It’s not often that I find a company that I want to buy for my Stocks and Shares ISA, but this is one of them. I consider it an all-star investment, which means that it ticks my boxes on five crucial measures. These are profitability, growth, value, the balance sheet, and investor sentiment.

Investing in India

Did you know that to invest in Indian companies, you have to meet scrupulous conditions unless you are an Indian resident or a non-resident Indian? That makes investing in the country more challenging than investing in US or UK companies.

Thankfully, here’s one that has an American Depository Receipt (ADR), and it’s listed on the New York Stock Exchange. Its name is Infosys (NYSE:INFY).

This is a business of information technology services, with nearly 250,000 employees. What’s clever about it is that it acts as an offshore outsourcing model to generate 60% of its revenue from North America. It caters to the full breadth of industries in the world, and it’s specifically effective at consulting, operations management, cloud services, and business processes.

Why I’m buying it

Here are the main reasons I’m going to buy a stake in Infosys. First, it meets my all-star criteria. Second, the price is down 30% from its all-time high. Third, it has a moat in cost-effective IT services, although I’ll discuss why this is being threatened.

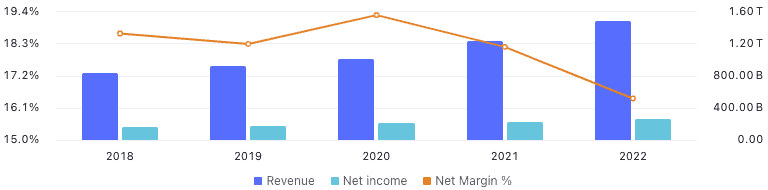

I know its net margin has been down a bit recently, but it’s still high, at 16%. Also, just look at how its revenues have been growing:

It looks to me like the pandemic was heavy-hitting for Infosys, but it managed to maintain top-line growth nonetheless. Its balance sheet also took a hit, but still, at this time, it’s got plenty more equity than debts.

The risk of AI

Astute readers will understand that Infosys’ moat in cheap human-led IT services is being directly threatened by new companies with the same offerings run by artificial intelligence.

However, Infosys’ management is clever. It recently introduced a comprehensive suite of AI-led tools underpinned by “12,000 AI assets, more than 150 pre-trained AI models, and over 10 AI platforms”.

Nonetheless, this new age brings cost efficiencies on-shore. Domestic AI providers in the US may find themselves gaining market share against Infosys. It’s a tricky economic puzzle to crack, and who wins over the long term is likely to be both parties, in my opinion.

I think American AI-services companies will grow fast now. And Indian IT services that also use AI will continue to grow, but just slightly slower.

A share price on the move

I mentioned that investor sentiment is important for the business to meet my all-star criteria, and Infosys has gained 174% in price over the past decade. That indicates high levels of interest in the shares over the long term. In fact, its compound annual growth rate in price over the past decade is 10.6%.

At a time when the Indian economy is going through such significant growth, I believe getting a stake in an Indian firm is paramount for me. Infosys is in my industry of expertise, so it only makes sense that I become a shareholder.