts linked to the retail price index only guard against losing in real terms.

The FTSE 250 is up almost 8% this year and I don’t see any realistic way for Supermarket Income REIT to keep up with this. Inflation-linked uplifts won’t generate that kind of increase.

The only real way for the company to achieve higher growth is by expanding its portfolio. But distributing virtually all of its income as dividends means this will have to be financed with either debt or equity.

That increases the risk for investors. Increased debt can make the firm vulnerable in the event of higher interest rates and a rising share count makes the dividend harder to maintain.

I don’t think the big issue for shareholders looking for passive income is that the dividend won’t go down. It’s that it won’t go up – at least not after adjusting for inflation.

Is this a good opportunity?

To say Supermarket Income REIT isn’t exciting in terms of growth is an understatement. But investors should consider it for what it is – a fairly reliable dividend stock with an 8.6% yield.

The risk of long-term underperformance means I’d prefer to look elsewhere. But for investors seeking passive income over the next 10 years or so, I think this could be a good stock to consider buying.