I recently sold my holding in Nvidia, which is hardly under the radar, and added two shares to my Stocks and Shares ISA that possibly are. Here’s why I’m bullish on their growth prospects.

hVIVO

First, we have hVIVO (LSE: HVO). This is a small healthcare company with a market cap of just £196m.

The share price has risen 73% over one year, but remains 25% lower than the 38p it reached in April 2021. This does highlight how volatile small-caps like this can be, which is worth bearing in mind.

The firm is a world leader in designing and running human challenge clinical trials. These involve exposing volunteers to infectious agents under controlled conditions to test potential vaccines or treatments.

They can potentially save hVIVO’s customers, which include a growing number of large biopharmas, time and money.

2023 was a record one for the company. Revenue rose 16% year on year to £56m while EBITDA jumped 44% to £13m. It inked its first challenge trial contract with an Asia-Pacific client in over a decade and even announced an annual dividend.

For 2024, management expects revenue of £62m, with 90% of this already contracted, then £100m by 2028. To support this growth, it’s opening (ahead of schedule) a new 50-quarantine-bedroom facility in Canary Wharf.

To my mind, this company has a clear roadmap to becoming a larger business.

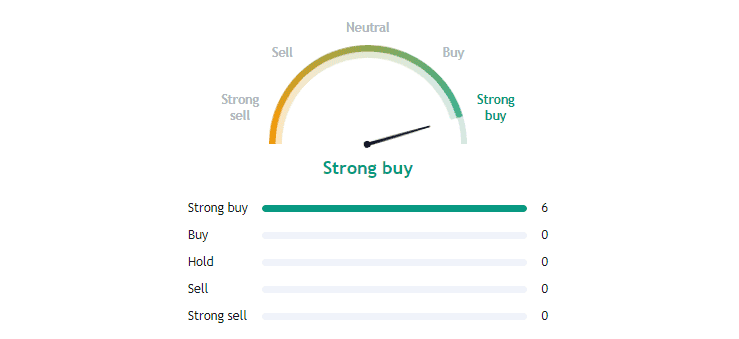

Meanwhile, the shares look reasonably cheap trading at 21 times this year’s forecast earnings. This might be why all of the six analysts covering the stock in the last three months rate it as a ‘strong buy’.

The consensus price target is 36p, which is 25% above the current share price of 28p. I’m aiming to fill out my position over the summer.

Toast

The second under-the-radar stock I’ve been buying is Toast (NYSE: TOST). This is a firm that operates a restaurant management platform enabling card payments, online orders, and inventory management, among other things.

Essentially, it’s an operating system that powers all the behind-the-scenes stuff for a monthly fee. This saves staff time and allows them to focus on their customers.

In 2023, revenue rocketed 42% to $3.9bn while its annualised recurring revenue increased 35% to more than $1.2bn. Over 6,500 net new restaurants were added in Q4, bringing the total to around 106,000 locations.

In a sure sign of its growing scale and importance, the company processed more than $126bn in gross payment volume last year (up 38%).

Big-name customers include Caribou Coffee and Marriott International. And Choice Hotels International is making Toast’s technology a standard for two of its upscale brands, Cambria Hotels and Radisson.

Now, the firm is still loss-making, which adds risk to the investment case here. It reported a net loss of $236m last year. But analysts do expect the business to turn profitable this year.

The forward price-to-earnings (P/E) ratio for 2025 is around 34. I’m comfortable with that valuation.

Looking ahead, the international opportunity seems massive. There are an estimated 22m restaurant sites worldwide, which dwarfs Toast’s 106,000 locations (almost all in the US).

Now at $23, the share price is down 57% since the firm went public in 2021. I think this provides an excellent entry point for me to invest.