Imagine Warren Buffett was a born-and-bred London or Manchester local with his razor-sharp financial mind focused on UK stocks. The world-famous US investor typically sticks to familiar stocks back home but I would love to know what he might choose if he was based in Blighty.

Fuelling up for foreign shores

Non-renewable resources like oil, coal and gas have come under increasing scrutiny lately as environmental issues take the spotlight. Ambitious emission-reduction targets are forcing the industry to recalibrate towards renewables, threatening their bottom line.

But Buffett isn’t running for the hills.

The Oracle of Omaha recently doubled down on major US oil company Chevron, increasing his company Berkshire-Hathaway’s stake by 14.4%. One might think the obvious British equivalent would be Shell (LSE:SHEL), with the price up 17.7% in the past year. But does that mean Buffett would pick it?

Shell has been in the news lately due to recently-appointed CEO Wael Sawan’s comments regarding a possible migration to the New York Stock Exchange (NYSE). For long-term UK investors, this would make Shell shares less attractive — but could it equate to a price jump in the short term? UK shares tend to make significant gains following buyout rumours from US firms but a listing migration is a different story altogether.

It’s certainly worth keeping a close eye on.

Personally, I don’t think Buffett would invest in a company like Shell in the current economic climate. It’s very undervalued compared to its US counterparts even though the share price recently hit an all-time high. In my experience, prices tend to correct after hitting new highs – especially when the CEO is considering moving a listing to more lucrative shores.

With all this uncertainty, I think a risk-averse investor like Buffett might choose a more stable energy-related stock like National Grid.

The world’s favourite beverage company

Coca-Cola is one of the world’s most popular beverages and the NYSE-listed company has long been one of Buffett’s favourite stock picks. For UK-based investors, the European counterpart Coca-Cola HBC (LSE:CCH) is available on the London Stock Exchange (LSE).

Coca-Cola is a rock-solid brand, with the HBC side of the business dominating much of the European soft drinks market. But does it have growth potential? Unless it can expand to other planets in the universe, I worry its growth prospects are a bit limited. I guess that’s the problem with cornering the entire market!

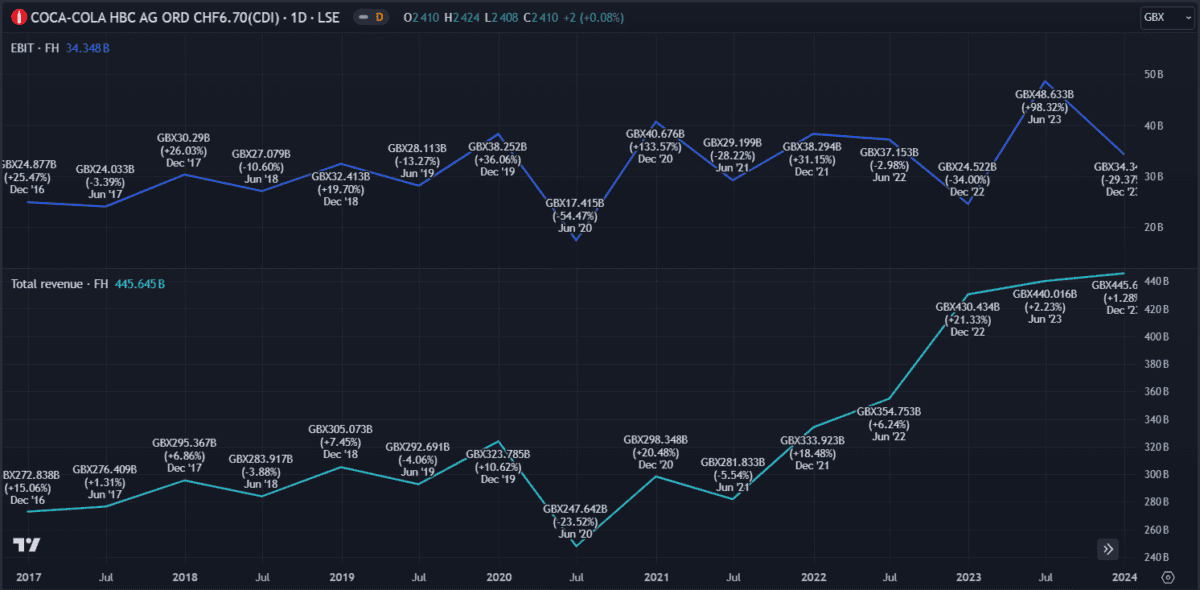

Despite its dominance, the soft drinks giant is at risk from competition as private-label brands begin capitalising on the growing demographic of health-conscious consumers. Key metrics to look at when considering growth potential are revenue and earnings before interest and tax (EBIT).

While its EBIT has remained relatively constant over the past five years, revenue has enjoyed a promising increase of 50%. Unfortunately, Coca-Cola HBC isn’t quite the cash cow that its US counterpart is. The share price is down 12.5% in the past five years, as opposed to 21% growth for the US stock.

Still, I think it represents the type of low-risk, reliable stock that Buffett might choose as a long-term investment. I might even consider adding it to my portfolio soon!