Individuals can try to build a healthy second income for retirement in a number of ways. Products like the Cash ISA have enjoyed a renaissance more recently as savings rates have perked up.

According to HM Revenue and Customs, the number of Cash ISAs that were subscribed to in 2022/23 rose by a whopping 722,000 year on year, to just under 7.9m. It’s no coincidence that this coincided with the Bank of England starting its interest rate hiking cycle in late 2021.

However, opting to just save cash rather than invest could result in significant missed returns, and the situation may only worsen over time.

Let me show you how.

Rates to drop?

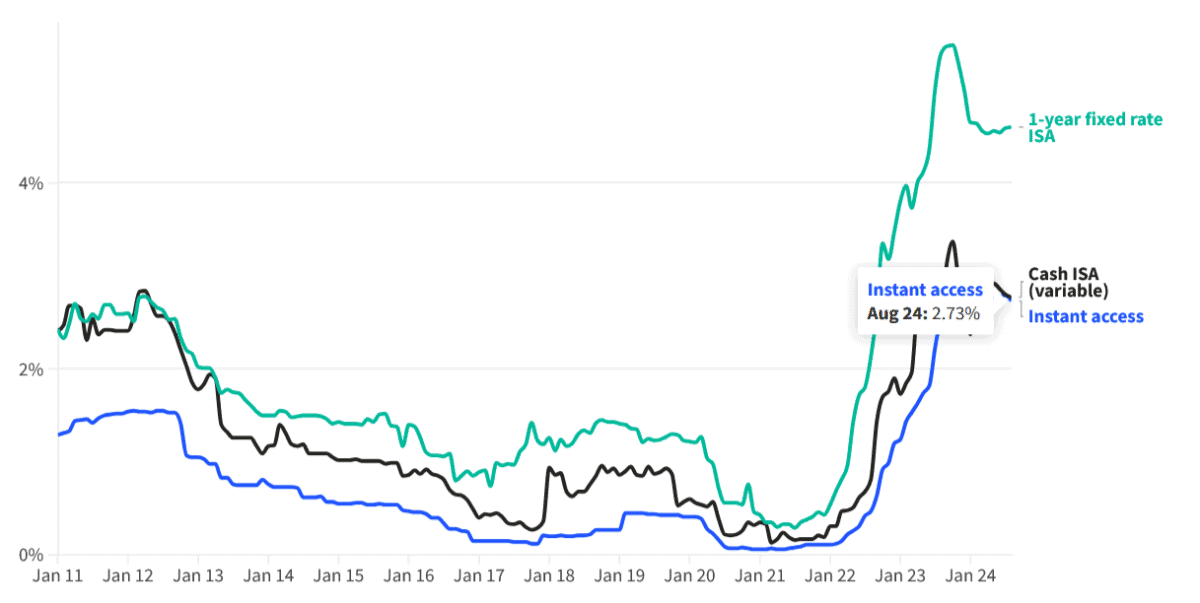

Today, one of the best easy-access Cash ISA on the market offers a healthy 5.12% interest rate. As the chart below shows, the average rate for these tax-friendly products is comfortably ahead of what savers enjoyed between 2011 and 2022.

However, rates are tipped to fall steadily across the market as the BoE begins to loosen monetary policy. So leaving all one’s money locked in a savings account could be a massive mistake.

For the sake of this example, let’s say that the best-paying Cash ISA offers a rate of 4% for the next 30 years. A £300 investment each month at this rate would make me £208,215 over the period.

If I then drew down 4% of this each year, I’d have a monthly income of £694.

Better returns

That’s far below what I could be making if I invested in, say, the FTSE 100 or FTSE 250 instead. These UK share indexes have provided an average long-term return of 7% and 11% respectively over the long term.

However, it’s essential to remember that past performance isn’t a reliable guide to future returns. Share investing is much riskier than parking my money in a secure savings account, and I could even make a loss on certain stocks. This is why having a certain amount in savings for emergencies is always a good idea.

Reducing risk

This is also why investing in an exchange-traded fund (ETF) could be a good idea. These financial instruments spread risk by allocating my cash across a wide range of equities.

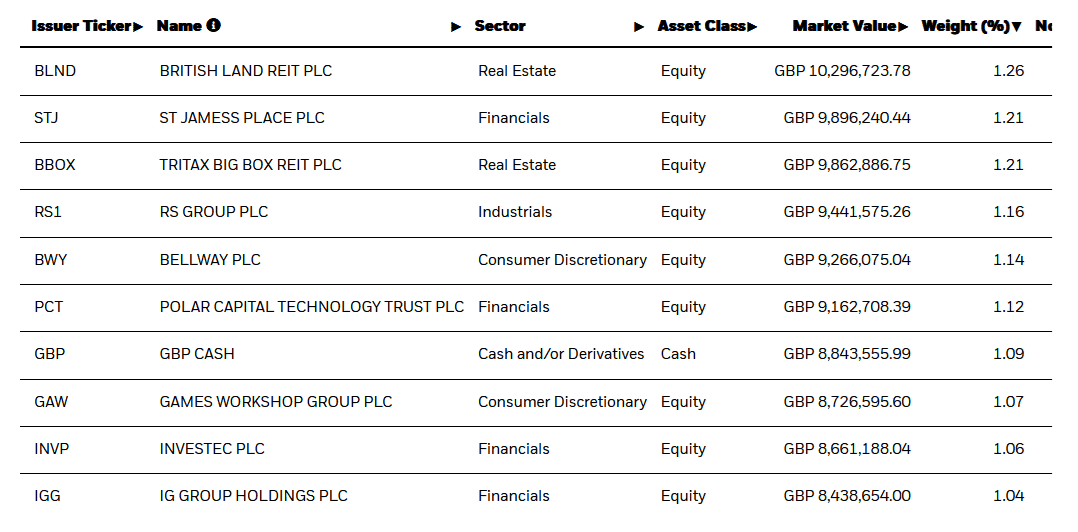

Based on the above, buying the iShares FTSE 250 UCITS ETF (LSE:MIDD) could be a great idea. By investing my cash across hundreds of different companies, I have exposure to a multitude of industries and geographies, thereby minimising the impact of underperformance in any one particular area.

Furthermore, the ETF provides me with a mix of cyclical and defensive shares, which can provide me with a smooth return over time. There is the risk, however, that the fund’s focus on UK shares could be a problem should broader demand for British assets decline.

If the FTSE 250’s long-term return of 11% continues, a £300 monthly investment in this ETF would turn into £841,356 after 30 years, excluding the impact of slight tracking errors.

That would then make me a monthly £2,805 passive income based on a 4% drawdown rate. That’s four times higher than the £694 I’d enjoy by invest in that 4%-yielding Cash ISA mentioned above.

It’s why I plan to continue investing in stocks and funds over simply saving cash.