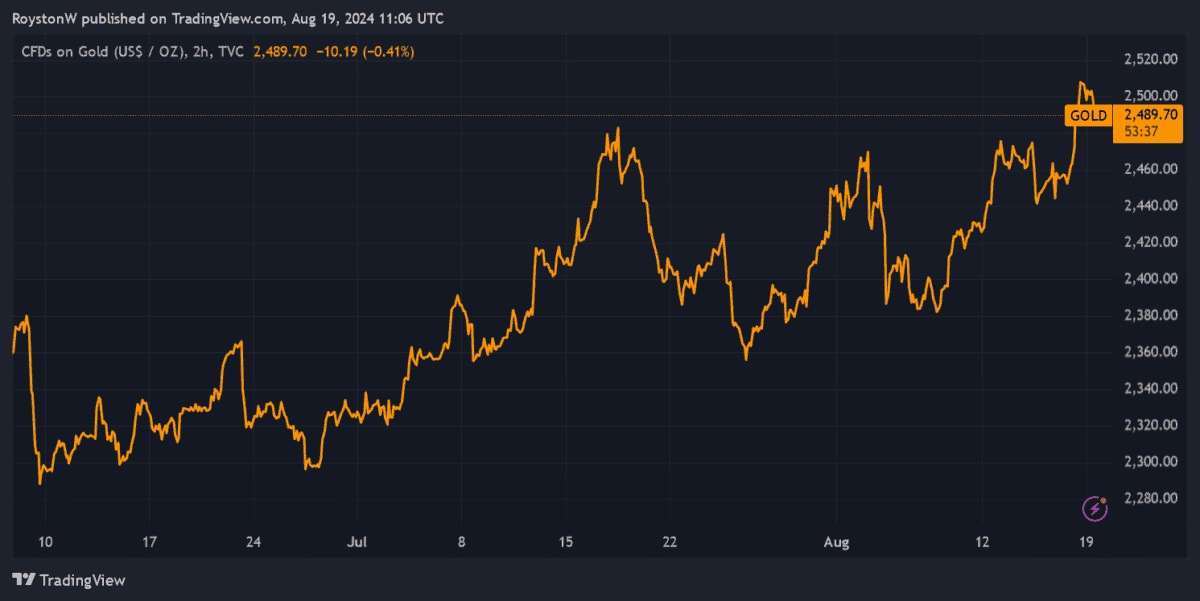

Gold prices continue to soar at the end of the summer. As I type, the yellow metal’s in the process of hitting new record peaks above $2,500 an ounce. I’m looking to buy a cheap share or two to capitalise on this price boom when I next have cash to invest.

There are multiple factors driving the gold rush, such as the expectation that inflation will rise as interest rates are reduced by central banks. Rate cuts by the Federal Reserve in particular are helping the yellow metal by weakening the US dollar. This makes it more cost-effective to buy buck-denominated assets like gold.

Safe-haven gold buying is also accelerating following Ukraine’s invasion of Russia and fresh violence in Gaza and Israel. These recent actions are fuelling fears of widening conflicts in Europe and the Middle East, respectively.

A top ETF

Investors can tap into gold’s bull run in many ways. One way that I think is worth serious consideration is buying an exchange-traded fund (ETF) like the iShares Gold Producers UCITS ETF (LSE:SPGP).

As the name implies, this provides exposure to companies that source most of their revenues from gold mining. And over the past year it’s provided an impressive 21.4% return.

There are drawbacks to owning a fund that focuses on gold miners, compared to one that simply tracks the gold price. Operational problems are common in the mining sector, and can be hugely expensive once lost revenues and big costs are taken into account.

However, this iShares product greatly reduces this risk by investing in a wide raft of companies. In fact it owns stakes in 62 companies today, including many heavyweight names with great track records such as Newmont, Agnico Eagle and Barrick Gold.

With an expense ratio of 0.55%, it has one of the lowest fees attributable to this sort of ETF too.

A great gold stock

Investing in a single mining stock can be more risky, for the reasons outlined above. But there’s also the opportunity to make spectacular, sector-beating returns.

This is something that buyers of Centamin (LSE:CEY) shares have experienced over the past year. The FTSE 250 miner’s share price has rocketed 54% during the past 12 months.

This reflects, in part, ongoing production at the flagship Sukari mine in Egypt, with 2024 output on course to rise to 470,000-500,000 ounces in 2024.

It’s also due to promising drilling work at its Doropo exploration project, a huge project in the Côte d’Ivoire. Centamin is expecting to receive a mining licence here by the end of the year, although this isn’t guaranteed and problems on this front could harm the share price.

Finally, Centamin’s share price surge reflects an explosion of interest from value seekers looking to get in on the gold rush.

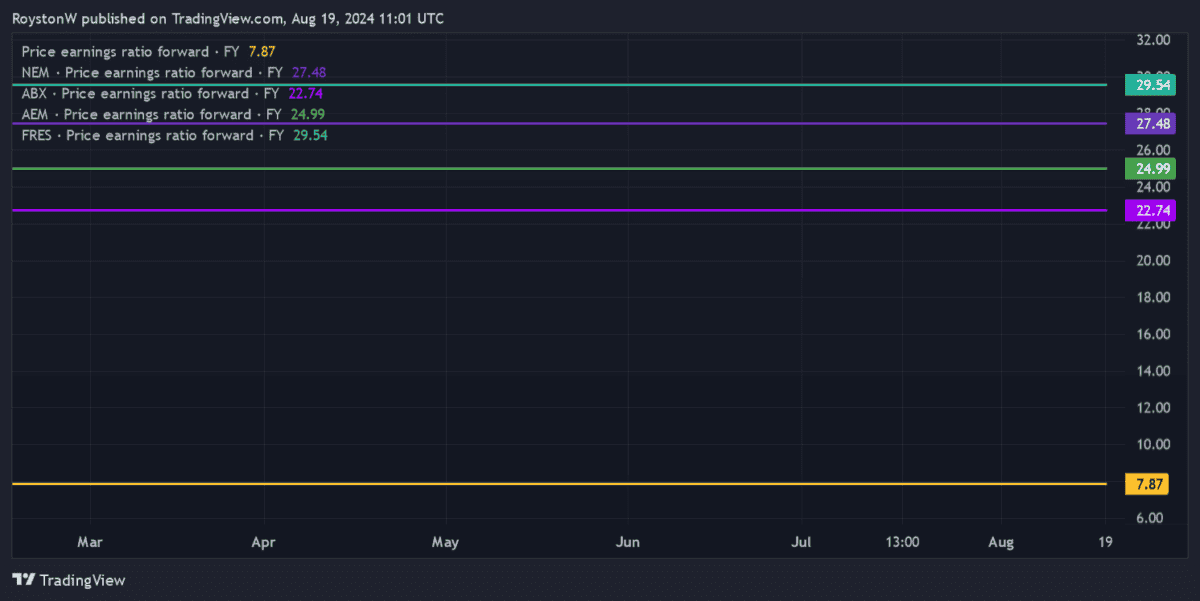

As the chart below shows, the FTSE 250 company still trades at a large discount to the broader gold mining sector, based on the forward price-to-earnings (P/E) ratio). This could provide the base for even more industry-beating share price gains looking ahead.