Looking for the best cheap FTSE 100 shares to buy this month? We might think high street bank Lloyds‘ (LSE:LLOY) shares are worth a close look at the current price of 53.06p.

At this level, the Black Horse Bank trades on a price-to-earnings (P/E) ratio of 7.9 times for 2025. This is far below the Footsie average of 14.3 times.

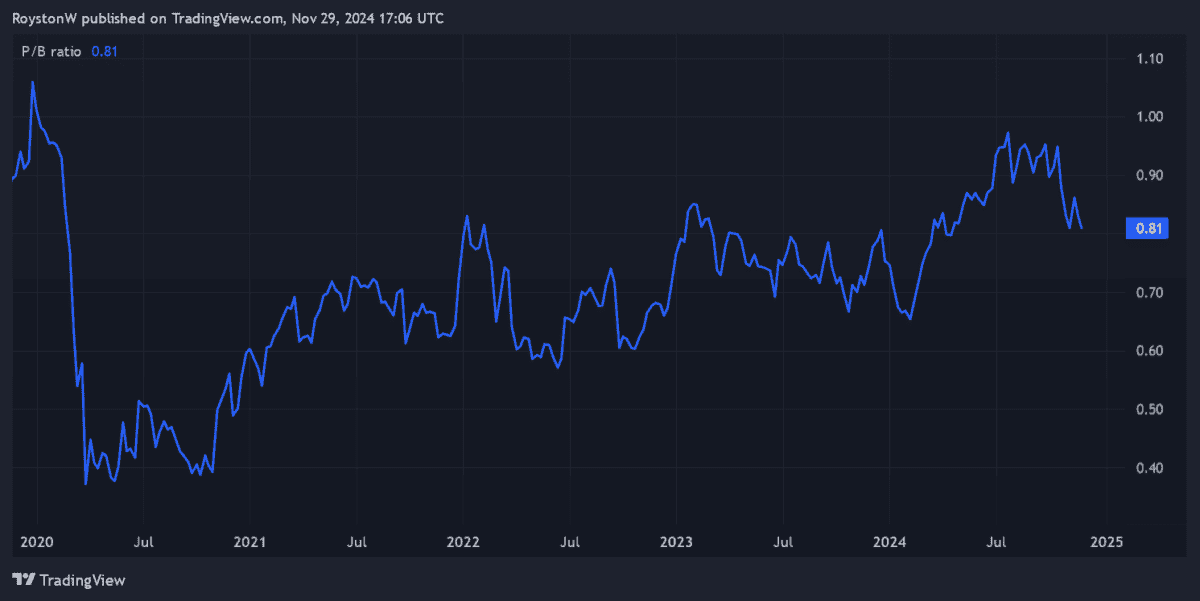

Lloyds’ shares also trade at a discount to the value of the bank’s assets. At 0.8, its price-to-book (P/B) score sits comfortably below the value watermark of 1.

Should you invest £1,000 in AstraZeneca right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if AstraZeneca made the list?

Finally, at 6.4%, the 2025 dividend yield here on Lloyds shares sails above the FTSE 100 average of 3.7%.

On the plus side

These numbers are impressive. But as a potential investor, I need to consider whether the low valuation here reflects significant, and potentially unacceptable, internal and/or external threats.

There’s a lot I like about Lloyds. It has significant brand recognition, a critical quality in an industry where peoples’ money’s involved. It’s also a market leader in mortgages, a sector which could be set for strong growth if (as expected) homebuilding in the UK’s accelerated.

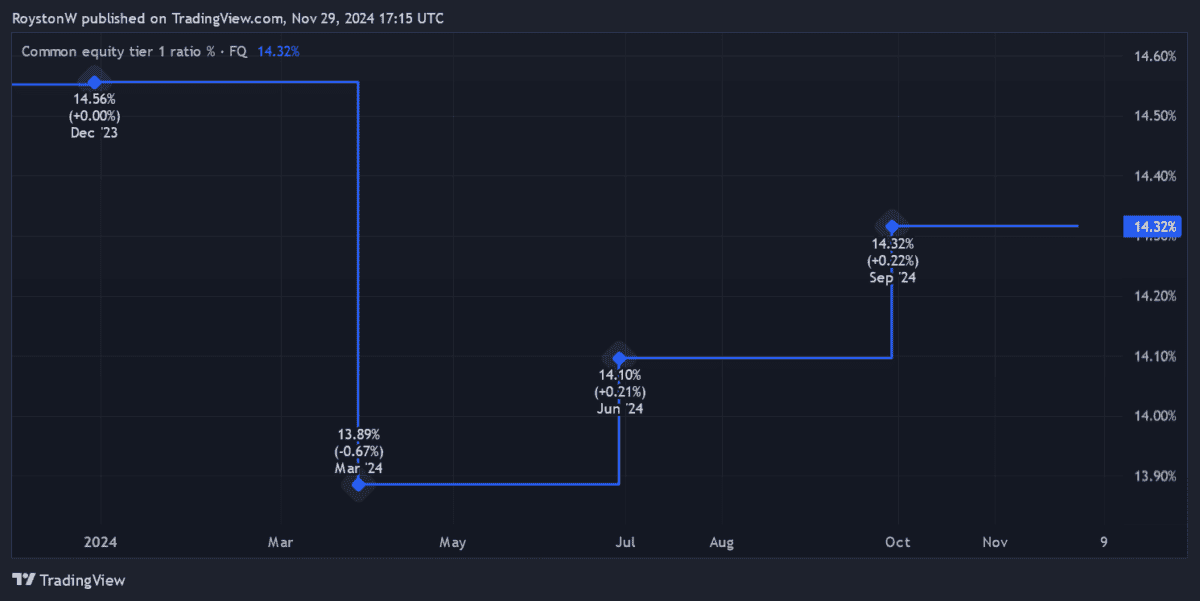

I also like the bank’s strong financial foundations. With a CET1 capital ratio at around 14.3% — ahead of its 13% target — Lloyds has significant scope to invest in growth while also continuing to pay large dividends.

Yet despite these qualities, I believe the risks of me buying Lloyds shares today outweigh these benefits.

Poor sales and rising impairments

For one thing, UK-focused banks like this may struggle to grow revenues as the domestic economy flatlines. News that British GDP grew just 0.1% in the third quarter following a shock September contraction is a bad omen heading into 2025.

With economic conditions remaining tough, Lloyds also faces a further stream of heavy credit impairments. I’m particularly concerned about the potential for heavy mortgage-related costs — the Bank of England (BoE) thinks half of UK home loans, equating to around 4.4m, will become more expensive for borrowers to service over the next three years, due to higher interest rates.

Competition and car loan costs

I’m also concerned about demand for Lloyds’ credit and savings products going forwards as competition rises in the UK banking sector.

Challenger banks are aggressively expanding their product ranges to win customers from traditional operators. And they could have extra financial firepower to take on the likes of Lloyds, with the BoE eyeing changes to Basel III capital requirement rules.

Finally, profits at Lloyds could take an eye-popping hit if it’s found guilty of mis-selling car loans. The bank’s set aside £450m to cover this eventuality, but this figure is under review as a Financial Conduct Authority (FCA) probe rolls on.

Ratings agency Moody’s thinks total motor finance claims — a market in which Lloyds is a leading player — could total £30bn. In this scenario, share prices across the financial services industry could plummet.

On balance then, I’m happy to avoid Lloyds shares despite their cheapness. I’d rather find other shares to buy.