Checking the performance of share prices on the FTSE 100 can often be confusing. Usually, a share price is a fairly good indicator of how well a company is performing. But now and then, a price will drop to extremely low levels for no obviously logical reason. This prompts the question: is it a great buying opportunity, or is the company doomed to fail?

I noticed one share that’s down 25% in the past month, so I decided to investigate.

The digital delivery giant

Ocado (LSE:OCDO) is a popular UK online retail service, providing door-to-door delivery of items from top brands like Marks & Spencer and Harvey Nichols. For many years, it’s been one of the UK’s leading options for the delivery of groceries and household items. During pandemic-era lockdowns, it saw a huge increase in demand, causing the share price to triple over six months to almost £30.

However, as lockdowns eased, things began to take a turn for the worse. Rather than return to pre-pandemic levels of around £10, the share price has collapsed to a mere £3.54.

Financials

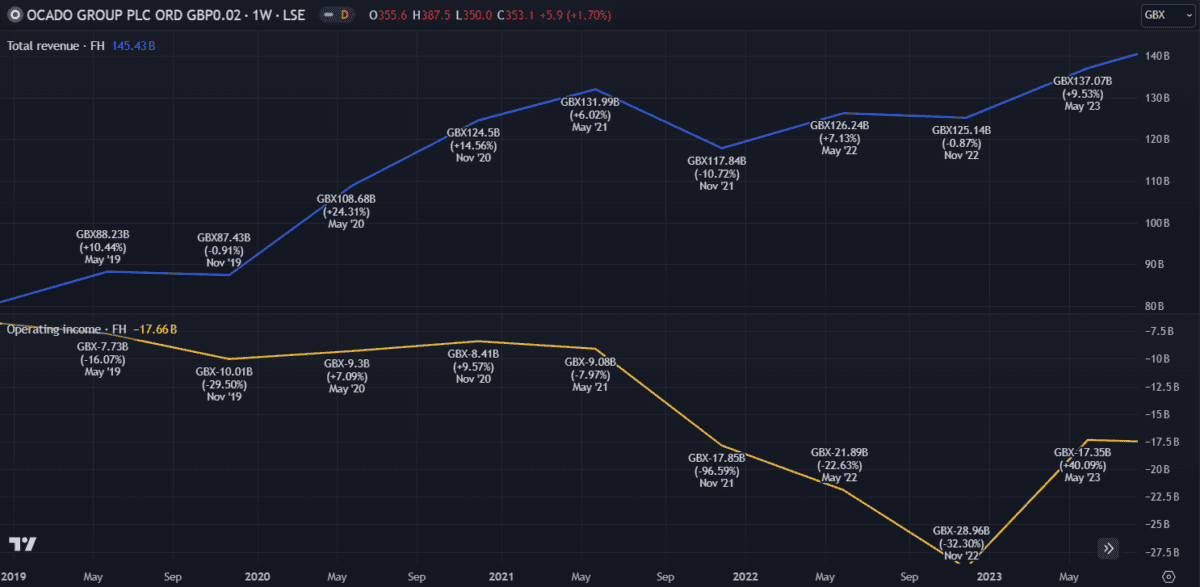

Despite the worsening outlook, Ocado actually exceeded analysts’ expectations in its most recent 2023 full-year earnings results. It reported a 39p loss per share, up from a 59p loss in 2022, and revenue of £2.83bn, up 12% from last year. These figures exceeded analyst expectations by 22% and 2.9%, respectively.

And while the company recorded a net loss of £314m, this was still 31% narrower than last year. Profit margins have improved to -11% from -18% earlier in the year. The balance sheet looks decent too. Its assets outweigh its liabilities and although it carries £1.46bn in debt, this is sufficiently covered by £1.5bn in equity.

Overall, it would appear its financial position is improving, yet the share price continues its downward spiral. With a market cap that’s now fallen below £3bn (from £6.8bn last December), it’s at risk of losing its place in the FTSE 100.

So what’s the problem?

One hint might be the discrepancy between revenue and income. While Ocado’s revenue has been growing steadily for several years, its net income has been falling consistently. That’s not entirely unusual for a new tech company that’s spending excessively on new infrastructure and assets. While the company is over two decades old, some of the extra expenditure may be focused on development of its Smart Platform system.

Some losses could also be attributed to a strained partnership with M&S. In February, the company withheld a £197m payment to Ocado after the joint venture allegedly failed to provide the expected results. But the share price had already been declining for months prior to the news so it’s hard to quantify the effect.

The bottom line

With a solid balance sheet, consistent flow of revenue and improving losses, I see no reason Ocado won’t recover eventually. The company appears to be overspending and may have incurred some unexpected losses on failed partnerships but is otherwise in good shape.

The share price could still fall further from here but I believe there’s good potential for a recovery in the long term. But just how long that will be, is unclear. For now, I’d tread with caution.