To my mind, ‘passive income’ is one of the sweetest keyphrases in the investor’s vocabulary. Who doesn’t love the idea of enjoying a second income without having to lift a finger?

There are multiple ways individuals can target a second income with little-to-no-effort. But to my mind, the best way to achieve this is by building a portfolio of shares, exchange-traded funds (ETFs), funds, and cash.

This method can provide the perfect balance of risk and reward. And, over time, it can provide an income stream that we can comfortably live off of.

Should you invest £1,000 in Schroders Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Schroders Plc made the list?

The plan

But how to get started? There’s a world of financial products we can use to try to build long-term wealth, and a wide variety of financial assets.

The first thing I’d do is open a tax-efficient Stocks & Shares ISA or a Self-Invested Personal Pension. After paying trading and management fees (if applicable), the rest of the earnings are mine. I don’t have to pay a penny to the taxman and, over time, this can add up to a princely sum.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

The next thing I’d do is create a balanced portfolio of FTSE 100 and FTSE 250 shares. I’d also get exposure to the US stock market with the S&P 500.

Such a strategy would allow me to spread out risk and smooth my returns over time. What’s more, these indices have provided exceptional returns in recent decades, giving me the chance to turbocharge my wealth.

A juicy nest egg

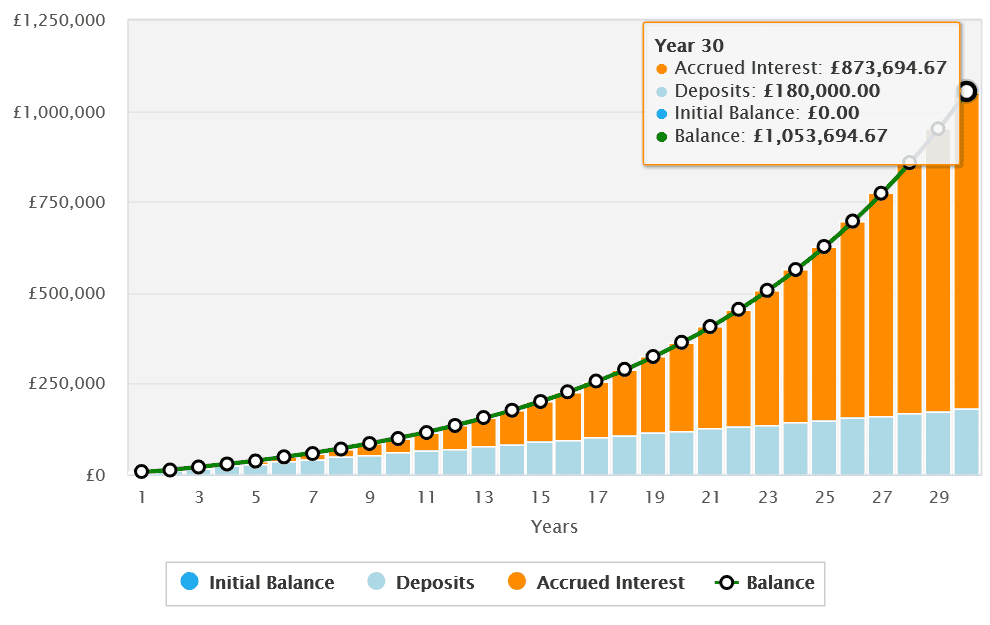

The Footsie’s delivered an average annual return of 8% since its inception during the past 30 years. The FTSE 250’s return stands at 11%, while the S&P 500 has provided a long-term return of around 10%.

Past performance is no guarantee of future returns. But if past performance continues, a £500 investment distributed equally across these indices would turn into £1,053,695 after 30 years.

I could then draw down 4% from this £1m+ nest egg each year for a yearly passive income of £42,148. At this rate, I could stretch my retirement fund out for 30 years.

A top FTSE stock

I could try to achieve this by spreading my monthly investment across three ETFs that track the FTSE 100, FTSE 250 and S&P 500. Alternatively, I might choose to buy individual shares instead of, or in addition to, this. This approach can help me to possibly achieve a market-beating return.

Ashtead Group‘s (LSE:AHT) a blue-chip stock I’ve added to my own portfolio. It’s delivered the best return of any current FTSE 100 share over the past two decades. I’m confident it will continue to be a strong performer as it continues to rapidly expand.

The company’s Sunbelt Rentals unit is the second-largest heavy equipment supplier in the US. With a large presence in Canada and the UK too, it’s capitalising effectively on the rising trend of customers renting hardware instead of buying it.

Encouragingly, Ashtead remains highly cash generative, and so it has the firepower to continue making profits-boosting acquisitions. Earnings may suffer if the economic landscape worsens and construction activity cools. But, on balance, I think this is a top Footsie stock to consider today.