When I retire, which I expect will be at least a couple of decades from now, I hope to top up my pension earnings with passive income from my Stocks & Shares ISA. Collectively, these earnings could make my retirement more financially comfortable and enjoyable.

For the last decade, I’ve been investing in UK and US stocks as part of my strategy to build a portfolio large enough to support me through my retirement. Needless to say, the money invested over that period has added up over time.

However, millions of Britons are sitting on savings that won’t deliver life-changing returns over the long run due to negative real rates. So with £25,000 in savings, I could look to put that money to work by investing in stocks and funds.

Should you invest £1,000 in Tesla right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Tesla made the list?

While investing may sound inherently more risky to many people, a well-diversified portfolio can actually help manage risk over the long term. Here’s how it’s done.

Mitigating risk

Funds, ETFs (exchange-traded funds), and trackers offer cost-effective ways to spread investments across multiple companies, sectors, and geographical regions.

This allows us as investors to mitigate the impact of poor performance from any single investment. These instruments also allow investors to gain broad market exposure, possibly balancing between US, UK, and global markets.

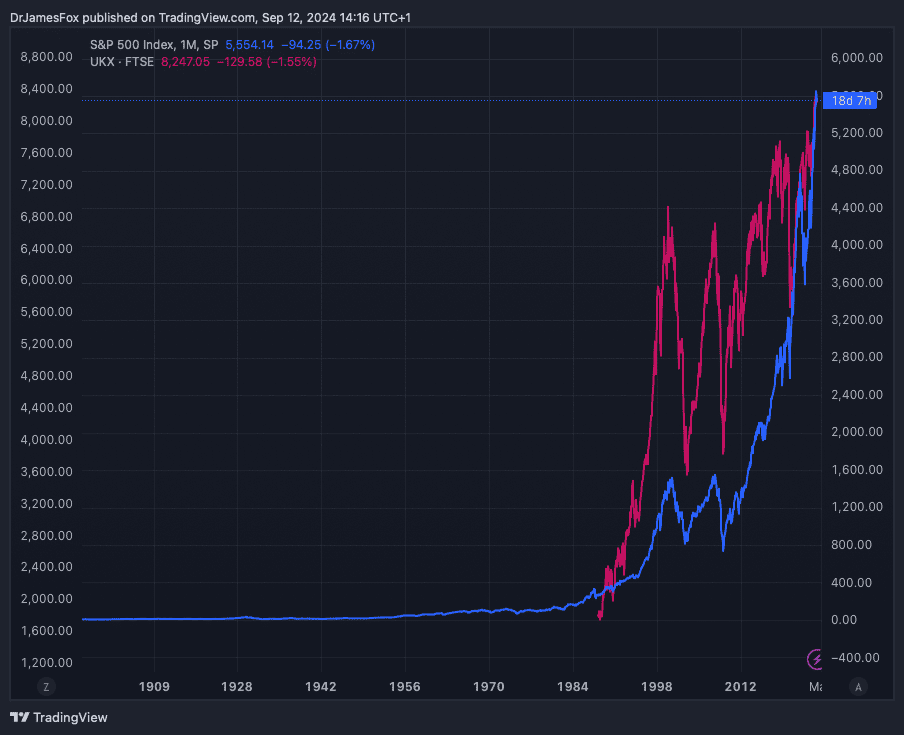

Historically, stock markets have shown strong long-term growth potential. From 1900 to 2023, US stocks returned 6.4% annually in real terms, while UK stocks delivered 5.3%.

Looking at slightly more recent statistics, the S&P 500, a benchmark for the US stock market, has delivered an average annual return of about 10.7% since its introduction in 1957.

This outpaces inflation and many other forms of investment. We can gain access to these returns by simply investing in trackers funds or purchasing shares in sector specific funds.

Taking this 10.7% rate of return and assuming I can replicate that over the coming decades, it would take 20 years for me to turn my £25,000 into a portfolio that could deliver £12,000 a year.

A sensible choice

There are many ways to invest, and this depends on circumstances and on our objectives. Personally, given my profession and the fact that I put money into my ISA monthly, I prefer to pick one or two new stocks every month — often re-picks.

However, if I were starting investing with a lump sum today, I’d consider spreading my money across funds and ETFs, like the Vanguard S&P 500 UCITS ETF GBP (LSE:VUSA).

It’s among the most popular ETFs for good reason. It simply tracks the performance of the S&P 500 index, offering European investors easy access to the US stock market. It provides exposure to 500 of the largest US companies, representing about 80% of the US equity market capitalisation.

It also stands out for its low cost, with an expense ratio of just 0.07%, significantly lower than many actively managed funds. It’s highly liquid, making it easy for investors to buy and sell shares without incurring large spreads or transaction costs.

Of course, even the most diverse of funds can go down as well as up. Recessions, trade wars, and actual wars could also negatively impact the performance of US stocks, and this ETF. Nonetheless, short, medium, and long-term performance has been very strong.