A Stocks and Shares ISA is undoubtedly the best way for me to invest with a long-term mindset. It gives me the ability to save hundreds of thousands of pounds that I’d usually pay in tax when it comes time to sell my investments. Additionally, with my ISA, I don’t have to pay tax on my dividend income, which is another big bonus.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

A Chinese internet empire

The company I have found, called NetEase (NASDAQ:NTES), has a market cap of $69bn and is one of China’s leading internet technology companies. All of its revenue comes from China, and it has the following areas of operation:

- Online game services: people know the company for its PC and mobile games, and it has created some of China’s most popular titles

- Youdao: this is the company’s educational technology subsidiary, which provides online courses, language learning applications, and electronic dictionaries

- Music streaming: NetEase Cloud Music is a leading music streaming service in China, and it includes user-generated content and social networking features

- E-commerce: often referred to as NetEase Strict Selection, it focuses on a range of e-commerce goods with high-quality standards

- Other services: it also operates other internet services, including email and advertising, helping to bolster its technology ecosystem

Astounding returns

Over the past 20 years, the shares have risen 4,160% in price, meaning a compound annual growth rate of 20.6%.

Let’s compare that to the most popular US index, the S&P 500, and also the UK’s FTSE 100. As we can see, NetEase has been the elite investment pick over the past two decades by orders of magnitude:

Some people think if a stock has risen fast in the past, it will keep on climbing. Others think if it’s already grown so much, it can’t go any higher. Both can be right or wrong, and it depends on the details of the business.

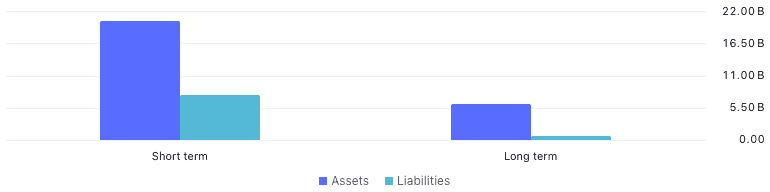

One element NetEase has going for it, which I particularly like, is a balance sheet with a very healthy 67% of assets balanced by equity. That means management hasn’t overburdened the company with debt.

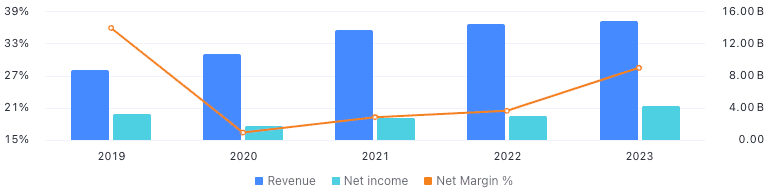

Additionally, the company has a net margin of 28.4%, which is right at the top end of its industry rankings. It struggled with this momentarily around the time of the pandemic, but now it’s back on top:

Also, after a couple of years of laggard earnings growth, analysts are expecting this to pick up significantly in 2024 and beyond. So, I reckon the great share price growth is likely to continue.

Risks if I invest

One of the issues with NetEase shares is that I think they aren’t selling at any meaningful discount. That means that if I invest now and something goes wrong in the business, there’s no margin of safety in my purchase price to protect me.

For example, a significant cybersecurity breach could affect customer data and the reputation of the firm as a result. Share prices tend to fall considerably after events like this and can take time to recover, depending on the scale of the incident.

Overall, I appreciate the company, and I think it’s an excellent investment choice. Even though the price is high, I’ve put it on my watchlist for when I next invest.