I believe a Stocks and Shares ISA is the best option for UK investors to make the most out of their money. Not only can they choose whichever assets they want, but they can invest up to £20,000 a year tax-free. That could add up to a serious savings total in the long run!

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Naturally, choosing the right stocks isn’t that easy. Getting it right requires lots of time spent researching. And that’s where the magic of investment funds comes in. For a small fee, an investment trust is managed by professionals who have all day to research and pick the perfect mix of stocks.

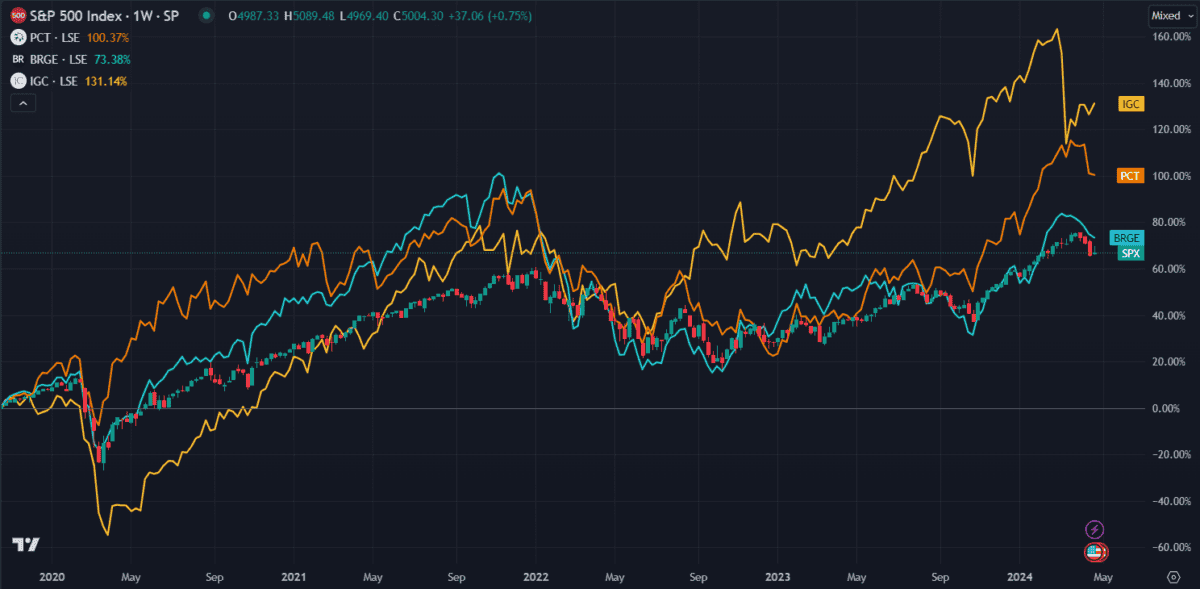

With that in mind, I’ve uncovered three investment trusts from around the world that have outperformed the S&P 500 over the past five years.

The best of the best in Europe?

Up 70.3% in the past five years, Blackrock Greater Europe Investment Trust (LSE:BRGE) is only just beating the S&P 500. This is because it’s largely focused on European stocks that don’t perform quite as well as their US counterparts. However, the fact that it’s maintaining equal growth with the S&P 500 is impressive.

The fund provides exposure to the leaders of European industry like pharma giant Novo Nordisk and semiconductor manufacturer ASML, along with global luxury brands like Ferrari and LVMH.

However, some believe EU economic growth is limited by high labour costs and a very strict regulatory environment. While this helps to reduce volatility, it also results in sluggish productivity. The S&P Global Eurozone GDP forecasts were recently reduced to 1.3% in both 2025 and 2026, down from 1.5% and 1.4%, respectively.

The world’s largest market

Up 82.9% in the past five years, India Capital Growth Fund (LSE:IGC) is doing slightly better than the S&P 500. As the country with the world’s largest population, India is an often-overlooked opportunity for UK investors. Yet its stock market has outperformed the majority of developed and emerging global markets over the past two decades.

The fund provides exposure to the nation’s leading businesses, although many are largely unheard of outside of the country. It’s weighted towards finance (22%), consumer discretionary (21%), industrials (14%) and materials (14%).

However, with no diversification outside of the country, it would be heavily affected by a slump in the local economy. It’s been doing well so far but there’s no guarantee the economy will continue to grow. The country’s top talent tends to migrate abroad, leaving local businesses struggling to maintain a skilled workforce.

The booming US tech industry

Up 106.2% in the past five years, Polar Capital Technology Trust (LSE:PCT) is far outperforming the S&P 500. Most likely this is because it’s focused almost exclusively on the top-performing tech stocks in the S&P 500 like Nvidia, Apple and Microsoft. As such, it provides exposure to all the best bits of the index without the lower-end stocks bringing down the overall average.

At the same time, it lacks the kind of diversification that’s critical during a market slump. Tech stocks tend to fall in unison when things go south, so this fund is prone to high volatility and sudden drops. I myself would balance this fund in an ISA along with other funds to avoid this risk.