I’ll be honest — I’m more of a value investor than a growth investor, but I appreciate the advantages that different stocks can bring to a portfolio.

Whatever investing style an individual chooses, it’s important to diversify. So I’ve identified two stocks that I feel don’t get the attention they deserve.

WH Smith

WH Smith (LSE:SMWH) is one of the UK’s most popular high street retailers, traditionally known for its books and magazines. These days that doesn’t sound like a very profitable business, which may explain the declining share price. Over the past five years, the share price has lost 40% of its value, although admittedly most of that was during Covid.

A mild recovery petered out and the price declined again from early 2021. It has mostly been trading sideways since, in a range between £13 and £16.

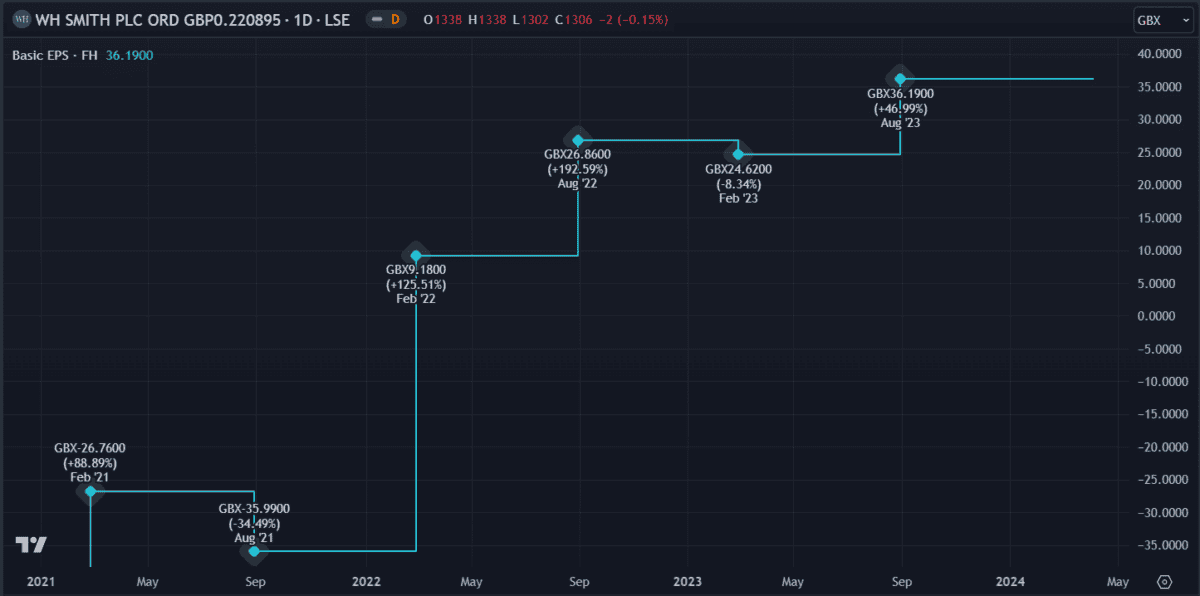

However, in its 2023 annual earnings report, WH Smith revealed a 28% increase in revenue and a 68% increase in net income. Earnings per share (EPS) has increased an average of 118% per year for the past three years (although it missed analysts expectations by 25% in 2023).

Could this mean the company’s fortunes are turning around? Quite possibly.

The business appears to have sharpened its focus on travel-related premises, particularly airports. The resurgence in travel over the past few years means airport stores are enjoying increased foot traffic. In its latest earnings results this January, WH Smith reported an 8% rise in sales, with the travel division alone reporting 15% revenue growth.

It’s also revealed plans to open 50 new stores in North America, a more lucrative market that may help subsidise the suppressed economy back home.

Looking at the average price target from 13 different analysts, there’s a good consensus that it will rise about 35% in the next 12 months. That certainly sounds promising to me, so I’m seriously considering buying some of the stock now before it takes off.

Ashtead Group

Ashtead Group (LSE:AHT) is another growth stock I like the look of, although it’s in a vastly different position to WH Smith. As the world’s largest equipment rental company, its scope covers construction and industrial sectors in the UK, US, and Canada.

The share price has risen 26% in the past year and is up 175% in the past five years. Unlike WH Smith, it recovered rapidly after the pandemic and was trading at double pre-Covid levels by mid-2021. The shaky economy knocked it down a bit in early 2022 but it’s still been doing well since.

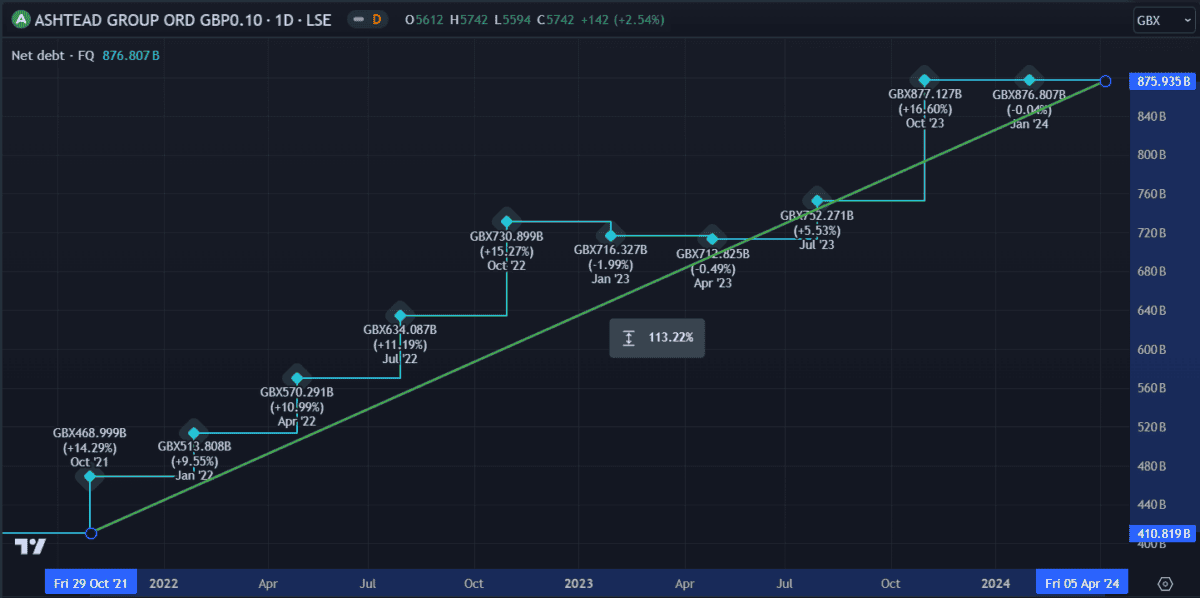

One concern is its debt, which has increased 113% since October 2021.

Now at £8.7bn it’s not well covered by equity or cash flows. That leaves it with a high debt-to-equity ratio of 1.64. The value of its assets is sufficient to cover it if things went south but still, I’d rather see better debt management.

Overall, it’s a promising company that appears to be performing well. The only problem for me is that the share price is a bit high now. This is reflected in its price-to-earnings (P/E) ratio of 19, which is well above the industry average of 13.5.

While I think it has good long-term growth potential, I’ll wait to see if the price drops a bit before I buy.