The London stock market is an excellent place to look for passive income stocks. Prices of UK shares have risen sharply in recent weeks. Yet due to years of poor performance, many great stocks still look brilliantly cheap at the mid-point of May.

I’m searching for stocks to buy to make a solid second income. And the following dividend shares look like they could be too cheap to miss. Their low price-to-earnings (P/E) ratios and giant dividend yields can be seen below.

| Company | Forward P/E ratio | Forward dividend yield |

|---|---|---|

| Target Healthcare REIT (LSE:THRL) | 12.4 times | 6.9% |

| Assura (LSE:AGR) | 12 times | 8% |

If analyst forecasts prove accurate, a £20,000 lump sum invested in these shares would provide a £1,500 passive income this year. The average dividend yield for these income stocks is 7.5%.

I believe these businesses look in good shape to steadily increase the dividends they pay over time, too. Here’s why I think shrewd investors need to give them a close look.

Take aim

Real estate investment trusts (REITs) are famously popular for the unique rules that govern their dividend policies.

In exchange for certain tax advantages, these companies have to pay at least 90% of their annual rental earnings out by way of dividends.

Care home operator Target Healthcare REIT is one such stock I already own. And at current prices, I’m considering buying more for my portfolio.

Its forward P/E ratio of 12.4 times is well below its five-year average of 18 times. On top of this, its price-to-book (P/B) multiple sits at a rock-bottom 0.7.

Any reading below one indicates that a stock is undervalued.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

Target’s low valuation reflects fears that interest rates may remain longer than expected. It’s a scenario that would keep the REIT’s net asset values (NAVs), and by extension earnings, under pressure.

But largely speaking, the outlook here for the next couple of decades is highly encouraging. And this makes Target an attractive dividend stock to own, in my opinion.

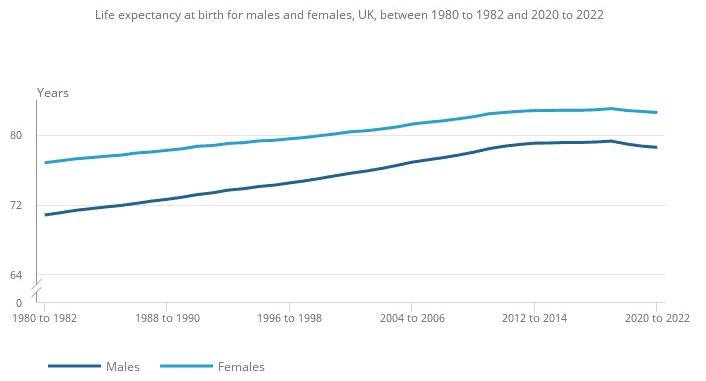

As the chart shows, life expectancies in the UK are soaring. And as healthcare improves, along with rising living and working conditions, this uptrend is likely to continue, meaning demand for care home spaces should keep heading higher.

Another healthcare hero

Assura is another REIT that is too cheap to ignore right now.

At 12 times, this property stock’s forward P/E multiple sits well below a five-year average of 20.8 times. On top of this, Assura’s corresponding P/B of 0.8 also comes in under one.

Like Target Healthcare, this UK share is vulnerable if interest rates stay at current elevated levels. Profits are also highly sensitive to any changes in NHS policy. This property stock lets out primary healthcare properties like GP surgeries.

But Assura is also well placed to capitalise on Britain’s growing elderly population, and the increasing strain this is putting in existing healthcare infrastructure.

Besides, under current NHS policy, the FTSE 250 share is thriving as patients are diverted from hospitals to other facilities. This is a stock I expect to provide big (and growing) dividends for years to come.