Halma (LSE:HLMA) has enjoyed another spectacular year in 2024. The FTSE 100 stock — which manufactures safety equipment and hazard detection gear — continues to deliver record performances despite the tough economic backdrop.

Another sparkling trading update on Thursday (21 November) has driven Halma shares 8% higher. This takes total gains since the start of the year to 20%.

Should you invest £1,000 in Halma Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Halma Plc made the list?

Is this the Footsie‘s best growth stock to buy today?

£1bn sales landmark

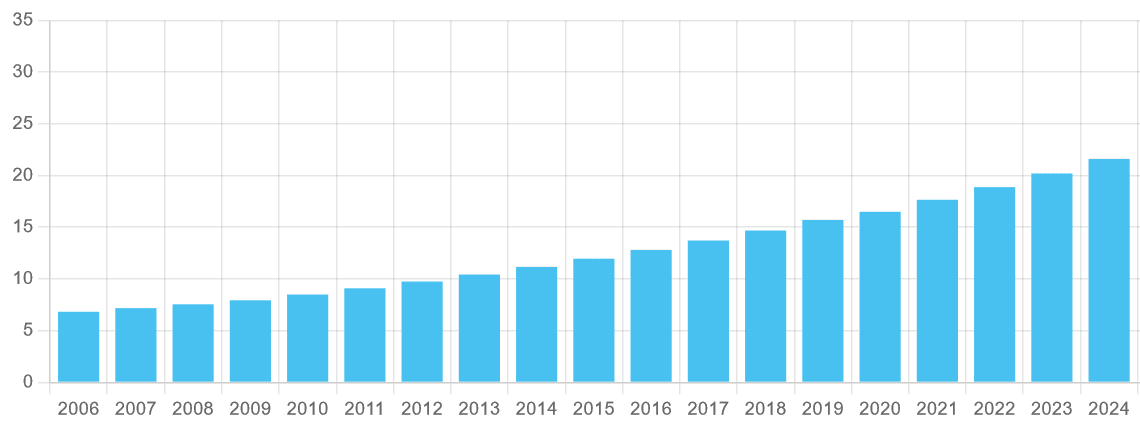

Halma’s a master of identifying lucrative acquisitions and squeezing every drop of value from them. It’s why the M&A-driven business has delivered 21 consecutive years of record profits.

Thursday’s update showed that the strategy continues to pay off wonderfully. Revenues soared 13% between April and September to fresh all-time peaks of £1.07bn. Organic revenues were up 11.5% in the period, with new acquisitions making up the remainder.

Halma’s adjusted EBIT margin rose 70 basis points, to 20.7%, thanks to strength at its Environmental & Analysis unit. Combined with those booming sales, adjusted EBIT soared 17% to £222.5m.

Pre-tax profit was up 16% at £174m, also a new all-time peak.

Reasons to be cheerful

Unsurprisingly, this record-setting performance — one that beat even Halma’s lofty expectations — has got the market buzzing. But this is only half the story.

As well as delivering impressive revenues and profits growth, the Footsie firm also reported remarkable cash creation for the first half.

Cash conversion clocked in at 108%, surging from 96% in the same 2023 period. It was also way ahead of the company’s 90% target.

This is significant for two reasons. Firstly, it gives Halma additional strength to make more earnings-boosting acquisitions. Incidentally, the firm’s net-debt-to-adjusted-EBITDA ratio also fell to 1.27 times from 1.42 times, further inside its goal of two times and below.

Secondly, Halma’s cash boost has enabled it to deliver another impressive dividend increase.

At 9p per share, the interim payout has been raised 7% year on year. This reinforces the company’s appeal as one of the FTSE 100’s best dividend growth shares (annual dividends have risen for 45 straight years).

A top buy?

There’s clearly a lot to get excited about over at Halma then. But would I buy its shares today? I’m not so sure.

This is clearly a high-quality company with a bright outlook. It has plenty of financial firepower to capitalise on what it’s described as its “healthy pipeline of potential acquisitions“. It also has considerable growth opportunities across its developed and emerging markets.

However, I feel that much of this is now baked into Halma’s share price. Following today’s gains, the company now trades on a huge forward price-to-earnings (P/E) ratio of 30.2 times.

This is more than double the Footsie average of 14.2 times.

Halma’s high valuation may limit any further share price gains. It could even prompt a share price reversal if the blockbuster trading updates dry up. This might happen, for instance, if the global economy takes a fresh downturn.

I’ll give Halma a close look if it falls in value. But for the moment I’m happy to sit on the sidelines.