The UK stock market has massively underperformed in recent years. So there are a lot of value stocks on the London Stock Exchange right now.

One I’ve bought for my own portfolio is Volex (LSE: VLX). In the years ahead, I reckon the artificial intelligence (AI) boom could send this stock much higher.

A data centre play

One way I’ve been looking to play the AI theme is through the build-out of data centres. These provide the computer processing power, along with the data storage space, required to run AI applications.

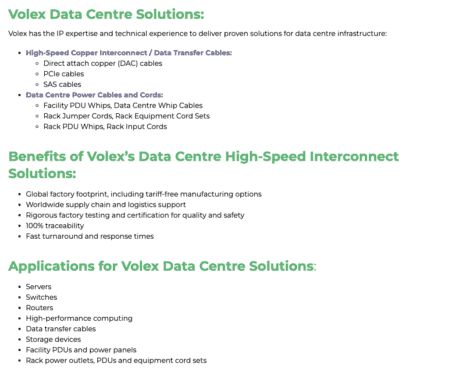

This is where Volex comes in. As a manufacturing company, it generates a large chunk of its revenues from creating power cords and data transmission cables for data centres.

So it looks well placed to benefit from the build-out of these facilities in the years ahead.

It’s worth noting that according to Prescient & Strategic Intelligence, the global data centre market could be worth around $620bn by 2030, up from $340bn today (growth of 10.5% a year).

Given this growth outlook, I think the future’s very bright for Volex.

Surging revenues

Already, Volex is having a lot of success on the data centre front. For the 26 weeks to 1 October 2023, for example, revenues in its Complex Industrial Technology division grew by a huge 30.1% on an organic basis.

Meanwhile, in a recent trading update, the company said this division delivered “extremely strong growth” for the full financial year (ended 31 March).

The company noted in the update that the growth from this division was due to increased sales of high-speed data centre cables.

Increasing investment in artificial intelligence technology requires intensive data processing, an application that is ideally suited to the cutting-edge products that Volex has developed.

Volex H1 2024 report

An undervalued stock

However, despite this momentum and the attractive growth outlook, Volex shares currently have a very low valuation.

With analysts forecasting earnings per share of 36.1 cents for the year ending 31 March 2025, the price-to-earnings (P/E) ratio here is only 12.

I believe the company’s undervalued at that earnings multiple. In my view, I believe its P/E ratio should be somewhere between 15 and 20 (which implies substantial share price gains from here).

A lot of potential

It’s worth pointing out that Volex also makes products for the electric vehicle (EV), healthcare, and consumer electricals markets. I like this business diversification. However, a risk is that any of these markets could face a slowdown.

We’ve recently seen this scenario with the EV market. In H1, Volex’s EV revenues actually declined.

Another risk to consider is acquisitions. This is a company that likes to buy smaller manufacturing businesses. The problem is acquisitions don’t always work out.

Overall though, I like the risk/reward proposition. With a low valuation, and growth coming from the global data centre build out, I think this value stock has the potential to generate attractive returns in the years ahead.