Looking to invest on the London Stock Exchange this month? Here’s a dirt cheap dividend share and a soaring exchange-traded fund (ETF) I think are worth considering.

Bank of Georgia Group

Bank of Georgia‘s (LSE:BGEO) share price has plummeted by double-digit percentages in recent weeks. I think this represents a great dip-buying opportunity for investors seeking value shares with huge dividend yields.

For 2024, the FTSE 250 bank trades on a forward price-to-earnings (P/E) ratio of 3.1 times. As for dividend yields, these ring in at 7.6% and 8.1% for this year and next year respectively. To put that in context, both figures are more than double the average for FTSE 250 shares.

Should you invest £1,000 in Phoenix Group Holdings Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Phoenix Group Holdings Plc made the list?

Bank of Georgia’s slump reflects growing concerns over rising political uncertainty in the country and, more specifically, its future relationships with Russia and the European Union. These issues will naturally have significant implications for Georgia’s economy and the companies that operate there.

Still, I’d argue that Bank of Georgia’s rock-bottom P/E ratio of 3 times more than reflects any dangers to its profits.

On balance, I think the bank remains a great way to capitalise on booming financial products demand in its emerging market. Profits rose 16% in the first half of 2024 as loan levels rocketed, latest financials showed.

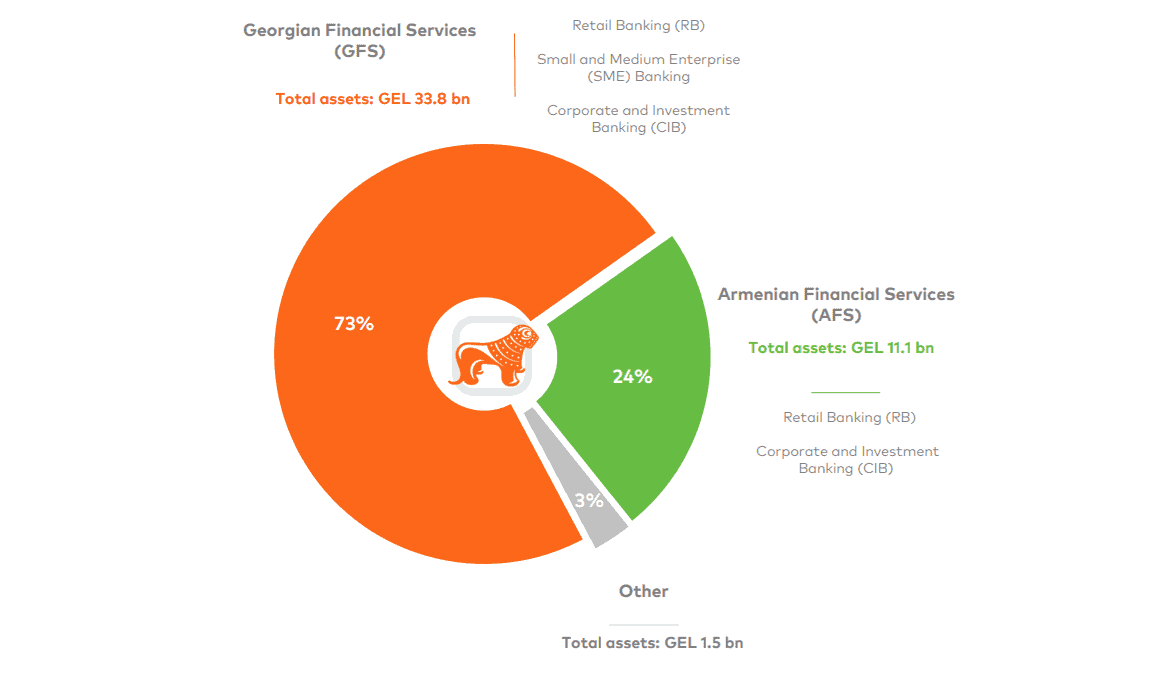

I’m also encouraged by its acquisition of Ameriabank this year. This gives it significant exposure to Armenia, another of the region’s fastest-growing economies.

While it’s not without risk, I think the firm could prove to be an excellent long-term prospect.

iShares Gold Producers ETF

Precious metals prices have boomed in 2024. Gold, for instance, has soared to record highs across multiple currencies, and in sterling terms broke through £2,000 per ounce late last month for the first time.

Silver’s also tearing it up, and on a dollar basis has struck its highest since 2012 in recent days.

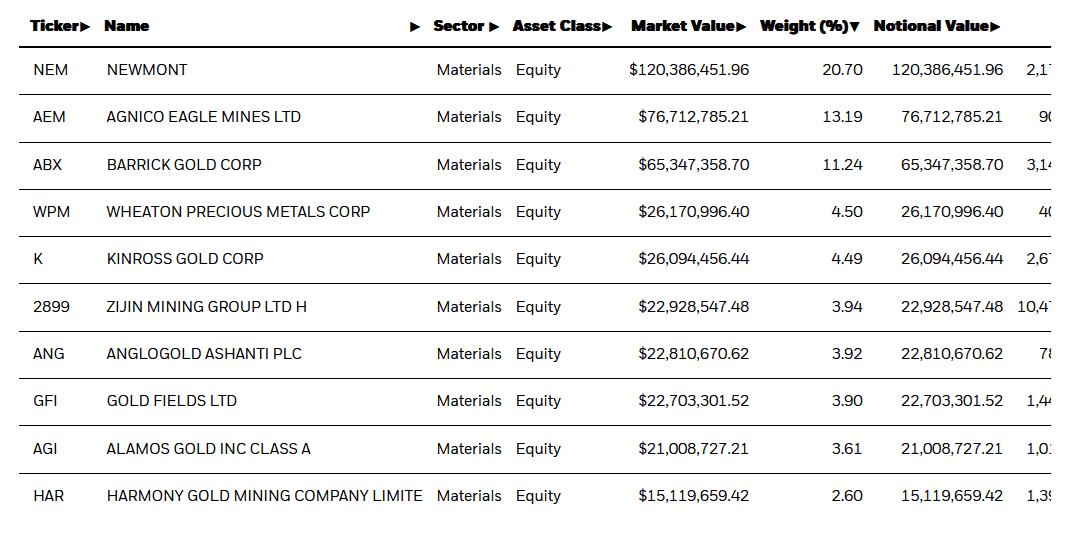

I think investing in a gold-based exchange-traded fund (ETF) could be a good idea in this climate. One that’s caught my eye is the iShares Gold Producers ETF (LSE:SPGP), which has a relatively low annual cost of 0.55%.

As the name suggests, it invests in gold mining companies rather than tracking the bullion price itself. This has a huge advantage for me as an investor, as many of the miners it owns pay a dividend which the fund automatically reinvests.

On the downside, purchasing this mining-focused gold ETF exposes me to the problematic nature of metals production. However, because the fund invests in a wide range of different companies, the risk of such troubles on my overall returns are reduced, but not eliminated.

Of course, there’s no guarantee that gold prices will keep rallying. However, a blend of central bank rate cuts, ongoing worries over the US and Chinese economies, and escalating trouble in the Middle East all mean the precious metal could continue soaring in October and beyond.