The FTSE 250‘s packed with brilliant growth shares right now. And following years of underperformance, investors can pick many of these up at bargain-basement prices.

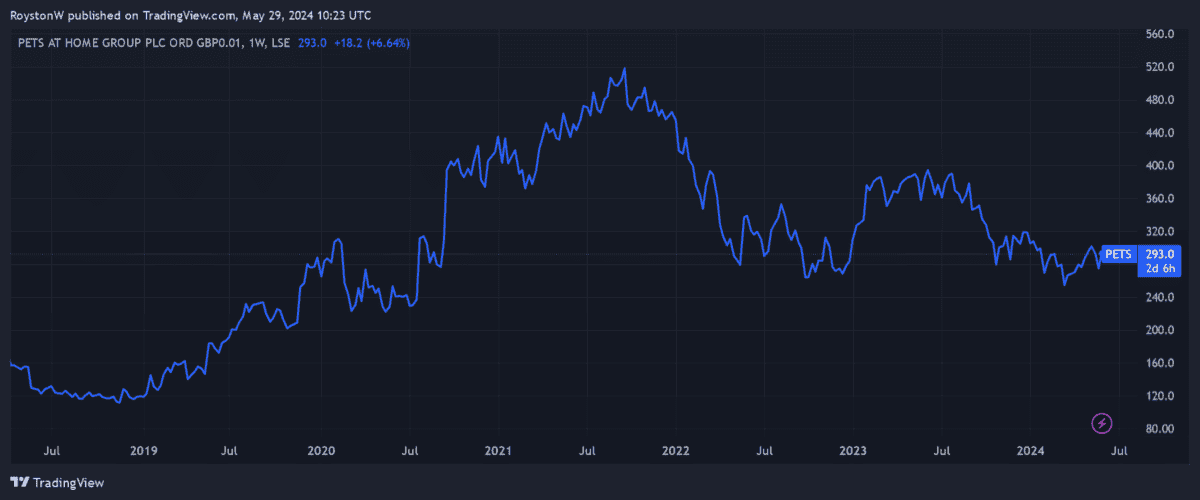

Take retailer Pets at Home (LSE:PETS). At around 293p per share, it trades on a trailing price-to-earnings (P/E) ratio of 16.9 times. This is some distance below its five-year average of 22 times.

The cost-of-living crisis has damaged demand for its discretionary products more recently. But as inflationary pressures ease, could now be the time to buy this recovering growth share?

In the doghouse

Pets at Home shares slumped at the start of the year when it downgraded profits predictions for the full year (to March).

Back then, the retailer slashed its underlying pre-tax profits estimates to £132m, a result it confirmed yesterday (28 May). This was down 3.2% year on year.

Group sales rose 5.2% over the period, to £1.5bn, with turnover rising 5.1% on a like-for-like basis. However, the company was hit by declining revenues as sales of its higher-margin accessories struggled.

At group level, margins dropped 1.2% year on year to 46.8%.

Growth returning?

However, more stable trading of late suggests the retailer could be turning the corner. City analysts certainly believe Pets at Home’s earnings column will rebound over the next couple of years. They forecast growth of 11% in both of the next two financial years.

This reflects expectations that people will have more to spend on their pets as inflation and interest rates likely fall.

A long period of economic stagnation could prove problematic for the FTSE 250 company. On top of this, the business also has to overcome severe competition from supermarkets and online pet retailers to grow revenues.

But Pets at Home’s transformation programme could help it to supercharge turnover from this point on. Investment in branding and its digital platform is already delivering big rewards, and the company recently opened a new distribution centre to facilitate future sales growth.

The cat’s whiskers

On balance, I think Pets at Home shares could be a brilliant long-term investment, given how strongly petcare spending is forecast to continue growing.

Sector sales in the UK have rocketed 150% over the past 20 years and now total £8bn a year, according to Pet Keen. This illustrates how we are devoting more and more attention and resources to our furry companions.

As the revenues chart above shows, Pets at Home has been able to effectively harness steady growth in the animalcare market. And a persistent rise in sign-ups to its loyalty scheme’s a good omen. The number of Pets Club members rose another 1.6% last year, to 7.8m.

I think Pets at Home is one of the FTSE 250’s most attractive growth shares. And at current prices, I think it’s a bargain worth serious consideration.