The FTSE 100 is on a roll right now. At around 7,900 points, the UK’s premier share index is within a whisker of hitting new highs. And as market confidence steadily builds, a barge through this level looks inevitable.

Yet despite this strength, the Footsie is still jam-packed with brilliant bargains. Financial services giant Phoenix Group Holdings (LSE:PHNX) is one blue-chip share that I think still offers attractive value despite recent gains. Let me show you why.

Earnings

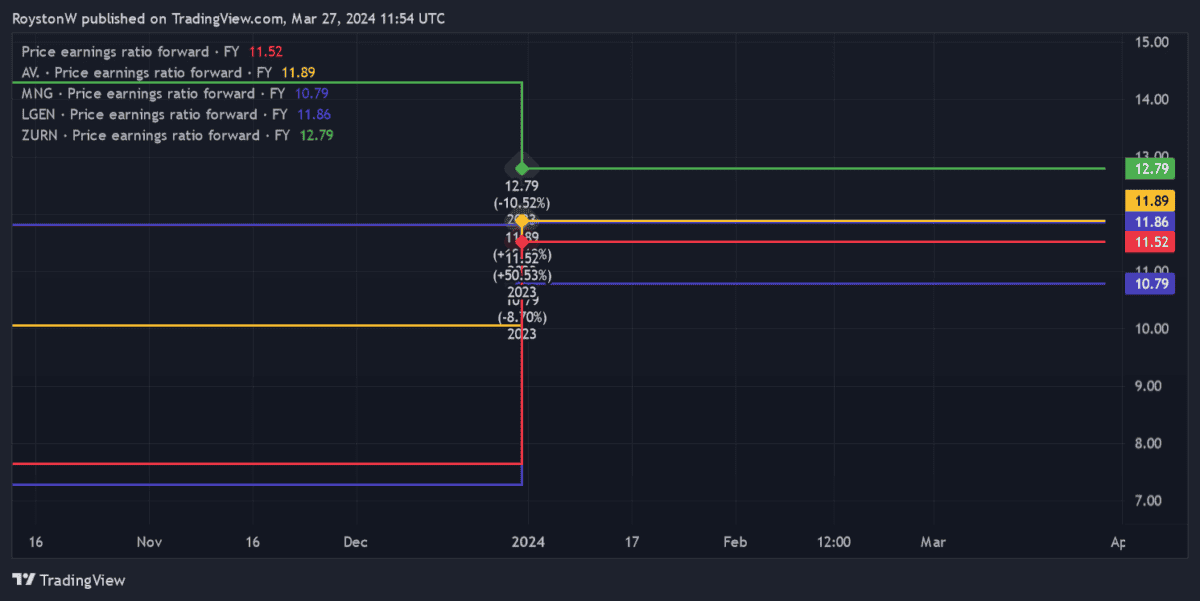

The first port of call is to consider Phoenix’s share price relative to forecast earnings. At 539p per share, it trades on a forward price-to-earnings (P/E) ratio of 11.5 times, which is just above the FTSE 100 average of 10.5 times.

It’s also worth considering the company’s value compared with other firms in the savings, wealth, and pensions arena. As the chart below shows, its P/E ratio is below those of (in descending order) Zurich Insurance Group, Aviva, and Legal & General Group.

It is marginally more expensive on this basis than M&G, however. So, on balance the business offers solid (if not outstanding) value, in my opinion.

Dividends

The forward dividend yield is another critical measure of how cheap a share is. This represents dividend income as a percentage of the current share price.

On this metric, Phoenix Group’s shares can be considered pretty outstanding. At 10%, the yield here soars above the 3.7% average for FTSE shares.

Furthermore, as the table below indicates, Phoenix also comfortably beats all of its rivals (bar M&G) on this metric.

| Stock | Forward dividend yield |

|---|---|

| Aviva | 7% |

| Legal & General | 8.4% |

| M&G | 10.5% |

| Zurich | 5.9% |

Assets

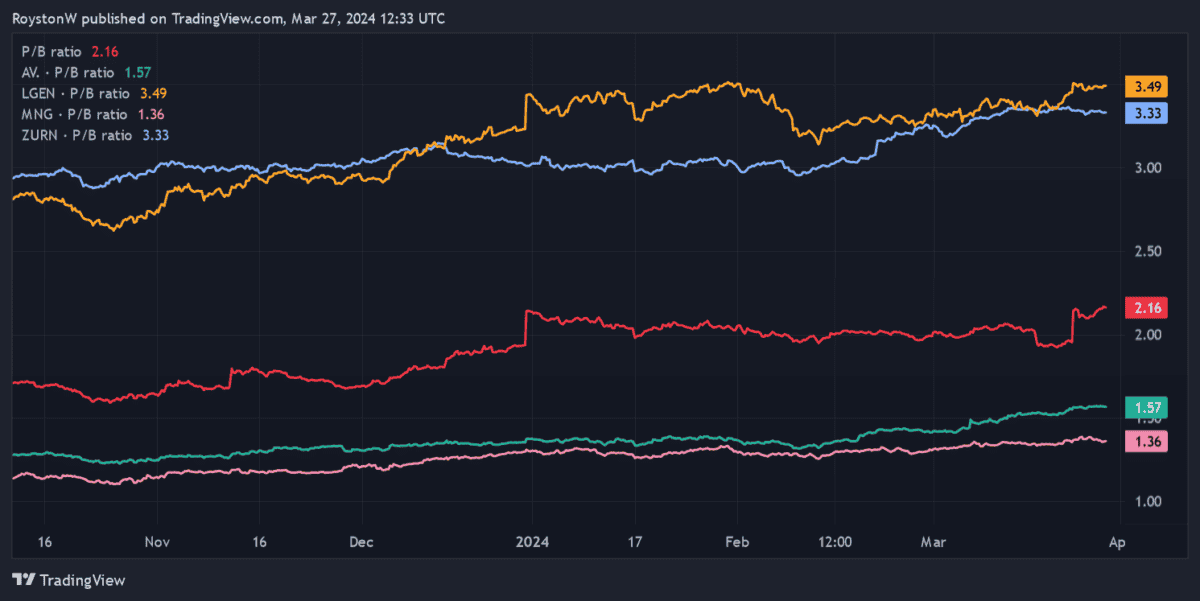

The last thing to consider is how Phoenix’s share price stacks up relative to the value of the firm’s assets. A popular way to do this is to calculate its price-to-book (P/B) ratio, which divides the firm’s total book value (assets minus liabilities) by the total number of outstanding shares.

With a reading of around 2.2, the business trades at a decent premium to the value of its assets. As an investor I’d be looking for a reading around or below one.

While disappointing, Phoenix isn’t the financial services industry’s most expensive operator based on the P/B ratio. As the chart shows, Legal & General and Zurich carry readings above three. But Phoenix’s multiple is higher than those of Aviva and M&G.

Should I buy Phoenix shares?

Based on these charts, M&G is hands down the best value stock across this grouping, as well as compared with the broader FTSE 100.

But what about Phoenix? Well the charts indicate to me that Phoenix shares still offer solid for value. Indeed, they could be especially attractive for investors seeking passive income thanks to that enormous dividend yield that’s supported by a robust balance sheet (its Solvency II surplus came in at £3.9bn in 2023).

The financial services industry may suffer further turbulence if the interest rates remain elevated. But the longer-term outlook here remains robust, with rapidly ageing populations tipped to supercharge demand for wealth and pension products.

I think Phoenix — which is the UK’s largest savings and retirement business — could be a great way to generate dividend income in the coming decades. And at current prices I’m considering opening a position.