Rolls-Royce (LSE: RR) shares have generated truly incredible returns since bottoming out at 38p during the pandemic. They’re now up more than 1,000% inside four years!

This shows how investing in quality companies when they’ve been written off by the market can work wonders for wealth. Once I’ve identified the opportunity and bought the shares, I can sit back and wait for the recovery to take place.

However, it isn’t always that easy. I can be right long term but wrong in the short term, and vice versa. For example, if I’d bought Rolls-Royce shares at 144p in October 2021, I would have been down by 50% by October the following year.

And if I’d given up and sold my shares out of frustration right then? I’d have missed out on the epic 500%+ rally that followed!

A history of 50%+ drawdowns

According to investing platform interactive investor, Rolls-Royce was the third most bought stock by its customers in June (behind Nvidia and Legal & General).

Clearly, many of these investors are expecting good things from the stock, and I can’t blame them. I am too as a shareholder. The FTSE 100 engine maker is seeing strong demand in its Defence division due to a tragically warring world, while growth in its Civil Aerospace business is being driven by recovering global travel.

Profits are growing, margins are expanding, and the balance sheet is suddenly much less of a concern. So, it’s certainly not unreasonable to expect further share price growth over time.

However, it’s also important to remember that Rolls-Royce can be a very volatile stock. It’s had multiple 50%+ share price declines over the past quarter of a century.

Here are some noticeable ones:

- Between July 2001 and March 2003, the stock bombed 70%

- November 2007-November 2008: -51%

- December 2013-Novemeber 2015: -50%

- May 2019-October 2020: -87%

- October 2021-October 2022: -51%

When we zoom out, volatility like this is actually fairly common in investing. We don’t know when the next massive drawdown in the Rolls-Royce share price will happen. It could be next week or next year. Or perhaps 2030. But history suggests another is coming at some point.

Non-linear progress hints at volatility

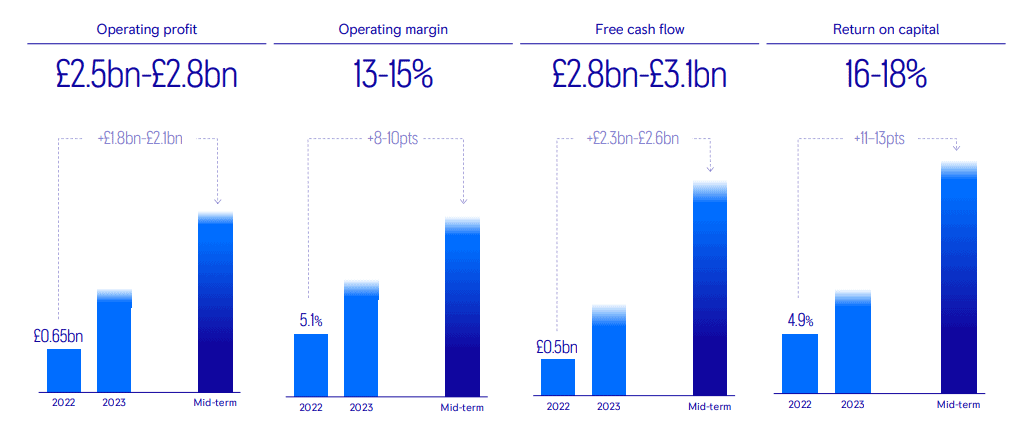

Rolls-Royce’s CEO Tufan Erginbilgiç has set out some ambitious profitability targets to be achieved by 2027.

Currently, the company is on track to deliver these. However, it has also warned that this trend will be “progressive, but not necessarily linear“.

So far under Erginbilgiç, progress has arguably been linear. But he’s repeatedly warned about “geopolitical uncertainty, supply chain challenges and inflationary pressures“. Any or all of these issues could worsen and quickly send the stock into reverse.

The waiting game

Charlie Munger famously said: “The big money is not in the buying and selling, but in the waiting.”

Unfortunately, the waiting part can also be the hardest because there’s the inevitable rollercoaster ride of emotions that come with it. I need to keep in mind that Rolls-Royce stock has declined significantly multiple times on the road to considerable gains. It could easily plunge again, so I have to be ready for that.

But assuming nothing fundamentally alters the growth story, my plan would be to keep holding through the next downturn, and even be ready to buy more shares.