When Swiss multinational investment bank UBS puts in a ‘buy’ signal on FTSE 100 shares, it pays to listen. With $3.96trn of assets under management, the 162-year-old institution is the largest private bank in the world.

Recently, UBS raised its price target on two companies I like, Aviva (LSE:AV.) and BAE Systems (LSE:BAE). One of these I already own and I think the other is rapidly becoming too good to ignore.

Let’s look at their financials to see what the fuss is about.

Aviva

UBS raised its target price for Aviva from 515p to 555p on 11 March. At the time, it noted Aviva’s “high return on capital, diversified business mix and upside potential relative to expectations“.

The upgrade follows positive 2023 full-year results released on 7 March 2024, reporting a positive net income of £1.09bn – up from negative £1.19bn in 2022. Another key development that likely influenced the upgrade is Aviva’s agreement to acquire Bermuda-based insurance firm Probitas Holdings for £240m.

The new target represents a 16.5% increase from the current price of 472p. That’s notably higher than the average 12-month analyst price target of 495p — a meagre 3.8% increase.

Far be it from me to doubt UBS but I’m interested to know why it’s so confident in such a high price target. Particularly considering that since early 2022, Aviva’s debt-to-equity (D/E) ratio has steadily increased from 37.8% to 66.4%. That’s still in a safe range but I’d rather it was going down than up.

Still, with a solid balance sheet and a reliable 7% dividend yield, I do see the potential value in Aviva. I’ve been considering the company for some time now, so I’ll take this UBS upgrade as a sign that it’s now time to buy.

BAE Systems

Also on 11 March, UBS raised its target price for BAE Systems by 14% from 1220p to 1450p.

BAE Systems has been a favourite of mine for a while now. I’ve spoken in the past of its growth potential as a key supplier to government defence agencies. More recently, though, I’ve felt it could be overvalued and set for a correction.

With UBS now indicating otherwise, I’m checking the charts to get a better idea.

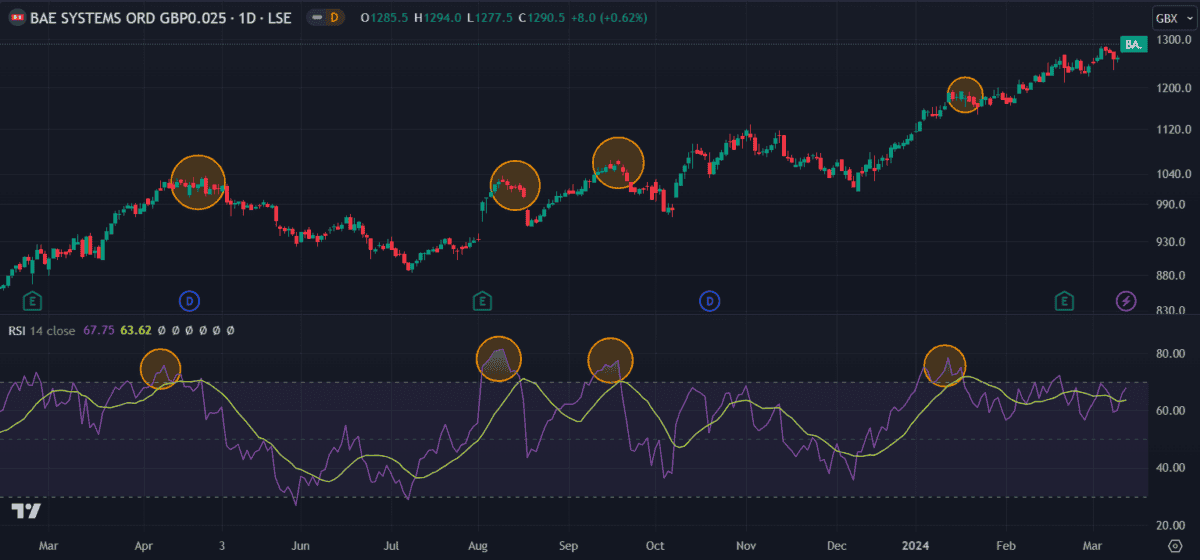

When trying to gauge a stock’s growth potential, I often look at its relative strength index (RSI). This allows me to get a quick idea of where the price might be headed.

Let’s look at the orange circles on the graph below.

BAE Systems share price vs RSI

Whenever the RSI goes above 70, the share price tends to dip soon after. With the RSI floating close to 70 for most of this year, I’m wondering how much further the BAE share price can climb. A similar pattern emerged in late February and March last year, with the price topping out in late April before correcting.

So, yes, the share price could still have some gas in the tank. And with UBS onboard, I’m certainly more inclined to hold than sell for now.

But I’ll be keeping a close eye on that RSI.