Falling over 14% last month, the easyJet (LSE:EZJ) share price underperformed all others on the FTSE 100. The stock is now changing hands for what it was in November 2023. That was just after it announced its results for the year ended 30 September 2023 (FY23).

At first glance it appears as though investors are sending a signal that little progress has been made over the past six months or so.

But I think that’s a little unfair.

Should you invest £1,000 in easyJet right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if easyJet made the list?

Delving into the numbers

That’s because, on 16 May, the airline reported its results for the six months ended 31 March 2024 (H1 24). And these revealed an increase in passenger numbers of nearly 11%, compared to H1 23.

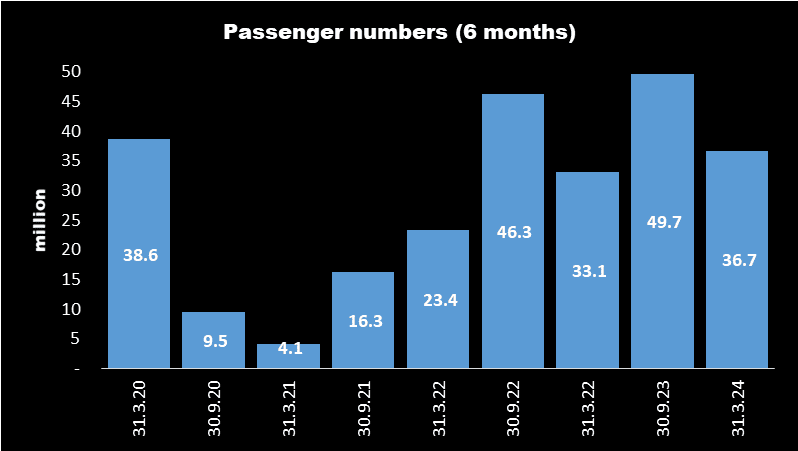

The chart below shows how passenger numbers have fluctuated over the last nine reporting periods.

Not only does it reveal the devastating impact of Covid — only 4.1m people flew with easyJet during H1 21 — but it also illustrates the difference between summer and winter trading, with fewer flights usually booked during the colder months.

And despite passenger numbers increasing for the third consecutive winter, they were still 1.9m lower in H1 24, compared to the same period in FY20. This suggests there’s still a little way to go before the airline is back to where is was pre-pandemic.

And this could put some upwards momentum back into the share price.

A seasonal business

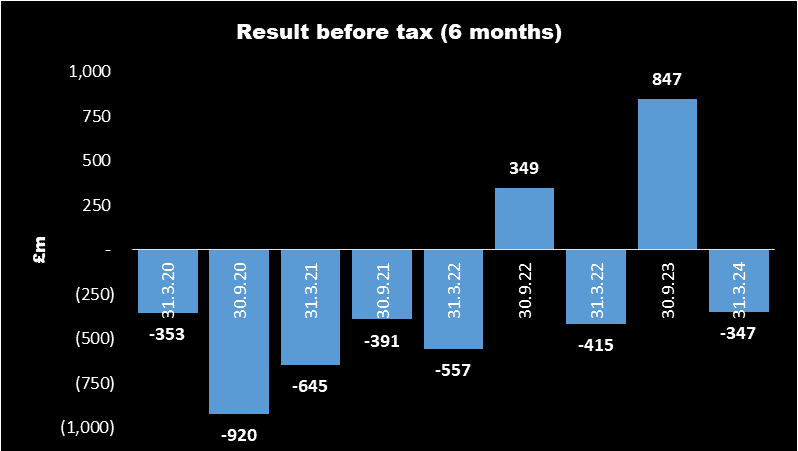

Due to lower winter demand, and a relatively high fixed cost base, the airline generally loses money in winter but is profitable in the summer.

However, it’s encouraging that its winter loss has fallen during each of the past three years.

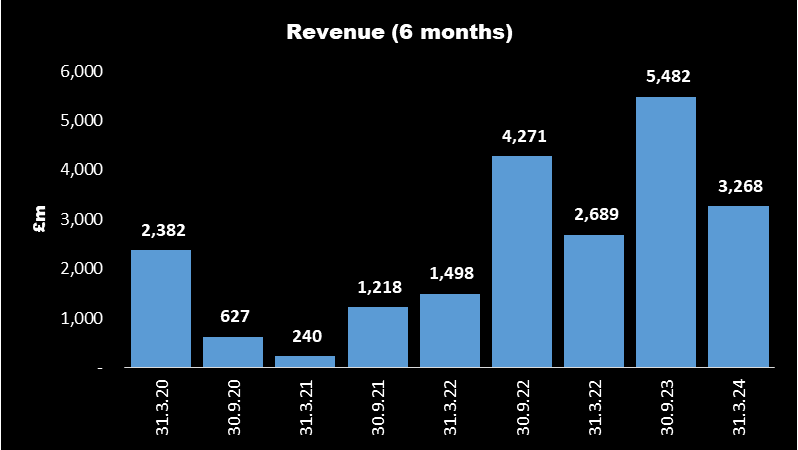

And despite flying 5% fewer people in H1 24 than it did in H1 20, revenue was 37% higher.

That’s because the airline now makes far more money from charging for luggage and seats (so-called ancillaries) than it did four years ago.

| Revenue per seat (£) | H1 2020 | H1 2024 | Change (%) |

|---|---|---|---|

| Passenger | 42.93 | 48.34 | + 12.6 |

| Ancillary | 12.67 | 21.53 | + 69.9 |

| Total | 55.60 | 69.87 | + 25.7 |

The company also presented a positive outlook for the second half of its 2024 financial year.

Revenue per seat, the proportion of seats sold and its capacity are all expected to be higher, compared to the same period in 2023.

And strong growth is expected from its package holidays.

Should I buy?

However, despite these apparently good reasons to invest, I don’t want to add the stock to my portfolio.

I think there’s a better value airline share available at the moment. International Consolidated Airlines, owner of British Airways, Aer Lingus and Vueling, currently trades on 5.3 times its expected earnings for its current financial year. This compares to a price-to-earnings ratio of 7.1 for easyJet.

Also, on 31 May, the Spanish government announced that it was fining four budget airlines — including easyJet — €150m for “abusive practices“. Other countries may now follow suit. Imposing fees for carrying cabin luggage could soon be outlawed.

And the airline has announced the unexpected departure of its chief executive of the past seven years. This could be a sign that he’s expecting some industry headwinds and that he wanted to quit when the company was flying high.

I’m therefore going to sit on the side lines and observe from a distance whether the easyJet share price can recover from a poor May.