From near-extinction to record highs, Rolls-Royce (LSE: RR) shares have staged a truly epic comeback.

Just under four years ago, the FTSE 100 stock was trading for a mere 39p. Today, it’s changing hands for 470p. That translates into a staggering 1,103% increase!

This means Rolls-Royce is a 10-bagger or more for those smart enough to have invested near the pandemic low.

Should you invest £1,000 in Senior Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Senior Plc made the list?

Unfortunately, I only cottoned on to the huge turnaround potential later. After some dithering, I finally pushed the buy button at 149p.

I’m keen to add to my holding but the share price rarely stops for breath. Is now the right time to buy?

Another upbeat update

In May, the engine maker delivered a positive trading update ahead of its half-year results on 1 August.

Chief Executive Tufan Erginbilgiç said: “We are driving growth, delivering contractual improvements and improved margins, unlocking efficiencies and creating value across the group. We have had a strong start to the year…[which] provides further confidence in our guidance for 2024.”

In the four months to 30 April, large engine flying hours returned to 100% of pre-pandemic levels, and could rise by another 10% for the full year. This is being driven by the continued recovery of international air traffic in Asia.

Meanwhile, the firm’s fleet continues to grow, with a substantial recent order for 60 Trent XWB engines from IndiGo. This was its first ever deal with India’s largest airline, which retains 60% share of the domestic passenger market despite having a fifth of its fleet grounded due to the failure of engines made by Pratt & Whitney, a US rival to Rolls-Royce.

India could be a very large growth market moving forward.

It goes on

The firm’s defence business is also growing as nations beef up their militaries. Australia has confirmed spending for the AUKUS submarine programme, which includes Rolls-Royce reactors. AUKUS is a trilateral defence pact for the Indo-Pacific region between Australia, the UK, and US (hence the name).

The company also highlighted recent upgrades from the three major credit ratings agencies. And it has reduced its gross debt position by repaying a €550m bond from underlying cash.

One ever-present risk here is a major engine recall, as has happened with RTX-owned Pratt & Whitney. In September, RTX said it expects this engine issue to cost up to $7bn. This includes compensating customers for lost capacity.

What about valuation?

Currently, the stock is trading at 31 times forward earnings. That’s more than BAE Systems (20.4) and RTX (19.7).

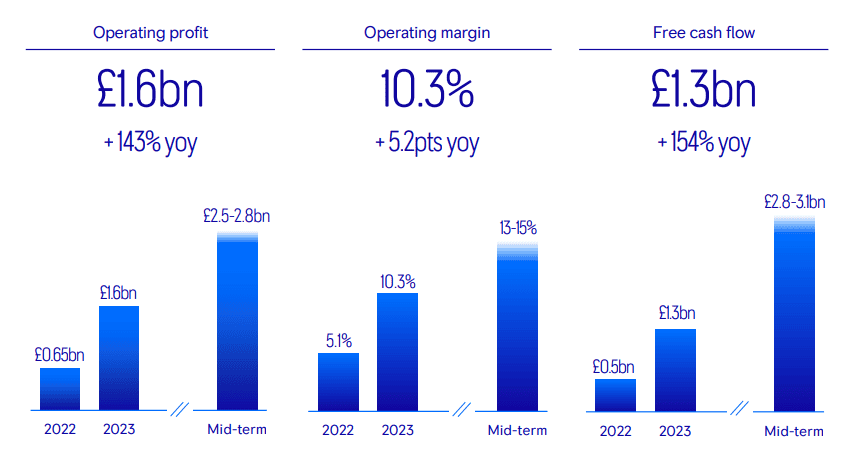

Then again, Rolls-Royce is expected to grow rapidly. By 2027, it’s aiming for underlying operating profit of £2.5bn-£2.8bn, an operating margin of 13%-15%, and free cash flow of £2.8bn-£3.1bn. It’s on course to achieve this.

In 2027, the firm is forecast to post earnings per share of 23p. If it does, the forward earnings multiple is around 20 times for 2027.

So the stock may be overvalued in the near term but decent value over the long run, if these forecasts prove correct.

For me, I remain bullish here. As global airlines add to their fleets and more planes are flown, Rolls-Royce should generate steady streams of income for decades.

If the August half-year update is positive, I may well buy more shares.