All stock market investors make mistakes, no matter how experienced. Warren Buffett famously lost a fair bit of money investing in Tesco, which he admitted was “a huge mistake“.

The key is to minimise costly rookie errors as time goes on. Here are three that stand out to me.

1. Not researching a stock

Many people behave differently with their money in the stock market than they would in other situations.

Investor Peter Lynch captured this perfectly in the quote below:

The public, when they buy a refrigerator, they go to consumer reports. They buy a microwave oven, they do that kind of research…They do research on apartments…But people hear a tip on a bus on some stock and they’ll put half their life savings in it before sunset.

Peter Lynch

Putting money in a stock without doing much (or any) research is gambling, not investing. It’s a recipe for losing money.

If I don’t know how to do basic stock research, that’s okay. There’s an ocean of material online to help me learn, including here at The Motley Fool.

2. Trying to time the market

The second mistake I’d avoid is trying to time the market. There’s a wealth of research that proves most day traders lose money. The market is just too unpredictable.

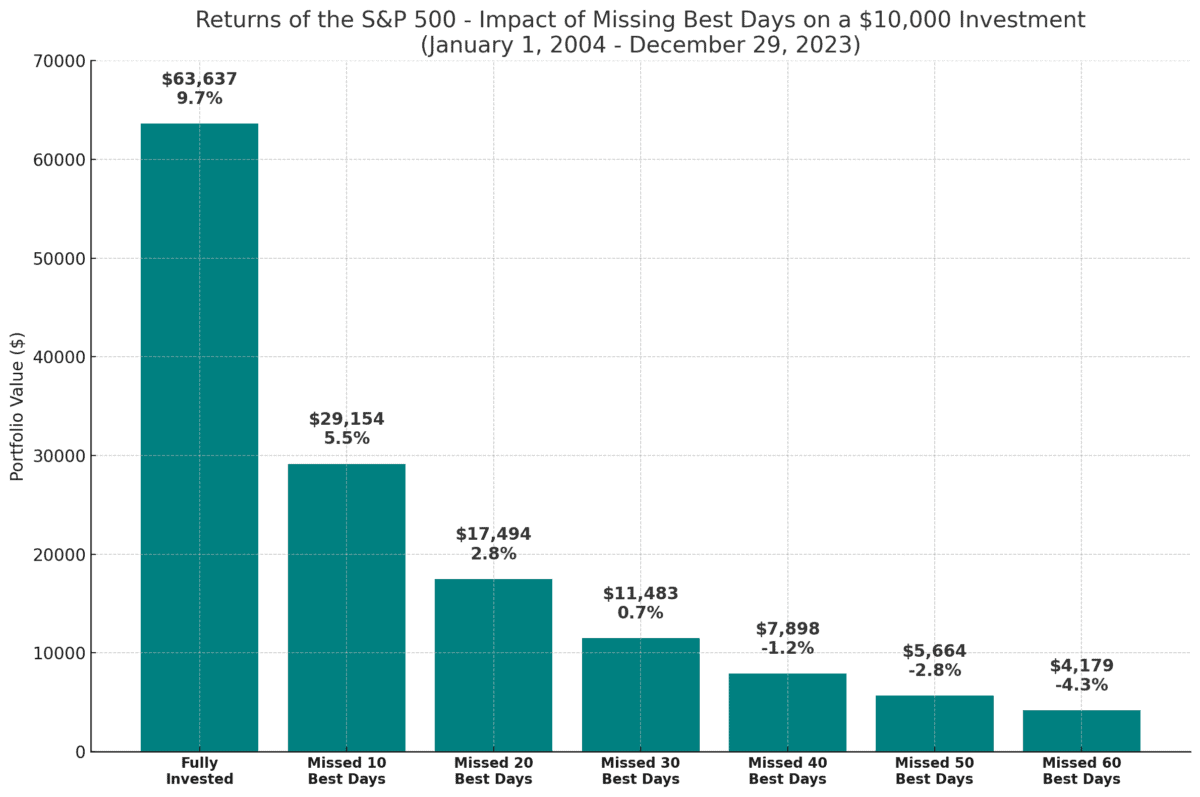

Consider this: between 2004 and 2023, seven of the S&P 500‘s best 10 days fell within two weeks of the 10 worst days, according to JP Morgan.

The chart below compares an individual who was fully invested over that time to investors who missed some of the best days as a result of being temporarily out of the market.

As we can see, missing the 10 best days would have reduced the final portfolio value by more than half — from $63,637 down to just $29,154!

This proves the old adage that “time in the market beats timing the market“. This is a core part of long-term — i.e. Foolish — investing.

3. Selling a stock too soon

For many investors, the most painful experience isn’t failing to identify an incredible stock or watching a dud crash and burn. Instead, it’s likely selling a winning company far too soon.

Take Amazon (NASDAQ: AMZN), for example. Back when the internet started to take off, a family member of mine was amazed at the sheer selection of books on Amazon (it started as an online bookseller). He was so impressed that he bought some shares.

You can probably guess what happened next. Yep, he sold those shares not long after, banking a bit of profit.

Today, the stock is at a record high after rising 10,360% in 20 years. The missed gains are enormous.

Thing is, Amazon has never given long-term investors a genuine reason to sell. It’s relentlessly captured growth markets, from e-commerce to cloud computing and now digital advertising.

Amazon’s revenue is expected to reach $638bn this year, then top $1trn by 2030!

Alas, I’ve never owned the stock, and I think it being broken up is a risk as the tech giant gets ever larger.

But the point still stands. If I sell a quality stock in its third year, and miss out enjoying its 23rd year, then I’m potentially leaving untold riches on the table.