One of the worst performers in the FTSE 250 recently has been Watches of Switzerland Group (LSE: WOSG). Currently, the stock’s down about 75% from its highs (set in early 2022).

Is it one of the best value stocks in the index today after this enormous decline? Let’s discuss.

The watch market is struggling

I follow the luxury watch market pretty closely as I have an interest in timepieces. And I can tell you that right now, the market isn’t doing very well.

Should you invest £1,000 in Watches Of Switzerland Group Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Watches Of Switzerland Group Plc made the list?

During the coronavirus pandemic – when people had a lot of disposable income – everyone wanted to buy a luxury watch. Today however, it’s a very different story.

With interest rates at higher levels and pandemic savings long gone, far fewer people have the money for luxury goods. And many of those who do would rather spend their cash on ‘experiences’ instead.

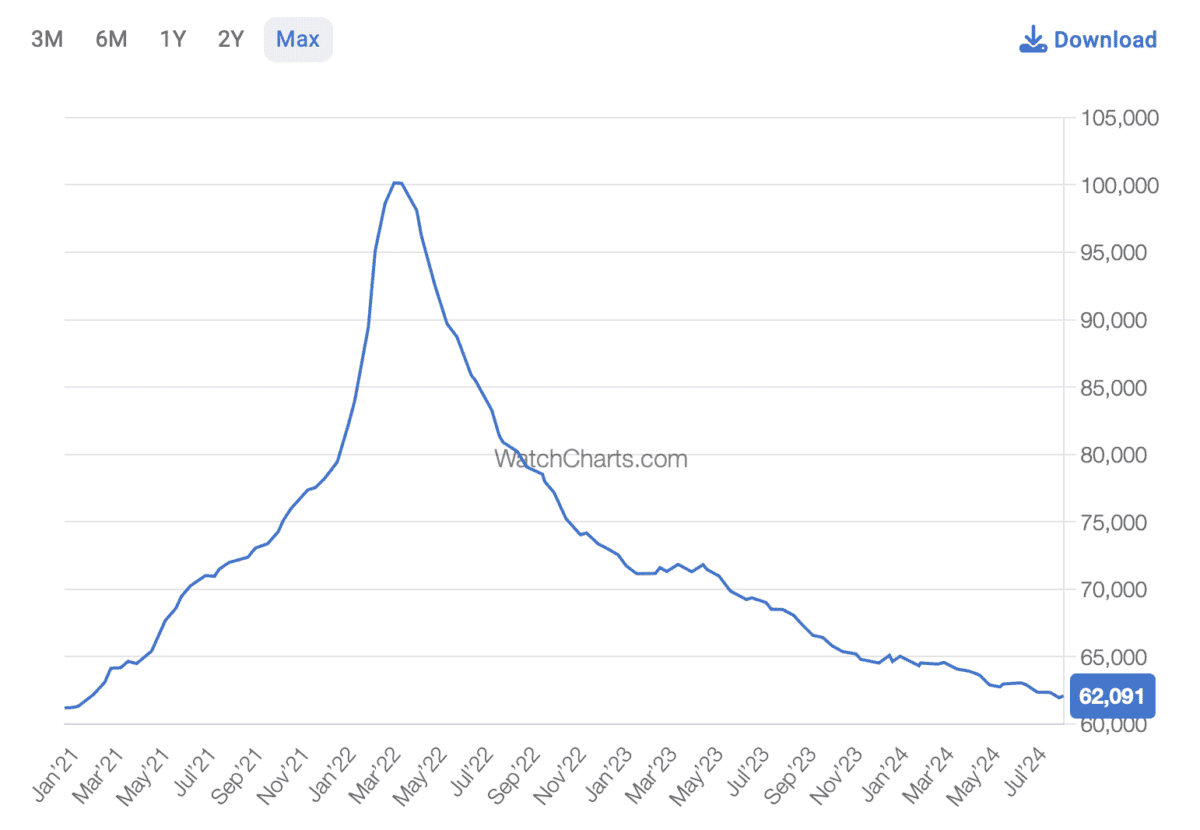

The weakness in the market can be seen in the Watch Market Index – an index of 60 watches from top luxury watch brands (a good indicator of secondary watch market price trends). Currently, this index is locked in a nasty downtrend.

Source: WatchCharts

Very low valuation

The thing is, the current weakness in its market appears to be priced into Watches of Switzerland shares already.

Currently, the stock has a price-to-earnings (P/E) ratio of just nine as the earnings per share forecast for this financial year is 42.8p. That’s an incredibly low valuation.

For reference, the median P/E ratio across the FTSE 250 is about 13.3. So the stock’s trading at a massive discount to the index.

One broker that clearly believes the stock’s undervalued right now is Barclays. Back in June, it raised its price target for Watches of Switzerland shares to 595p from 580p. That’s about 54% higher than the current share price.

Uncertainty in the near term

Of course, conditions in the luxury watch market could deteriorate further, putting pressure on the group’s revenues and profits.

Last financial year, the company’s adjusted earnings per share fell 28% year on year. If they were to fall by another 20-30% this financial year, the stock’s not going to look as cheap as it does currently (right now, analysts expect earnings growth of 13%).

The company’s said it’s cautiously optimistic in relation to the outlook for this financial year however, there are no guarantees the outlook will improve.

A top value stock today?

Personally, I’m not expecting a rebound in the luxury watch market in the near term. I think it’s going to take a while for consumer confidence to rebound to the extent that a lot more people are willing to go out and drop thousands of pounds on luxury watches.

That said, I do envisage a rebound in the market at some stage (when interest rates are a fair bit lower and people have more disposable income). So for patient long-term investors, I think there could be an opportunity to consider here.