When it comes to choosing investments for my portfolio, I’m always looking for the best. After all, it’s my hard-earned money that I’m putting at risk, and I want to make sure I’m choosing wisely.

I consider these UK shares about as good as it gets. So, let’s find out what I find compelling about the company and the associated risks.

Safer, cleaner, and healthier

Halma (LSE:HLMA) is a UK-listed, international company operating with the intent to keep people safe, the environment clean, and to improve health. For example, it creates fire detectors, safety systems for elevators, and devices that check water quality.

Recently, the company has acquired Ramtech, which specialises in wireless safety and security solutions. Through the deal, Halma has gained control of the WES3 technology and REACT system, which play a big role in large-scale projects like London’s Thames Tideway Tunnel. This is just one of many companies under the umbrella of Halma. It’s truly a conglomerate.

The company is clearly well diversified, including operations in the US, Europe, Asia, the UK, and the Middle East, among others. Additionally, the fact that it has positioned itself across various industries means it’s also protected from risks pertaining to specific segments of economies.

I consider it a top UK investment

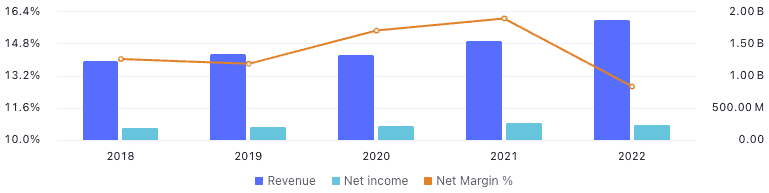

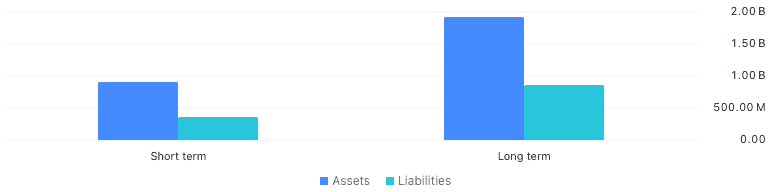

When assessing the quality of the shares, I was first drawn in by its very high net margin of 12.4%. Additionally, its balance sheet has a healthy amount more equity than debt. And its revenue has been growing at a healthy 11% annually over the past three years.

But that’s not all I like about the investment. Analysts are expecting the firm’s earnings to grow at a compound annual growth rate of 11.8% over the next four years. So, as the share price is down over 30% right now, I think I’ve got a bargain on my hands.

The main risks I see

One of the main concerns I have with Halma’s business model is that due to its conglomerate-style nature that is spread across different industries, it faces the risk of running itself too thin.

Other successful holding companies often operate a portfolio focused on one industry. As Halma’s management has quite a wide range of businesses to oversee, there are more diverse risks to contend with.

I think this could be difficult for the firm to control over the long term. Also, competitors could easily dominate if they specialise in areas where Halma only dabbles.

Think of all the new companies which are going to surface in healthcare, security, and cleanliness that adopt automation, artificial intelligence, and robotics. Halma could get left behind if it doesn’t adapt fast enough.

I think it’s an excellent choice

I consider this one of the best UK-listed businesses right now. Even though the risks are considerable, to me, the pros seem to outweigh them significantly.

I consider Halma as an almost five-star company. But if I do invest, I’ll want to watch the future acquisitions it makes and how it tackles advanced technology integration.

This one’s high up on my watchlist for when I next make some investments.