When I last wrote about the National Grid (LSE:NG.) share price, I said I would wait until after the dust had settled, following the company’s announcement of a £7bn 7-for-24 rights issue, before revisiting the investment case.

That’s because the news came as such a shock that its share price fell more than 10% on two consecutive days (23-24 May). However, I was confident that most shareholders would take up their rights as the new shares were being offered at 645p each — 27% below the prevailing market price.

A few weeks later and the position now appears to have stabilised.

Should you invest £1,000 in Diageo right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Diageo made the list?

But is it time for me to invest?

An income investor’s dream?

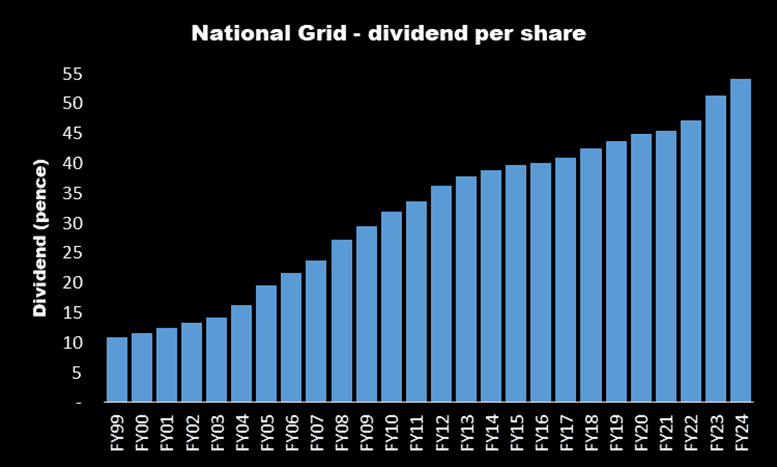

Those wanting to generate a decent level of passive income will struggle to find a stock with a better track record of paying dividends.

Taking into account rights issues and share consolidations, it’s increased its payout during each of the last 25 years.

This means it qualifies as a Dividend Aristocrat. A classy share, if you like.

Indeed, if the rights-adjusted dividend for its 2024 financial year is repeated this year, the stock is presently yielding 5.9%. This is comfortably above the FTSE 100 average of 3.8%.

Slow and steady

It’s also one of the steadiest stocks around.

It has a beta value of 0.23. This means, on average, if the wider market moves by 10%, National Grid’s share price will change by just 2.3%.

This reliability comes from its monopoly status in its key markets. Its earnings are therefore reasonably predictable. And less volatile than some of those operating in other, more glamorous, industries.

Although I’m sure existing shareholders were disappointed by the company’s unexpected need to raise some case, it should bring some longer-term benefits. The company achieved a post-tax return on equity of 8.9% during its 2024 financial year.

If it could replicate this on the £7bn raised from the rights issue, it could generate additional post-tax annual earnings of £623m. With a current price-to-earnings ratio of 14, there’s a potential increase in the company’s stock market valuation of £8.7bn (19.8%).

However, I’m sure some of this has already been priced in to the share price.

Risks

But over the next few months I wouldn’t be surprised if we see investors view the company with a little more caution.

The country’s new government hasn’t explained clearly how GB Energy — the proposed state-owned energy company — fits in with National Grid. This uncertainty could weigh on the share price.

And just because it’s a monopoly doesn’t mean it can charge what it likes. It still has to fulfil its regulatory obligations.

Also, the company carries a significant amount of debt. I find it interesting that its directors chose to ask shareholders for more money — rather than lenders — which could be interpreted as a sign that borrowings are close to their limit.

However, despite these concerns, I remain a fan of the company.

As well as its dividend, I like the fact that its management team doesn’t have to waste time finding new customers. It also hopes to increases its earnings per share by 6%-8% annually, between now and 2029.

Therefore, despite the risks — if I had some spare cash — I’d take a position.