If you’re above 40, you may — like me — regularly think about whether you’re on track to hit your retirement goals with your ISA. Your plans may include living a comfortable retirement with regular holidays and gifts to loved ones. They could even involve hanging up your work apron fairly early on.

It’s a fact that many people worry about how they’ll fund their retirement. Research from Charles Stanley shows that 28% of Brits aren’t on course to hit their goals for a ‘dream retirement.’ Another 39% said they didn’t know how much they’d need to retire comfortably.

They might not want to hear it. But for these people, taking immediate action is more important than ever as living and social costs rise, and uncertainty over future State Pension rules linger.

The good news is that grasping the nettle needn’t be a painful experience. Even someone at the age of 40 could, by investing the price of a cost of a daily coffee, build a multimillion-pound ISA by the time they reach 65.

Here’s how.

Building cash

I’m sure you’ve noticed prices in your local coffee shop creeping steadily higher. Today, my local Starbucks won’t charge me a penny less than £5.40 for a large caffè latte.

With coffee prices at 50-year highs, the cost of my daily fix looks set to keep climbing too. This is enough to give me the hump. And especially when I consider what a better use of my money investing in shares, funds, or trusts undoubtedly is.

Let’s say I save that £5.40 and make my morning coffee at home instead. At the end of each quarter I’d have roughly £493 to invest in my Stocks and Shares ISA.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Tasty windfalls

Past performance is no guarantee of future returns. But history shows us that even a modest amount like this could be enough to build significant long-term wealth.

The FTSE 100 has delivered an average annual return of 6.1% since 2014. S&P 500 shares, meanwhile, has provided an even-better 12.4%.

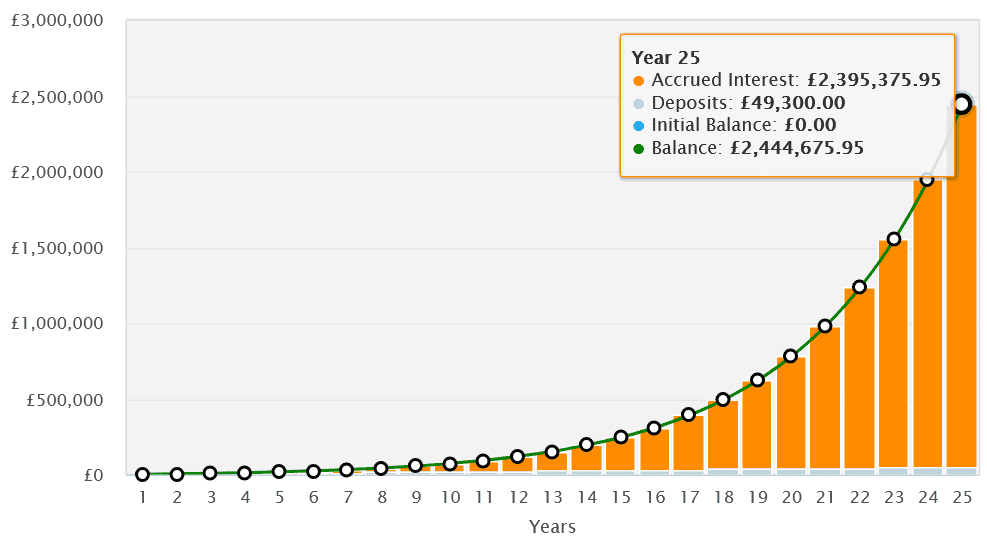

If someone invested £493 in a Footsie tracker fund each quarter, they could — after 25 years — have created an ISA worth £115,065 (excluding fees). With an S&P 500 fund, they’d have made £328,142.

They’re both decent windfalls, in my opinion, just for the cost of a skipped daily coffee. But thanks to a wide range of shares and funds, investors can potentially do even better.

A £2.4m ISA

For example, let’s say an investor parked their money into the iShares S&P 500 Information Technology Sector ETF (LSE:IUIT). Since its creation in 2015, this exchange-traded fund (ETF) has delivered a stunning average annual return of 22.9%.

If this rate were to continue, a 40-year old who invested £493 every quarter would have a portfolio worth a whopping £2,444,676 (excluding fees) by the time they reached 65.

I actually own this particular fund in my own portfolio. By spreading my cash across 69 shares (like Nvidia, Tesla, and Amazon), I can target high returns while also managing risk.

The profits I make could disappoint during economic downturns when tech revenues typically fall. But over the long term, I’m confident the fund could keep delivering big returns thanks to growth areas like artificial intelligence (AI), robotics, and quantum computing.