Seldom a day goes by that I don’t hear someone discussing passive income. A quick browse of the internet reveals a litany of different methods to earn extra cash on the side.

As Warren Buffett famously said: “If you don’t find a way to make money while you sleep, you will work until you die.”

While there are many ways to do this, one of my preferred methods is by investing in high-yield dividend shares. These are shares in companies that pay out a percentage of their profits to shareholders as an incentive to remain invested.

UK dividend stocks

The UK’s leading stock market index, the FTSE 100, hosts several shares that have 8% dividend yields or more. These are often distributed in increments of two or four payments. The dividend returns are paid in addition to any profit a shareholder could make off the price increase.

For example, investing £10,000 in a company with an 8% dividend yield would accrue £800 in annual dividends. If the same company’s share price increased 7% that year, the full returns would be £1,500. A savvy shareholder would reinvest their dividends into the pot to benefit from compounding returns. In this way, the investment would grow exponentially.

After 20 years, a £10,000 investment in a stock with an 8% yield and an average annual price increase of 7% would grow to £168,280. This amount would pay annual dividends of £11,923 – almost £1,000 in monthly passive income.

Choosing the right shares

A high dividend yield alone is no guarantee of returns — companies have the right to cut dividend payments if profits are lower than anticipated. For this reason, when investing in dividend shares, it’s important to choose reliable companies with evidence of long-term growth and stability.

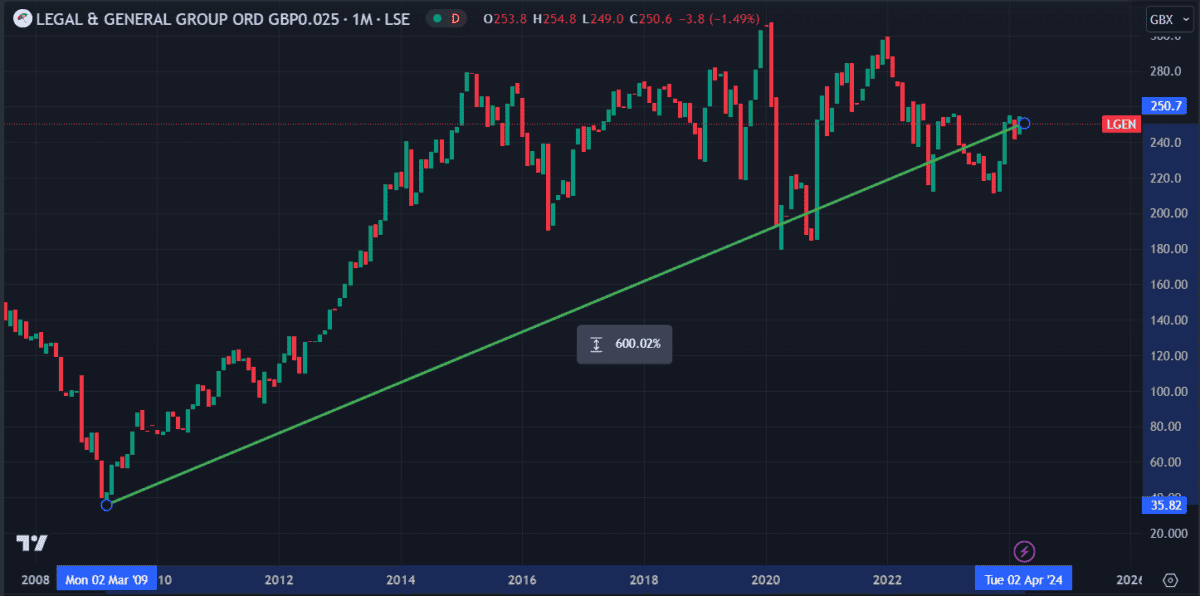

One share I feel would make a great dividend payer is Legal & General Group (LSE:LGEN), a well-established financial services and asset management firm based in London. At £2.50 per share, 4,000 shares would cost approximately £10,000.

Not only does it pay a handsome 8% dividend yield, but it’s set to increase that yield to 8.8% next year. A key player in the high-growth financial services sector, it’s made steady gains since the 2008 financial crisis, up 600%.

But the past five years have been less impressive, with the price down 12%. Subsequently, profit margins have reduced to 3.6% from 6.4% last year. This could be attributed to losses incurred during Covid, and the struggling economy since. If the UK economy doesn’t improve soon, Legal & General could continue to make losses in the short term.

However, that’s the beauty of dividends — even when price activity is subdued, shareholders stand to gain. At times of low growth, that 8% yield could pick up the slack — provided the lows don’t force the company to cut the dividend.

Overall, I’m positive about Legal & General. The consensus among analysts estimate the share price to be undervalued by 57%, with earnings forecast to grow 23% annually. As such, I plan to hold my shares long-term and reap the benefits of the high dividend yield.