It has been a difficult year for investors in Nio (NYSE: NIO), with the shares now 41% below where they started 2024. Still, Nio stock is 62% higher than it was five years ago.

The price has recently fallen below $5, a price last seen four years ago – shortly before it soared to over $60.

So, could the current price weakness offer a buying opportunity for my ISA? After all, I can buy US-listed companies in my Stocks and Shares ISA and Nio has piqued my interest for a while.

Decent position in a promising market

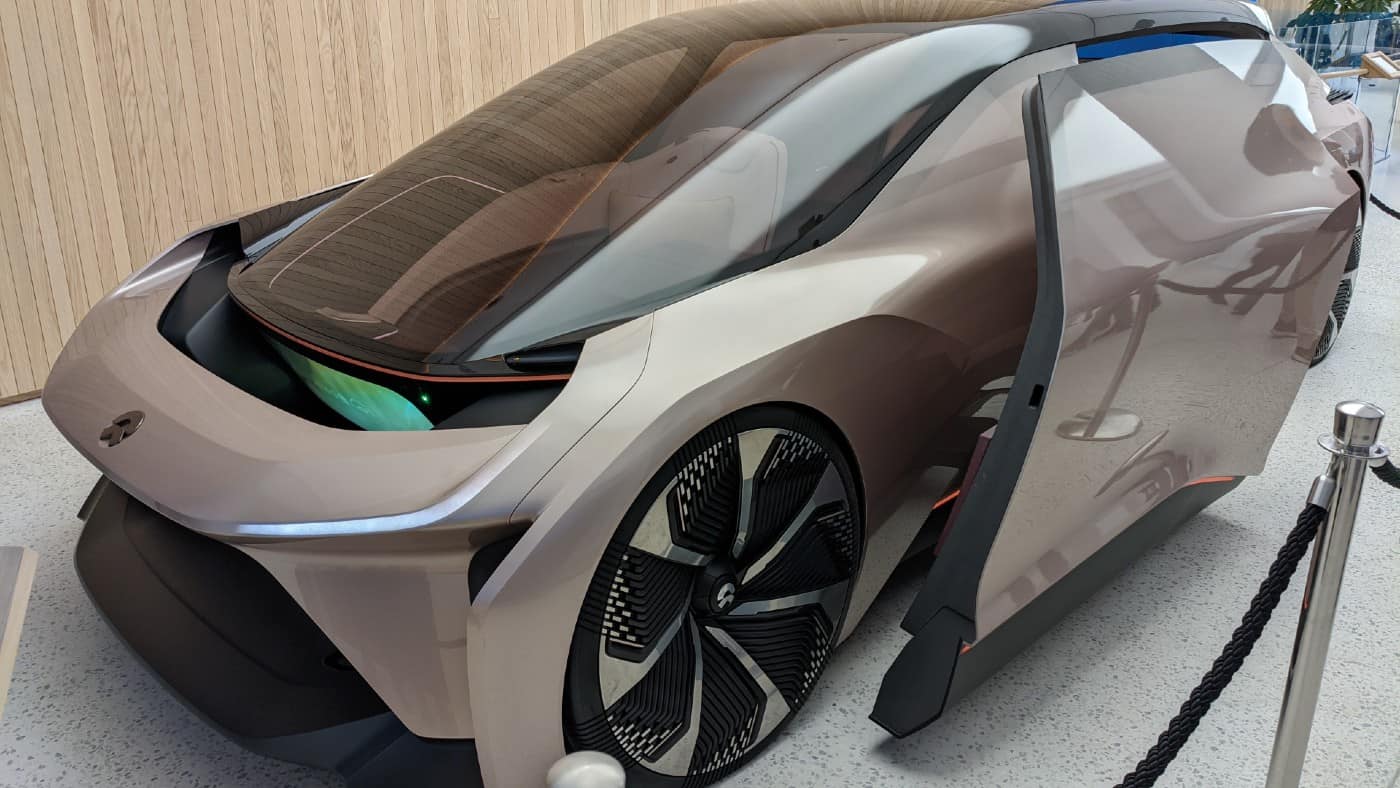

Nio is one of a host of electric vehicle producers. That is both good and bad, I reckon. Such a competitive field suggests there is a lot of promise, which is why entrepreneurs have rushed to set up vehicle makers.

Already, electric vehicle demand is high – and it is set to continue rising for a considerable time yet. Nio has some things that help set it apart in this crowded field. For example, its proprietary battery swapping technology is an elegant yet unusual solution to a common hurdle faced by electric vehicle drivers: limited range on a single charge.

But that crowded market could also put pressure on profit margins across the industry.

This is more than a purely theoretical risk. It is one that has already materialised and I think explains some of the negative sentiment towards the sector in recent months.

The stock is hardly alone in having tumbled so far in 2024. Tesla is down, too, though by a more modest 29%.

Lots to prove

I think the falling share price also reflects some company-specific challenges. One of them is scale. It is producing thousands of cars a month. Last month, for example, deliveries hit 15,620 vehicles. That is a 135% increase compared to the same month last year.

But that still leaves Nio far behind Tesla and established manufacturers like Toyota. That means it cannot get the same economies of scale that they can, hurting its potential profitability. Making cars is a capital-intensive industry that soaks up huge sums of cash. Being able to spread those expenditures over high sales volumes is therefore an important part of a successful business model.

Meanwhile, the economics of the business continue to look uncompelling. The company’s net loss grew 44% last year to just under $3bn. That is a lot of red ink to spill.

Wait and see

So although I like the company and think it has real potential, I also think the business model remains to be proven. Not only is the carmaker loss-making, but its bottom line has been heading in the wrong direction as it grows.

That could change, if sales volumes keep growing and Nio can reap more economies of scale.

But for now it remains to be seen whether that will happen. So, even below $5 apiece, the shares do not tempt me, for now.