Passive income is earned by doing very little. But as appealing as it might sound to earn lots of it, there’s a bit of patience needed. Let me explain.

For the purposes of this exercise, I’m going to assume I have savings of £20,000 available to invest. This is the amount that can be invested each year in a Stocks and Shares ISA.

Diversification

As a risk-averse investor, I’d be uncomfortable concentrating all of my funds in a single stock. I know that if I bought the ‘correct’ one, I could make a lot of money. But with an estimated 60,000 listed companies in the world, there’s a good chance I’d choose unwisely.

One way of potentially overcoming the problem of picking winners is to buy shares in an investment trust. Although I’d hold a single investment, my risk’s spread across the many stocks the trust owns. My exposure isn’t then limited to one particular industry, index, or country.

What to buy?

With this in mind, I’d use my hypothetical £20,000 to buy shares in Allianz Technology Trust (LSE:ATT). Although not guaranteed, I believe technology stocks are likely to out-perform the wider market.

I like the fact that the trust isn’t just focused on artificial intelligence (AI). Although I believe AI’s going to revolutionise our lives, I think it’s a little too early to identify which particular aspect of the technology is going to be the most profitable.

As its name suggests, ATT has a wider remit and invests in all parts of the tech sector. Having said that, its biggest holding (9.9% of total assets at 29 February 2024) is Nvidia, whose semiconductors are used in many AI applications.

Its next four biggest stakes are in Microsoft (8.1%), Meta Platforms (6%), Apple (6%) and Broadcom (4.2%).

Another positive is that it invests only in quoted companies. Its more famous peer, Scottish Mortgage Investment Trust, owns some of the “world’s most exceptional growth companies”. But many of them aren’t listed, which means valuing them accurately can be difficult.

Historical performance

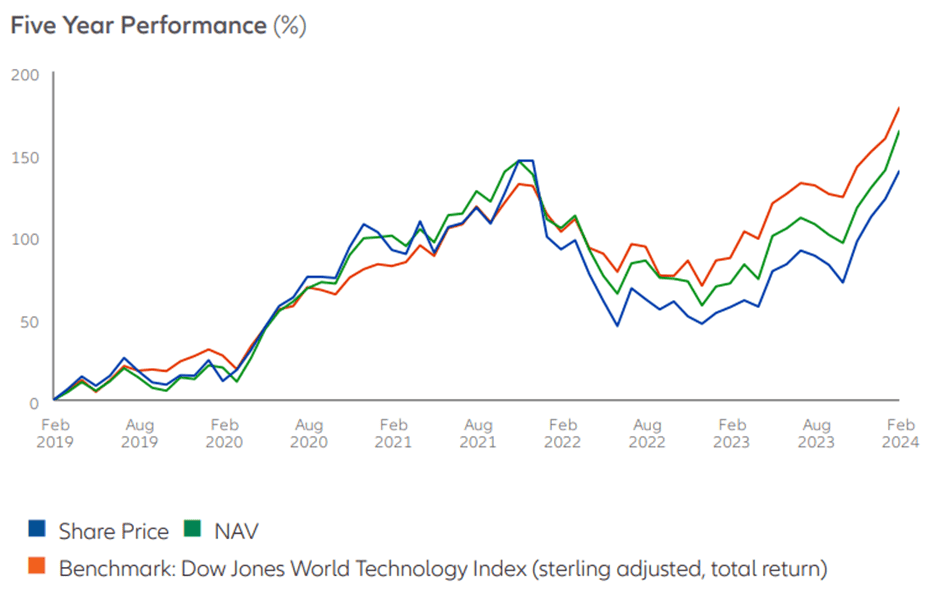

A summary of ATT’s performance, for the five years ended 29 February, is illustrated below.

Although it hasn’t performed as well as the Dow Jones World Technology Index, its cumulative five-year return of 139.4%’s impressive.

Also, the fund currently trades at a discount of approximately 10% to its net asset value, which implies the stock’s undervalued.

But tech stocks can be volatile. And when the dotcom bubble burst, we saw how quickly things can go spectacularly wrong.

However, for the purposes of this hypothetical exercise, I’m going to assume that the trust’s share price increases by 17.4% a year. This is equal to its compound annual growth rate during the five years ended 22 March.

Of course, there’s no guarantee history will be repeated. But if I could achieve this growth rate, after 20 years, my initial stake would be worth £494,757.

I could then sell up and buy some dividend stocks. Assuming an average yield of 6% — again, not guaranteed — I’d be able to generate an impressive income stream of £29,685 a year, with minimum effort.

That’s why I believe patience is the superpower of the wise.