The London stock market’s a great place to search for cheap stocks to buy. The FTSE 100 alone’s packed with brilliant bargains following a long period of underperformance.

I’m drawing up a list of value shares to buy for my own Stocks and Shares ISA. Here are two currently catching my attention.

Phoenix Group

Phoenix Group (LSE:PHNX) offers exceptional value across a range of metrics. City analysts think earnings here will soar 41% year on year in 2024. This leaves the fnancial services business trading on a price-to-earnings (PEG) ratio of 0.5. Any reading below 1 indicates a stock’s undervalued.

Should you invest £1,000 in Associated British Foods right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Associated British Foods made the list?

At the same time, Phoenix’s prospective dividend yield clocks in at an astonishing 9.6%. This makes it one of the biggest potential dividend payers on the FTSE 100 right now and, to me, its most attractive selling point.

Investors need to be wary when choosing high-yield dividend stocks. If a company’s stock price has dropped substantially due to poor performance or financial issues, the yield will look artificially high.

Enormous cash rewards are also often unsustainable, which can result in disappointing returns for long-term investors.

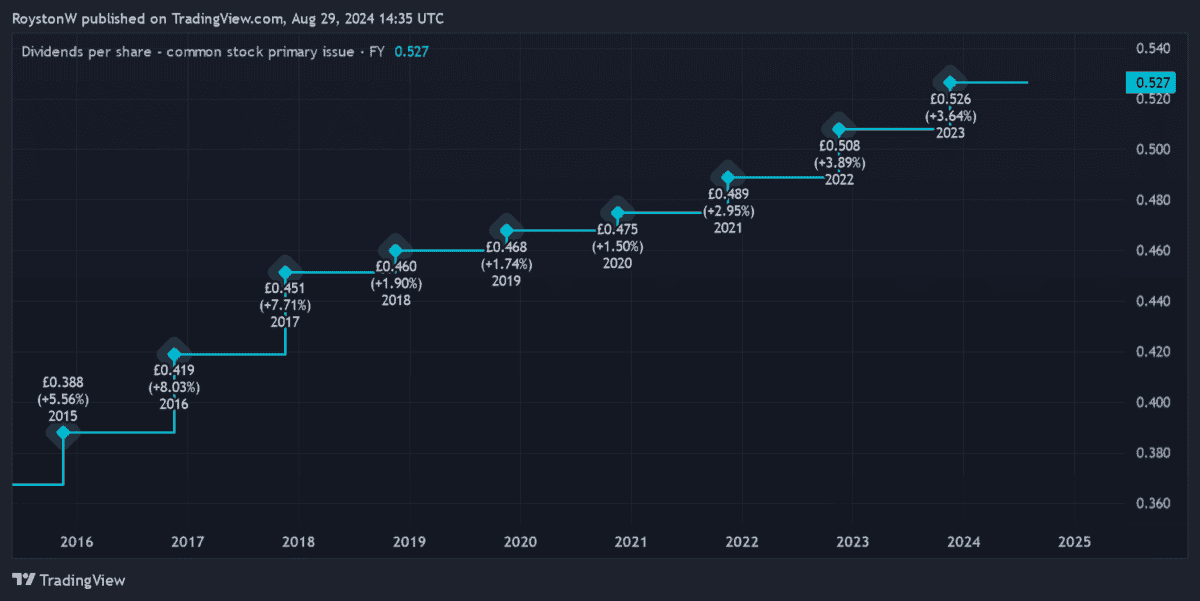

I don’t believe Phoenix represents a trap for income investors however. As the chart below shows, the company has an excellent track record of paying a large and growing dividend.

And City analysts expect this trend to continue which, in turn, pushes the yield on Phoenix’s shares to an outstanding 10.2% for 2026.

So why are City analysts so bullish? A strong profits outlook’s one, driven by rising pensions demand as the UK population steadily ages.

Phoenix’s impressive financial foundation’s another reason to be optimistic. The firm’s Solvency II capital ratio was a robust 176% as of December. Its balance sheet will receive an extra boost too, if it decides to put its SunLife division up for sale.

The company’s operations are highly sensitive to interest rate changes. But, on balance, I think it could prove to be a top addition to my portfolio.

Associated British Foods

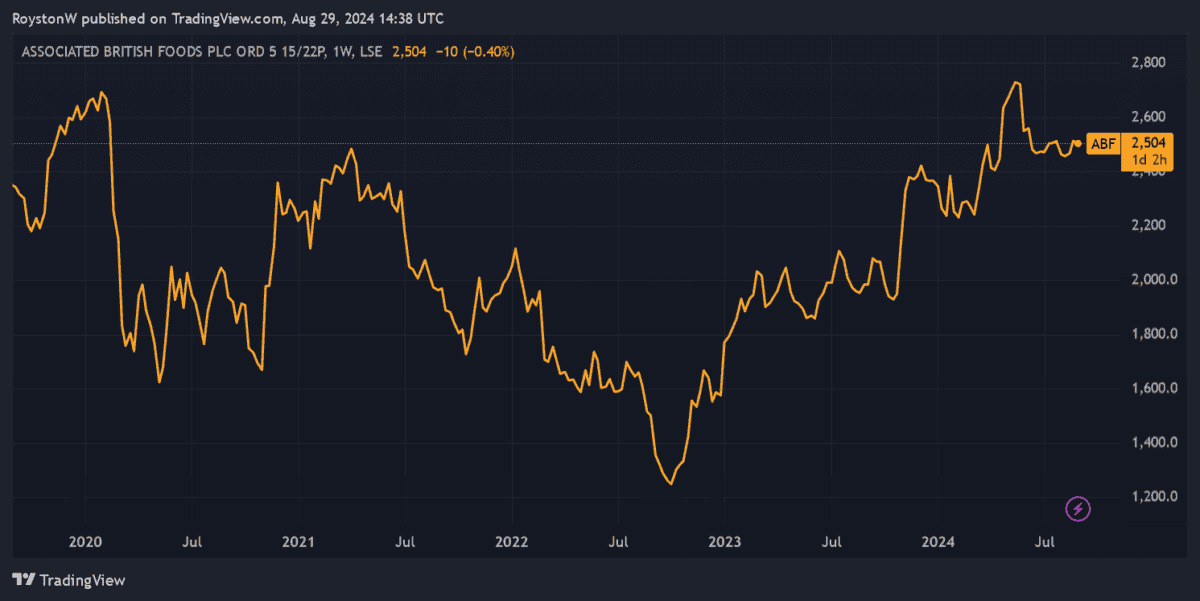

Powered by soaring sales at its Primark value retail division, City analysts think Associated British Foods (LSE:ABF) will rocket 35% this year. As a result, the company trades on a forward PEG ratio of 0.5.

We all know that competition in the fashion/lifestyle retail sector’s fierce. It’s a threat that potential investors here need to take seriously.

But Primark’s got strong brand power and a great track record of rolling out stores and products that consumers love. It’s why like-for-like revenues rose 2.1% in the six months to March, despite tough market conditions.

I’m not just impressed by Primark’s ability to keep attracting customers either. Work to improve margins also continues to pay off, with these rising to 11.3% in the first half, up from 8.3% a year earlier. This propelled operating profit 45% higher in the period.

I believe Associated British Foods has significant long-term investment potential as Primark expands. It had 440 stores in operation as of March, thanks to new store openings in the US and Europe. Although its products aren’t available on line, it is at least investing in Click & Collect to harness the e-commerce boom.

I think it’s a great stock for value-hungry investors like me to consider.