The J D Wetherspoon (LSE:JDW) share price is rising after the company’s latest trading update. And I think it could be one of the best stocks for UK investors to consider buying now.

The closure of up to 35 outlets might not seem encouraging. But beneath the surface, the FTSE 250 pub chain is making investments that could generate huge long-term value for investors.

Pub closures

According to its latest update, J D Wetherspoon has disposed of 18 pubs since the start of the year, with a further 17 up for sale. On the face of it, that’s not a sign of a growing business.

It’s natural to attribute this to unusually difficult conditions. The company has been upfront about the fact that it – along with the rest of the sector – has been battling increased costs.

A couple of things are worth noting though. The first is that Wetherspoon’s has been reducing its pub count since 2015 – well before inflation reached significant levels.

Another is that sales are still growing – revenues are up 29% since 2015, 10% over the last year, and increased further since the start of the year. There’s more going on here than meets the eye.

Strategy

Disposing of pubs isn’t desperation – it’s a strategic decision. Wetherspoon’s is known for low prices and this means the company has to keep its own costs low.

Lease liabilities are a key part of this. Buying the freehold for some of its pubs and closing others where this isn’t possible is a key way for the business to reduce its rent payments.

The effect of this hasn’t been showing up in the short term – lease liabilities were higher at the start of 2024 than they were a year ago. But the outlook for the long term is much more positive.

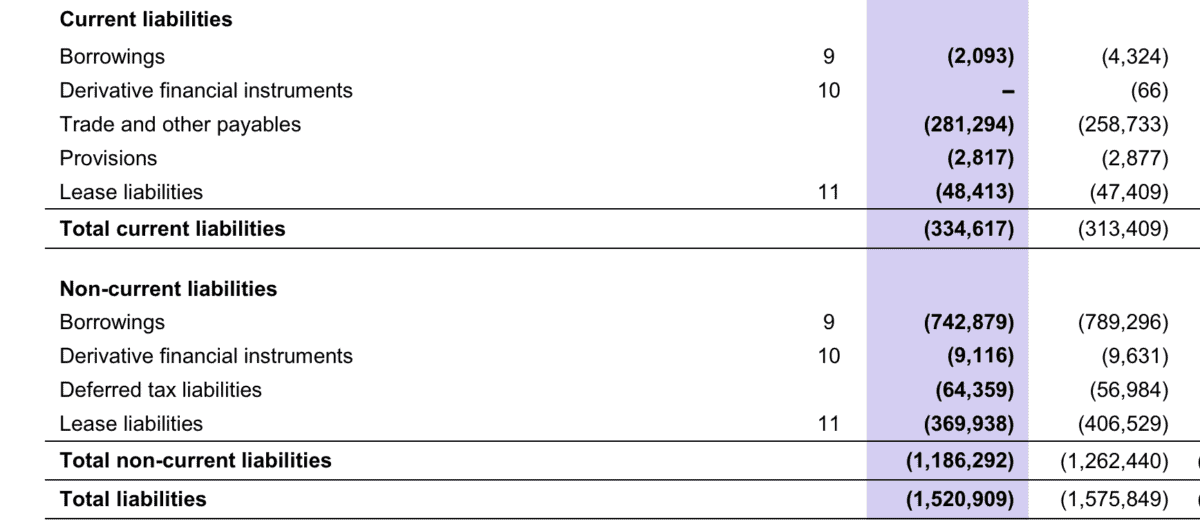

J D Wetherspoon Liabilities

Source: J.D. Wetherspoon Annual Report 2023

Non-current lease obligations have fell by 9% in 2023, from £406.5m to £369.9m. Over time, this should have a positive effect on both margins and profits.

Risks

It has been doing a good job of managing its expenses. But not all of its costs are under the company’s control.

One of the most obvious examples is tax. The business has to pay VAT on its food and alcohol duty on its beers wines and spirits. Any increase in rates (with alcoholic drinks a key focus of tax-raising efforts for decades), could dent profits.

While this doesn’t put the company at a disadvantage compared to other operators in the sector, there’s nothing it can do about these. With its USP being low prices, it’s a risk.

There might not be any sign of an immediate danger here. But it’s something investors should be mindful of, especially in an election year.

Long-term value

J D Wetherspoon is positioning itself for long-term value creation. Management estimates the business has potential for around 1,000 pubs, which implies scope for future growth.

More important though, is the company’s ability to maintain its value proposition to customers. In the short term, that means reducing costs by investing in freeholds and disposing of leases.

With sales continuing to grow, I expect a significant boost to profitability over the long term. That’s why I’m looking to buy the stock at today’s prices.