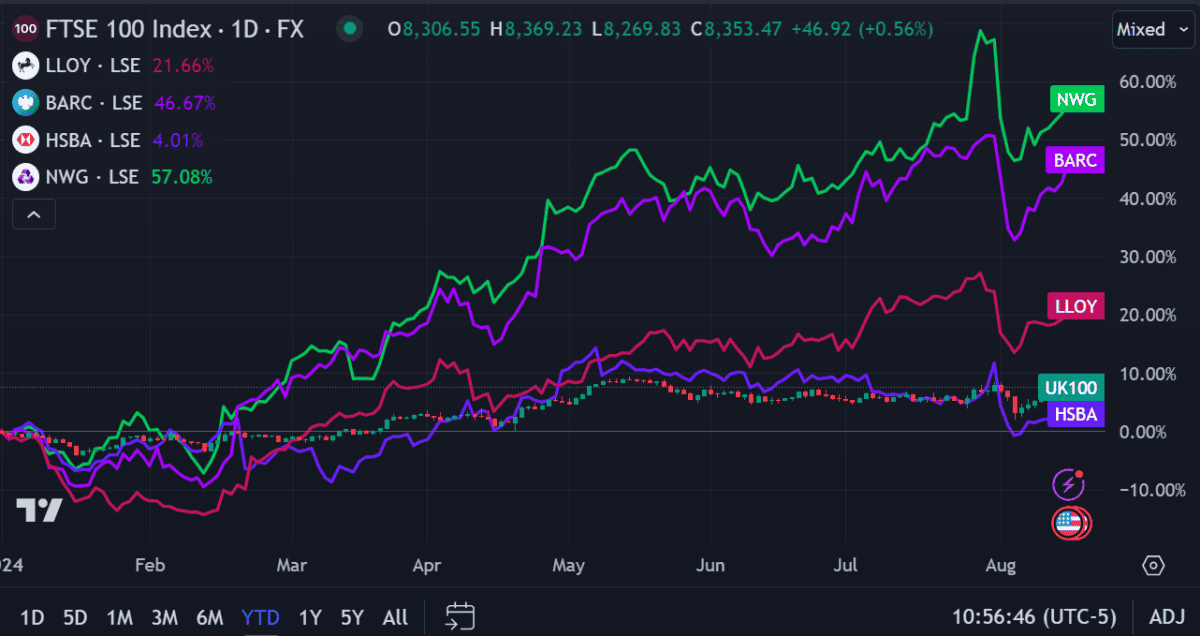

I’m not going to sugarcoat it — Barclays (LSE: BARC) is far outperforming the Lloyds (LSE: LLOY) in terms of share price so far this year. And not by just a bit. Year-to-date (YTD), its growth is more than double that of the black horse bank.

Still, at least Lloyds is doing better than the FTSE 100, which is more than I can say for at least one other bank.

Bank vs bank

As a customer, I’ve long been a fan of Barclays but I wouldn’t say my faith is unwavering. There are times when the bank really tests my patience. I’m not as familiar with Lloyds but it’s an attractive stock nonetheless.

So if I weren’t already invested in both, which would be the best pick today?

Let’s compare their financials.

Lloyds

With the mortgage market becoming increasingly competitive, Lloyds is feeling the pressure. This is its biggest money-spinner, so it needs to be on top. And since the Bank of England (BoE) cut interest rate cuts last month, things are even tougher.

The cuts mean Lloyds’ net interest margins decreased from 3.18% to 2.94% (the difference between what it pays in interest and what it charges). Basically, it’s now earning a bit less from loans.

Plus, its 2024 first-half results weren’t spectacular. Net income was down 9% and operating expenses rose, leading to a 14% decrease in profits before tax.

But still, the bank’s low share price seems to offer good value. It has an attractive forward price-to-earnings (P/E) ratio of 8.9, trading at 53% below fair value based on future cash flow estimates.

Last but not least, its key value proposition: an above-average dividend yield of 5.1%.

So how does Barclays measure up?

Barclays

The Barclays share price enjoyed the biggest boost from this week’s news that the US may avoid a recession. It climbed 3.4% on Thursday while other banks closed up around 1.5%.

That brings its yearly gains up to a huge 46%, making me wonder how much more it can grow. Surprisingly, it still hasn’t out-valued its earnings, with a forward P/E ratio of only 6.3. This places it well below both Lloyds and the UK bank average of 7.3.

Several key announcements this month helped its fortunes. It increased its dividend by 7.4% and initiated a $750m share buyback programme. It also expects to complete its acquisition of Tesco Bank by November this year.

My key concern with Barclay is that the current share price may be artificially inflated. The past two years have been an economic mess, with high interest rates skewing several metrics. Further rate cuts could tip the scales against it, potentially prompting shareholders to re-evaluate their positions.

Even after 16 years, the 2008 crisis lingers in the minds of many investors. Until the current recession jitters have been fully quashed, I remain wary of weighing too much on Barclays.

The bottom line

On the face of things, Barclays looks like its growth prospects outmatch Lloyds. But those same metrics give me pause for concern. It may promise a better return — but at what risk?

As a well-established market leader, Lloyds feels more stable to me, if somewhat less exciting.

So maybe holding a bit of both is the best idea after all?