Buying cheap shares can be a good way for investors to maximise their returns. Undervalued stocks have scope for substantial long-term price appreciation if earnings grow. Additionally, companies that are trading below value enjoy a margin of error that can limit price falls if market confidence sours.

With this in mind, here are two of my favourite FTSE 100 and FTSE 250 prospects to research today.

Grafton Group

With interest rates falling, building materials supplier Grafton Group (LSE:GFTU) could enjoy a singnificant sales uplift from now on.

The business operates a range of well-known retail brands such as Selco and Leyland. While it has operations in the UK, it sources 60% of revenues from European markets including Ireland, Finland and The Netherlands.

Such diversification spreads risk and provides exposure to different growth opportunities.

Grafton’s built its footprint through a steady stream of acquisitions. And, pleasingly, the firm still has a strong balance sheet it can use to explore further growth possibilities (it acquired Spanish aircon specialist Salvador Escoda for €132m in October).

There are risks here as the Eurozone construction sector continues to struggle. In October, the construction purchasing managers’ index (PMI) remained deep in contractionary territory at 43.

However, this is encouragingly the highest PMI reading for 10 months, and may be an early sign of a potential upswing. With inflation back below the European Central Bank’s 2% target, a raft of interest rate cuts could be coming that boost construction activity across Grafton’s regions.

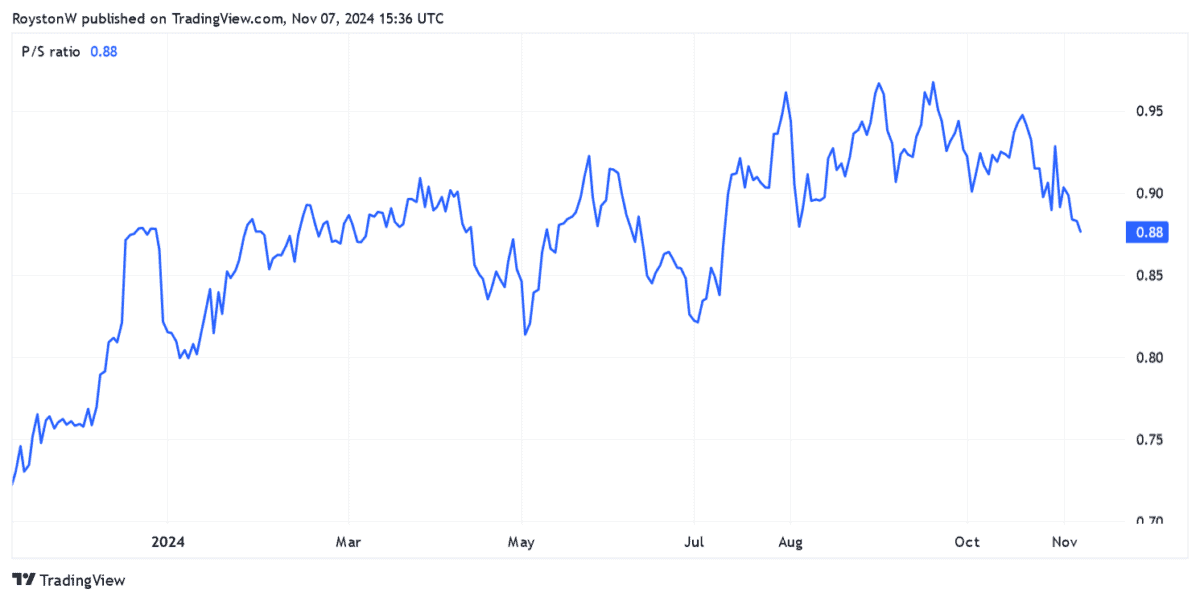

Besides, I think the cheapness of Grafton’s shares reflects the uncertain market outlook. As the chart below shows, its price-to-sales (P/S) ratio sits inside value territory of below 1. It’s a great share to consider at current prices.

Standard Chartered

Standard Chartered‘s (LSE:STAN) share price has ripped higher recently. But like Grafton, it also offers excellent value, in my view.

The bank’s price-to-earnings (P/E) ratio is just 6.8 times, which is a long way below the index average of around 14.5. It’s also below the P/E ratios of other blue-chip banks Lloyds, Barclays, NatWest and HSBC.

Meanwhile, StanChart’s P/S ratio is also a rock-bottom 0.7.

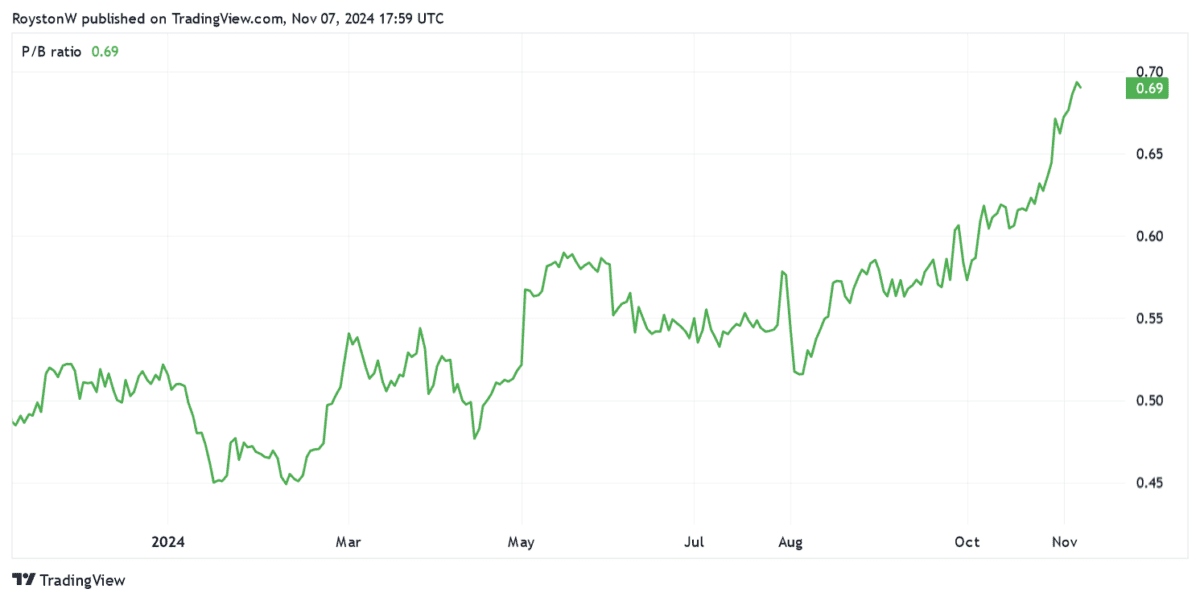

Finally, a price-to-book (P/B) ratio suggests the firm trades at a discount to the worth of its assets, as shown below. Like the P/S ratio, value territory sits below 1.

The bank’s low valuation reflects the threats posed by China’s troubled economy. However, I believe that the potential for significant profits growth more than outweighs this risk, and especially at today’s prices.

Past performance isn’t always a reliable guide to the future. But Standard Chartered’s ability to navigate these waters also gives me confidence as a potential investor.

It lifted profit guidance again last month after growing operating income (at constant currencies) 12% in Q3. Operating income’s now tipped to increase 10% this year, and by 5% to 7% in both 2025 and 2026.

With Asia and Africa’s financial sectors rapidly expanding, I think StanChart could be one of the FTSE 100’s best-performing banks over the long term.