Along with the other FTSE 100 banks, Lloyds Banking Group (LSE:LLOY) has seen its share price take off in 2024.

Up 12% since the start of the year, it has performed more strongly than the broader Footsie in that time. The UK’s premier share index has risen a more modest 6% by comparison.

Should you invest £1,000 in Lloyds Banking Group right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Lloyds Banking Group made the list?

However, I can’t help but fear that the bank’s recent rally is at odds with real-world conditions. In fact, I believe that the shares are in danger of a sharp price correction.

Here are four reasons why.

Tough conditions

Data suggesting that Britain has sprung straight out of recession is one reason why Lloyds’ shares have rallied. But make no mistake: economic conditions in the UK remain tough, meaning banks face the continued double whammy of weak loan growth and rising impairments.

Official data today (11 June) shows unemployment rose to 4.4% last month as the jobs market kept weakening. This was the highest level since 2016.

Britain’s economy is stuck in a prolonged period of low growth. And severe structural problems like weak productivity, high public debt, trade friction and regional inequality mean the UK faces an almighty struggle to break out of this trend.

Rate cuts pushed back

That unwelcome rise in unemployment was only one half of a worrying update for the banks. The ONS update also showed that wage growth remains strong at 6%.

This is bad because it reduces the chances of interest rate cuts in the near future. Lower rates reduce banks’ margins, but they also boost consumers’ affordability, in turn boosting financial services demand and reducing the chance for loan impairments.

Tuesday’s news means many analysts have kicked their prediction of rate cuts into September. Estimates have been steadily revised as the year has rolled on, and more could be coming that could pull banks’ earnings forecasts lower.

Home loan arrears

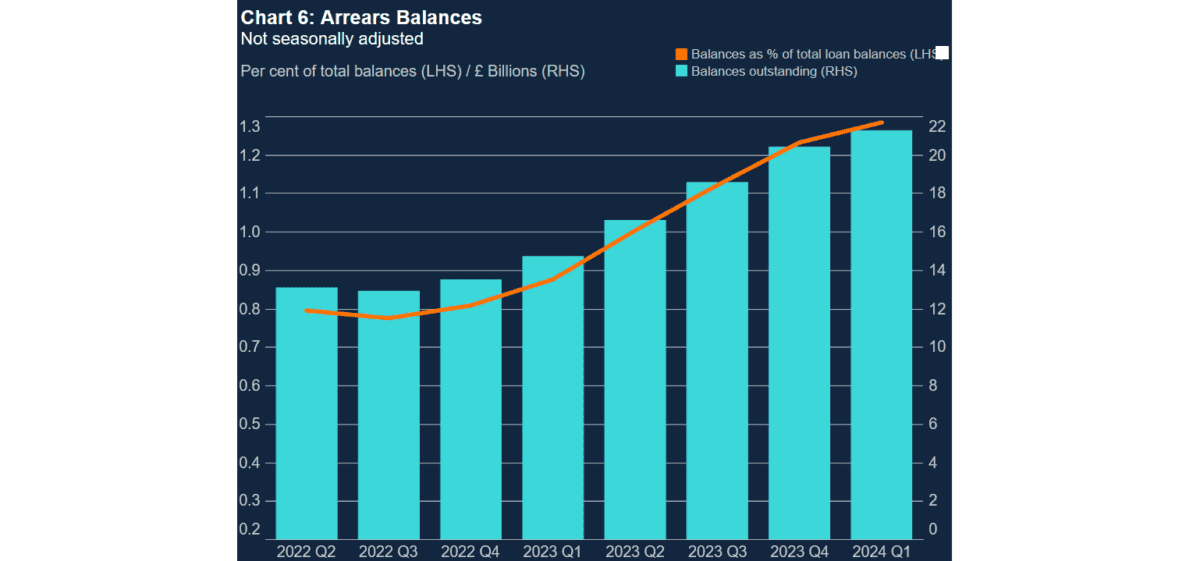

Rising mortgage arrears are another danger to banks’ profits. The threat is especially significant for Lloyds too, given its position as the country’s biggest home loans provider.

Bank of England data today showed that 1.28% of loans were in arrears in the March quarter, up from 1.23% in the prior three-month period. This was the highest reading for eight years, and could continue to rise given the outlook for the UK economy and interest rates.

Huge challenge

Lloyds’ ability to grow profits in tough economic conditions is even more under pressure than in the past. That’s because traditional banks also face significant competition from digital and challenger banks.

New entrants like Monzo and Starling are steadily eroding high street operators’ market shares. Their low overheads allow them to consistently offer more attractive products. And they’re expanding their range of services to take their revenues to the next level.

Last year Starling more than doubled its revenues (to £453m), as the number of customer accounts rose to 3.6m from 2.8m in 2023.

Here’s my plan

On the plus side, the bank has one of the strongest names in the business. And its heavy investment in digital banking is gradually paying off.

But the risks of a sharp price correction are significant, in my opinion. Despite its rock-bottom price-to-earnings (P/E) ratio of 8.4 times, I’d rather invest in other FTSE 100 shares today.