Apparently, the average person spends around £200 a month on groceries in the UK. Given that I regularly shop at Tesco (LSE: TSCO), this got me wondering how many shares I’d need to cover that in dividends.

Working out the yield

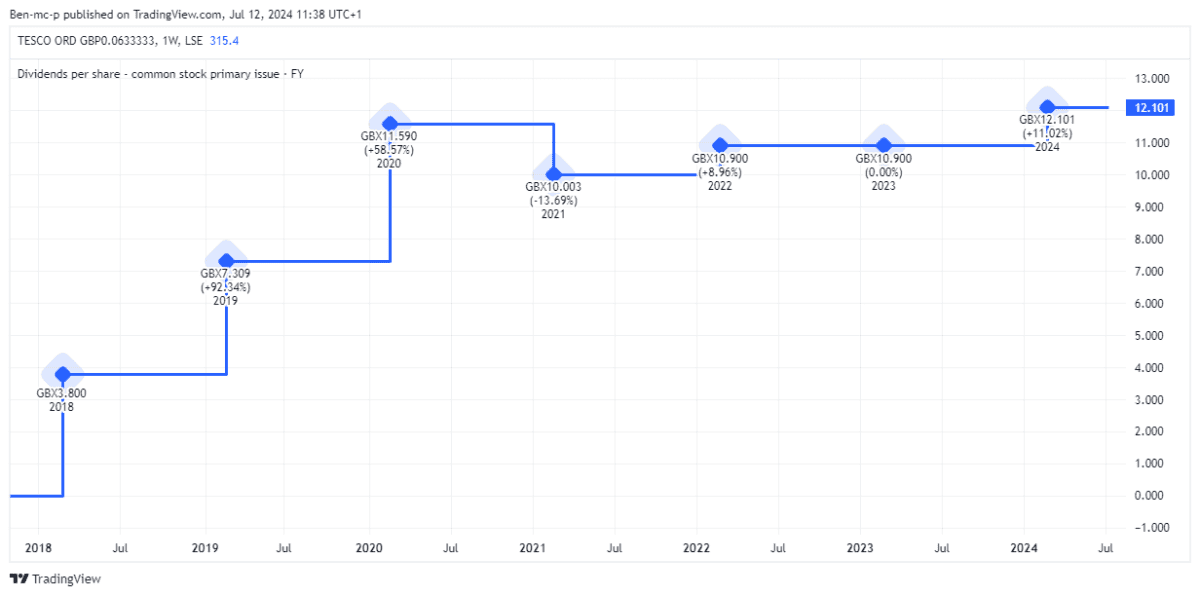

To work this out the old-fashioned way, I need to look at a few things. Firstly, the dividend per share paid by Tesco. For its FY24 (which ended in February), the supermarket giant paid out 12.1p per share.

That was 11% more than the previous year, when it kept its payout flat due to the disruption and uncertainty caused by the pandemic.

Should you invest £1,000 in Bunzl Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Bunzl Plc made the list?

However, those cash payouts are now in the rear-view mirror, with the second and final FY24 dividend of 8.25p paid out to shareholders in June. So I need to look at the anticipated dividend for this year (FY25), which is forecast to be 12.7p per share.

Next, the share price, which will give us our dividend yield. As I write on 12 July, this is 315p, translating into a forward yield of just over 4%.

Therefore, I’d need about 18,900 Tesco shares to bag the equivalent of £200 a month in dividends and pay for my groceries. They would set me back approximately £59,535.

Note, that’s more than the £20k Stocks and Shares ISA limit, so there could be income tax implications.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

A solid recent record

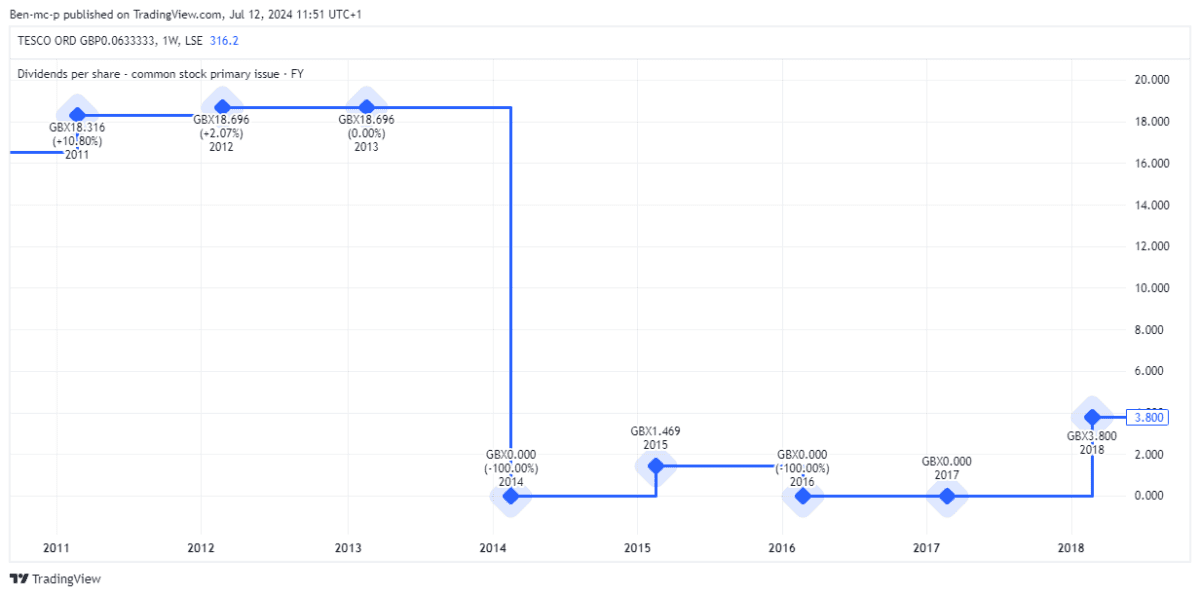

Tesco has a good record of growing its dividend since reinstating it in 2017 following an accounting scandal. It’s grown at a compound annual rate of 10.6% since FY19.

However, the fact that even a retail stalwart like Tesco didn’t pay out for three years serves to remind us that dividends are never guaranteed. Indeed, the payout is still lower than it was prior to being cancelled.

Still, it’s getting there. Forecasts see a dividend of 13.9p per share in FY26, for a yield of 4.4%. That means the shares would then pay me £2,627 a year — or the equivalent of £218 per month — in passive income.

Sunnier outlook

The share price is up around 26% over the past year. This likely reflects lower inflation, which should loosen shoppers’ purse strings and boost basket sizes.

In Q1, group sales rose 3.4% year on year to £15.3bn, while it expects full-year retail adjusted operating profit of £2.8bn, up slightly on FY24.

Would I buy Tesco shares?

I prefer to invest in two types of income stocks. The first are those slow-growers that carry ultra-high dividend yields in the 6% to 9+% range. Examples from the FTSE 100 include British American Tobacco (9.3%) and Legal & General (8.7%).

Alternatively, I’m willing to take a lower yield if the company is still growing its top line at a decent clip. I’d highlight Games Workshop (4%) and Greggs (2.1%) as FTSE 250 examples here.

Unfortunately, Tesco doesn’t really fit into either category. Though it’s done a great job solidifying its leading market position, the grocery sector is very established and low growth.

Moreover, it’s saturated with competition, from German discounters Aldi and Lidl to upstarts like HelloFresh and online juggernaut Amazon, which is sniffing around the UK grocery scene. Competition remains a risk to Tesco’s long-term profit growth.

Therefore, I’d rather pass up on Tesco shares for higher-yielding options.