The FTSE 250 is full of a few real gems. But the good companies aren’t as easy to find as in the FTSE 100.

However, I believe the greatest growth can be found in identifying quality companies in the FTSE 250, as they may be smaller, with have more future potential.

I think Volution Group (LSE:FAN), while already becoming quite big, is of high quality, and has more growth to come.

Investing in ventilation

The firm offers ventilation products for both residential and commercial purposes.

One element of Volution Group that I really like is that it’s well-diversified around the world. It generates revenue from the UK and Europe as its core markets, but also from Australasia, and the rest of the world.

Global diversification is great because it means if there’s an economic downturn in one country, it can still generate growth in others.

Very profitable and stable

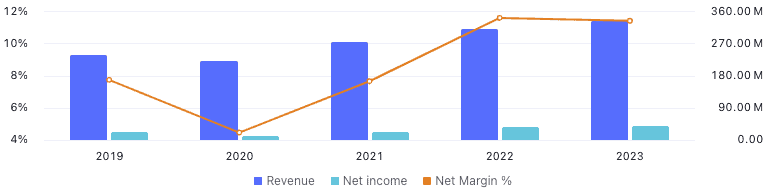

The business has some of the best margins in its industry, and they’ve only gone up recently. It took a bit of a knock in 2020 around the time of the pandemic. But now it’s back to being very strong in terms of profit:

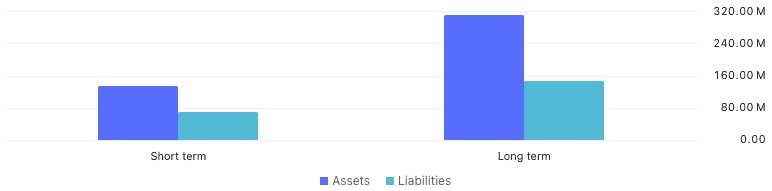

What I like is that it has supported this high profitability with a stable balance sheet. That means to me that it’s should to be able to keep up its performance in the future.

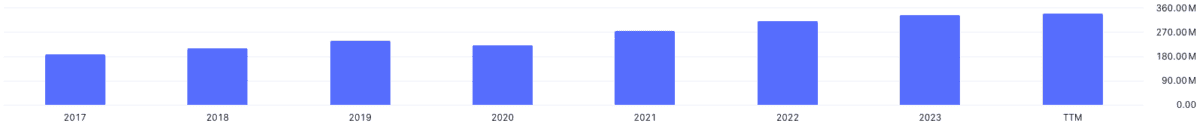

The firm has been growing very well over the long term too. And analysts are expecting its revenue to continue to grow at a compound annual growth rate of 4.4% over the next three years.

Notable risks

Now, while I’m bullish on this company, I have read a risk report from Volution. Here are two of the most severe risks management has outlined.

First, the firm isn’t recession-resistant. A slowdown in the construction industry can severely affect Volution Group. The prime reason for this is that its products are largely bought during construction for installation.

Second, with an expansion strategy including acquisitions, the business may fail to integrate the companies it buys. In a worst-case scenario, its deals could actually cause a net loss rather than help to fuel growth.

An excellent choice for me

Even considering the risks, I think this business is a great find.

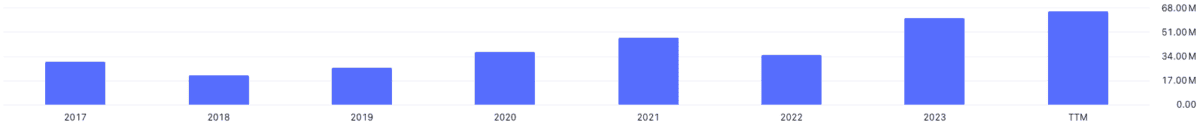

One final point I’m really impressed by is that while its earnings growth has been good over the past decade, its free cash flow growth has been phenomenal. It increased from 6.7% over the past 10 years annually, to 21.5% over the past five years, and 31.3% over the past year.

Free cash flow is an excellent measure of business growth. Profits can ebb and flow based on operational expenses, but free cash flow accounts for non-cash expenses. What this means is that expenses on the income statement are more accurately reflected on the cash flow statement in terms of cash produced or spent versus non-cash payments, asset appreciation or depreciation, and the like.

Based on the strengths outweighing the risks to me, I’ve put Volution Group on my watchlist for when I next invest.