Nvidia (NASDAQ: NVDA) stock has been creeping back up recently. From a low of $102 on 6 September, it’s jumped 18% to reach $121.

For longer-term investors though, such changes are merely rounding errors. Nvidia shares are up more than 262 times in value since September 2014!

Here, I want to look at analysts’ growth forecasts through to 2026 to determine if I think the stock looks attractively priced at $121.

Revenue growth estimates

Nvidia’s fiscal year runs from February to January. Somewhat confusingly, this means that the current year is FY25 and the next one (FY26) will commence in February.

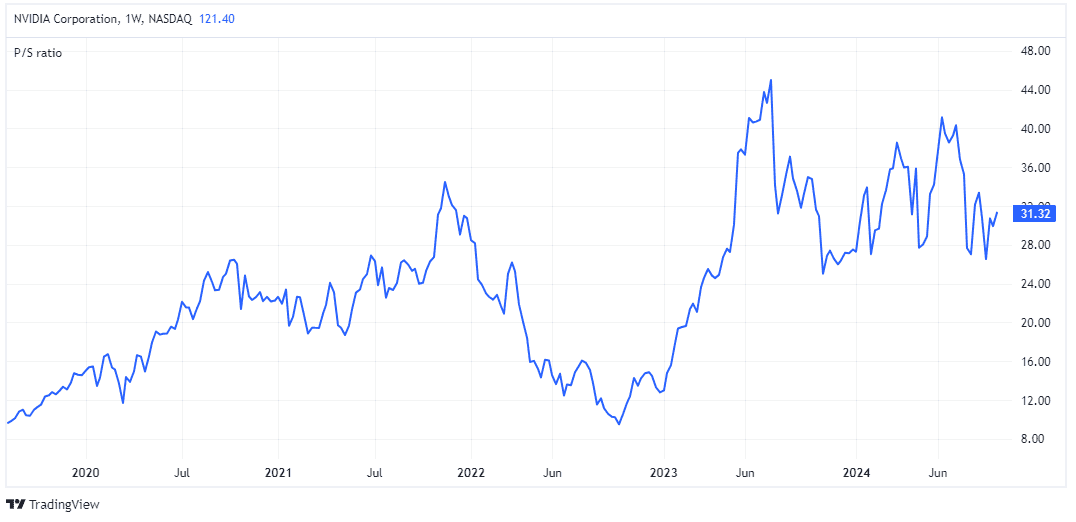

Last year (FY24), Nvidia’s revenue skyrocketed 126% year on year to $60.9bn. This gives the stock a very steep price-to-sales (P/S) ratio 31.3. That’s above the S&P 500, ‘Magnificent Seven’, or any other average you want to look at.

However, Wall Street expects very strong revenue growth in the next three years. Indeed, it sees Nvidia’s revenue exceeding $200bn by FY27. That would be a truly breathtaking rise from the $27bn reported in FY23.

If this forecast is accurate, we’re be looking at a forward-looking P/S multiple of 14.4 for then, all else being equal. This still seems a bit pricey to me, even if there’s a chance that Nvidia beats estimates.

| Fiscal year | Revenue forecast | P/S ratio |

|---|---|---|

| FY25 | $126bn | 23.6 |

| FY26 | $177bn | 16.8 |

| FY27 | $207bn | 14.4 |

But what about the earnings outlook?

Earnings growth estimates

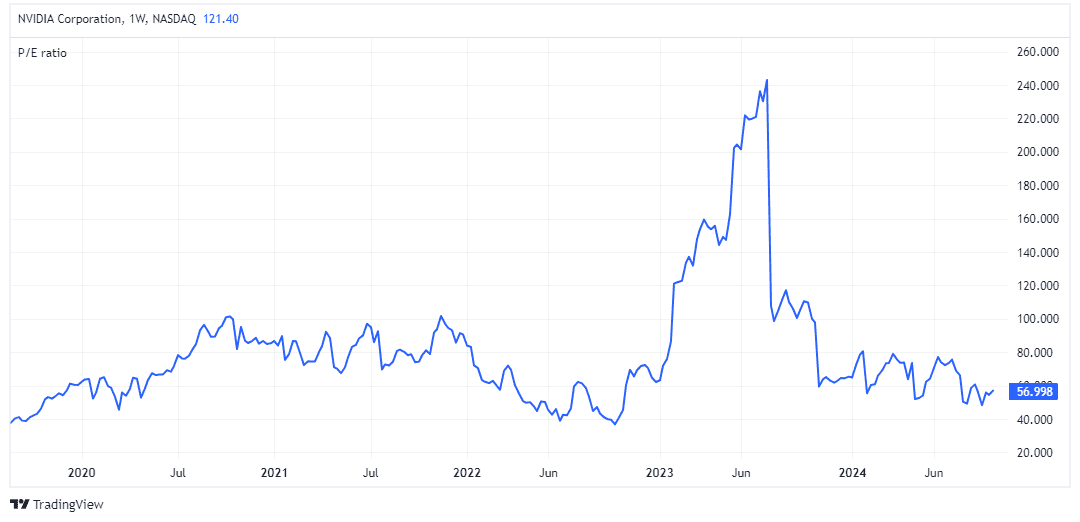

Right now, Nvidia stock is trading on a price-to-earnings (P/E) ratio of 57.

But the forward multiples start to fall significantly when we look at the earnings per share (EPS) forecasts for the next couple of years. We could be looking at a P/E ratio of 25 for FY27.

| Fiscal year | EPS forecast | Forward P/E ratio |

|---|---|---|

| FY25 | $2.84 | 42.7 |

| FY26 | $4.07 | 29.8 |

| FY27 | $4.83 | 25.1 |

The problem here, of course, is that we just don’t know what demand for the company’s graphics processing units (GPUs) will look like as far out as 2026. There’s a risk that it could be far less than currently projected.

In the near term though, I’m bullish, especially given some of the stories published recently on AI chip demand.

Billionaires have been ‘begging’

In September, for example, Oracle co-founder Larry Ellison revealed that he and Elon Musk took Nvidia CEO Jensen Huang out to dinner and basically “begged” him to give them access to more GPUs.

“I would describe the dinner as Oracle, me, and Elon begging Jensen for GPUs,” Ellison recalled. “Please take our money. Please take our money. By the way, I got dinner…We need you to take more of our money please.”

This highlights how desperate all the tech giants are to get their hands on Nvidia’s golden GPUs. They’d rather risk massively overspending than falling behind in the AI revolution.

Billionaires have been selling

On the other hand, some of Wall Street’s big names have recently been dumping Nvidia shares. For example, hedge fund manager David Tepper reduced his holding by 84% in the second quarter.

He said that Nvidia’s earnings look great for 2024, and probably 2025, but he has absolutely “no idea” about 2026. “There are too many unknowns regarding how this [AI] might develop, and the earnings variations are too large“, Tepper added.

Given the uncertainty beyond this year, I have no plans to invest in Nvidia shares at $121.